Stockport Property News

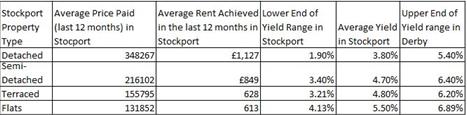

Stockport Buy-to-Let Yields - 1.90% to 6.89% a year

The mind-set and tactics you employ to buy your first Stockport buy to let property needs to be different to the tactics and methodology of buying a home for yourself to live in. The main difference is when purchasing your own property, you may well pay a little more to get the home you and your family want, and are less likely to compromise. When buying for your own use, it is only human nature you will want the best, so that quite often it is at the top end of your budget; because as my parents always used to tell me – you get what you pay for in this world!

Yet with a buy to let property, if your goal is a higher rental return – a higher price doesn’t always equate to higher monthly returns – in fact quite the opposite. Inexpensive Stockport properties can bring in bigger monthly returns. Most landlords use the phrase ‘yield’ instead of monthly return. To calculate the yield on a buy to let property one basically takes the monthly rent, multiplies it by 12 to get the annual rent and then divides it by the value of the property.

This means, if one increases the value of the property using this calculation, the subsequent yield drops. Or to put it another way, if a Stockport buy to let landlord has the decision of two properties that create the same amount of monthly rent, the landlord can increase their rental yield by selecting the lower priced property.

To give you an idea of the sort of returns in Stockport…

As we move forward, with the total amount of buy to let mortgages amounting to £199,310,614,000 in the country, landlords need to be aware of the investment performance of their property, especially in the era of tax increases and tax relief reductions. Landlords are looking to maximise their yield – and are doing so by buying cheaper properties.

However, before everyone in Stockport starts selling their upmarket properties and buying cheap ones, yield isn’t the only factor when deciding on what Stockport buy to let property to buy.

Void periods (i.e. the time when there isn’t a tenant in the property between tenancies) are an important factor and those properties at the cheaper end of the rental spectrum can suffer higher void periods too. Apartments can also have service charges and ground rents that aren’t accounted for in these gross yields. Landlords can also make money if the value of the property goes up and for those Stockport landlords who are looking for capital growth, an altered investment strategy may be required.

In Stockport, for example, over the last 20 years, this is how the average price paid for the four different types of Stockport property have changed…

- Stockport Detached Properties have increased in value by 367%

- Stockport Semi-Detached Properties have increased in value by 384%

- Stockport Terraced Properties have increased in value by 392%

- Stockport Apartments have increased in value by 346%

It is very much a balancing act of yield, capital growth and void periods when buying in Stockport. Every landlord’s investment strategy is unique to them.

If you would like a fresh pair of eyes to look at your portfolio, be you a private landlord that doesn’t use a letting agent or a landlord that uses one of my competitors – then feel free to drop in and let’s have a chat.

About The Blog

This Blog looks at what is happening in Stockport, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Leave a comment