Blog Post

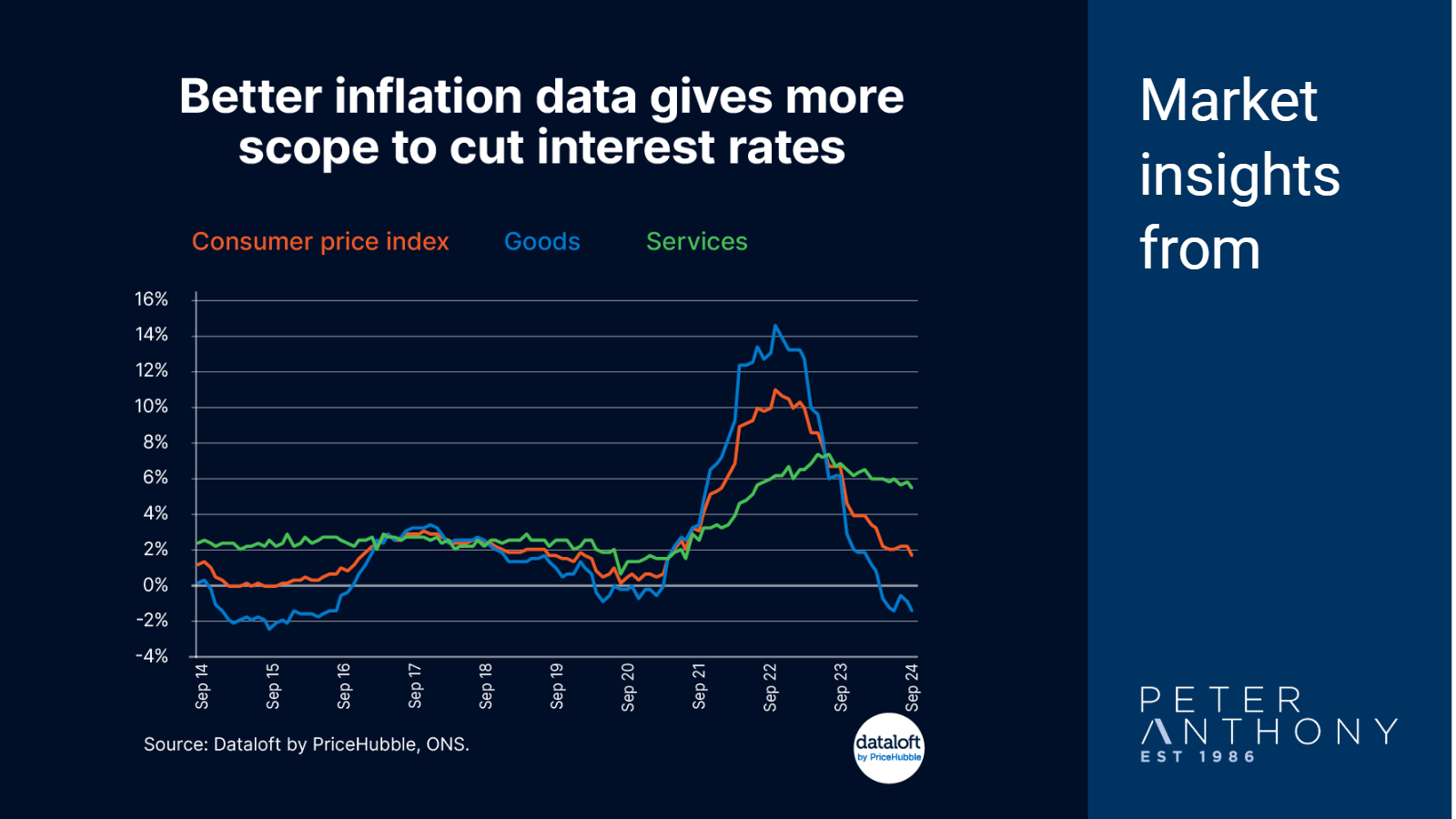

Better inflation data gives Bank of England more scope to cut interest rates

New inflation data showed the current rate is 1.7% (on the CPI measure). Inflation being back under target gives the Bank of England more scope on interest rates.

There are some elements that are still causing concern. The part of inflation that is proving ‘sticky’ is service inflation which remains high at 5.6%.

Goods inflation is much lower and indeed negative at -1.4%. This is actually the largest negative rate for goods inflation since August 2016.

Despite some stickiness in parts of the inflation data there is still scope for the Bank of England to cut interest rates.

October consensus forecasts showed expectations are for an average Bank rate of 4.7% by end Q4 2024. The next meeting is November 7th. Source: Dataloft by PriceHubble, ONS, HM Treasury Consensus Forecasts

Tom Simper

Oct 21, 2024, 14:00 PM

Tom Simper

Oct 21, 2024, 14:00 PM

Leave a comment