Manchester Property News

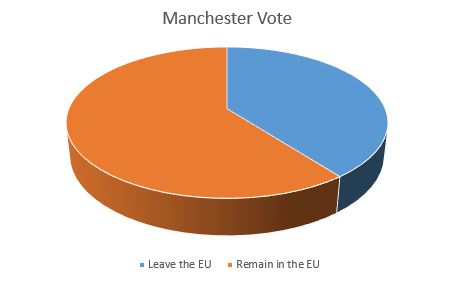

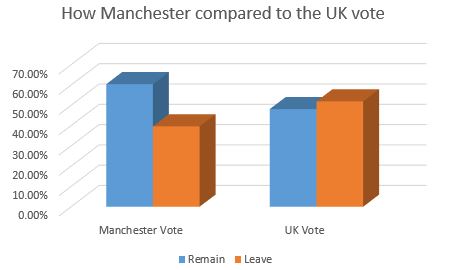

So 60.4% of Manchester Voters voted to Remain in the EU – What now for the 135,565 Manchester Landlords and Homeowners?

Well its over 24 hours now since the electorate made their decision that the UK we will be leaving the EU. The FTSE and the pound dropped then recovered a bit as the day went on. The USA, Canada and Germany said they still want to be our friends, but do we really know what is going to happen in the days, weeks and month to come? I don’t think anybody can reasonable predict how the markets and more importantly to me how house prices will react!

So what happens next for the 77,395 Manchester homeowners and 58,170 Manchester landlords especially the 46,250 of those homeowners with a mortgage?

The Chancellor George Osbourne in the campaign suggested property prices would drop by 18%. Using Treasury estimates, their method of calculating this was tenuous at best, but focused around the abrupt and hasty increase in UK interest rates, which in turn would raise the cost of mortgages, and therefore lower demand for property, causing a drop in property prices.… We will certainly see in the coming months if this prediction happens!

Manchester Property Values

Manchester property values will probably drop in the coming 12 to 18 months – but by 18% – I am sorry I find that a little pessimistic and believe that figure was rhetoric to get homeowners and landlords to vote in a particular way. But the UK property market is quite a monster.

Since the last In/Out EU Referendum in June 1975,

property values in Manchester have risen by 1400.3%

(That isn’t a typo) and whilst property prices did drop nationally by 18.7% between the peak of 2007 and bottom of the market in 2009, when one compares property values today in the country, compared to that all-time high of 2007, (the period before the financial crisis of the Credit Crunch of 2008/9) .. they are still up 13.3% higher.

Another Credit Crunch?

And so, not withstanding the Credit Crunch, the worst global economic outlook since the 1930s and the recession it brought us, a matter of a few years later, the Government were panicking in 2012/3/4 that the housing market was a runaway train that needed controlling.

Now the same Credit Crunch doom-merchants and that predicted soup kitchens in 2008/9 are predicting Brexit meltdown. Bad news sells newspapers. Stock markets may rise, stock markets may fall as was seen at various points during yesterday. However, the British public continued to buy property in 2009/10 and beyond. Aspiring first time buyers and buy to let landlords picked themselves up, took a good look and carried on buying… Why? because the British love Bricks and Mortar… we also need a roof over our head.

However, as mentioned previously, if the value of the pound drops, in the past UK Interest Rates have risen to reverse that drop. However, whilst a cheaper pound will make your pint of Estrella a little more expensive on your Spanish holiday this year and make your brand new Audi pricier .. it will make British export cheaper! Which is great for the economy.

Interest rates

… and what of interest rates? Since 2009, interest rates have been at 0.5% and lots of people have become accustomed to those sorts of levels. So what if interest rates rise .. end of the world? Interest rates in the 1986/88 property boom were on average 9.25%, the 1990’s they were on average around 6.5% and uber-boom years (when UK property values were rising by 20% a year for three or four straight years across the UK) .. 4.5%. Many of you reading this who are in their 50’s and older will remember interest rates at 15%.

But I suspect interest rates won’t rise that much anyway, as Mark Carney (Chief of the Bank Of England) knows, raising interest rates causes deflation – which is the last thing the British economy needs at the moment. In fact they have been printing money (aka Quantitative Easing) for the last few years (which causes inflation) to the tune of £375bn a month. A bit of inflation because the pound has slipped on the money markets (not too much mind you) might be a good thing?

.. because whilst property values might drop, they will certainly bounce back. It’s only a paper loss.. because it only becomes real if you sell. And if you have to sell,

whilst your property might have dropped by 5% or 10%, the one you want to buy would have dropped by the same 5% to 10% .. and here is the best part – (and work your sums out) you would actually be better off because the more expensive property you would be purchasing would have come down in value (in actual pound notes) than the one you are selling!

Manchester landlords or their 57,170 tenants living in their properties have nothing to fear either.

Buy to let is a long term investment. I think there might even be some buy to let bargains in the coming months as some people, irrespective of evidence, panic. Even Barricade the channel tunnel and close the ports at Dover and immigration stopped today, the British population will still increase at a rate that will exceed the current property building level. Britain is building 139,600 properties a year, but needs to build according to the eminent ‘Barker Review of Housing Supply Report’, about 250,000 properties a year to even stand still, and as the birth rate is increasing, the population is living longer and just under a quarter of all UK households now are occupied by a single person demand is only going up whilst supply is stifled. Greater demand than supply equals higher prices. That is definitely a fact!

So, what will happen next?

Well, there are many challenges ahead. The country has spoken and we are now in uncharted territory – but we have been through a couple of World Wars, an Oil Crisis, Black Monday, Black Wednesday, 15% interest rates and a Credit Crunch … and we survived!

And the value of your Manchester property? It might have a short term wobble… but in the long term -it’s safe as houses regardless!

*figures are based on Manchester City Council area, ONS and Land Registry

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Leave a comment