Levenshulme and Burnage Property News

-

Hook a new home

Read More

March is typically one of the strongest months for sellers to spring into action. This year there has been a higher amount of supply coming to the market, taking competition in the sales market to a 10-year high.

Although new spring buyers are unlikely to ...

-

Sales blossom in spring

Read More

With the onset of spring comes a wave of renewal with blooming flowers, longer days, and a fresh burst of energy that extends to the property market.

When it comes to selling a home, February and March stand out as the best months to list. ...

-

City Ranking Model

Read More.png?sfvrsn=fefd6531_1)

Bristol is the top place to experience rental growth, moving up 2 places from Q3 2024, according to the latest City Ranking Model from PriceHubble. This is followed by Manchester, dropping from top spot and London, moving up one place.

The ranking model draws on ...

-

Golf gains

Read More.png?sfvrsn=25896331_1)

Donald Trump has been sworn in as the 47th US president.

As a real estate developer, Trump began acquiring and building golf courses in 1999. Currently, he owns 18 golf courses worldwide, including two in Scotland.

Living near a golf course isn’t just about the ...

-

Forecast outlook

Read More

As a new year begins, it is a good time to think about what lies ahead for the housing market.

After several years of strong rental growth, the pace slowed at the end of 2024 and that trend is forecast to continue.

Earnings, a key ...

-

Home for Christmas

Read More

Christmas is the most merry time of the year, spreading love and festive cheer. Woodbridge in Suffolk wears the crown, of the happiest of UK towns. Richmond upon Thames jingled into second place, slipping from last year’s top spot, while Hexham in Northumberland came third....

-

Population growth insights

Read More

Latest data on population trends gives an insight into which cities are successfully attracting new residents. Population growth is a key driver of housing demand.

Cities which are prospering and have a strong jobs market will attract new residents. Other factors that drive population growth ...

-

Mortgage approvals rocketing up

Read More.png?sfvrsn=ce689b30_1)

Remember remember this November, the housing market is still ablaze with activity from igniting buyer interest.

Mortgage approvals rocketed up to 65,647 in September, reaching heights not seen since August 2022. This marks the fourth consecutive monthly increase, with rates a dazzling 49% over last ...

-

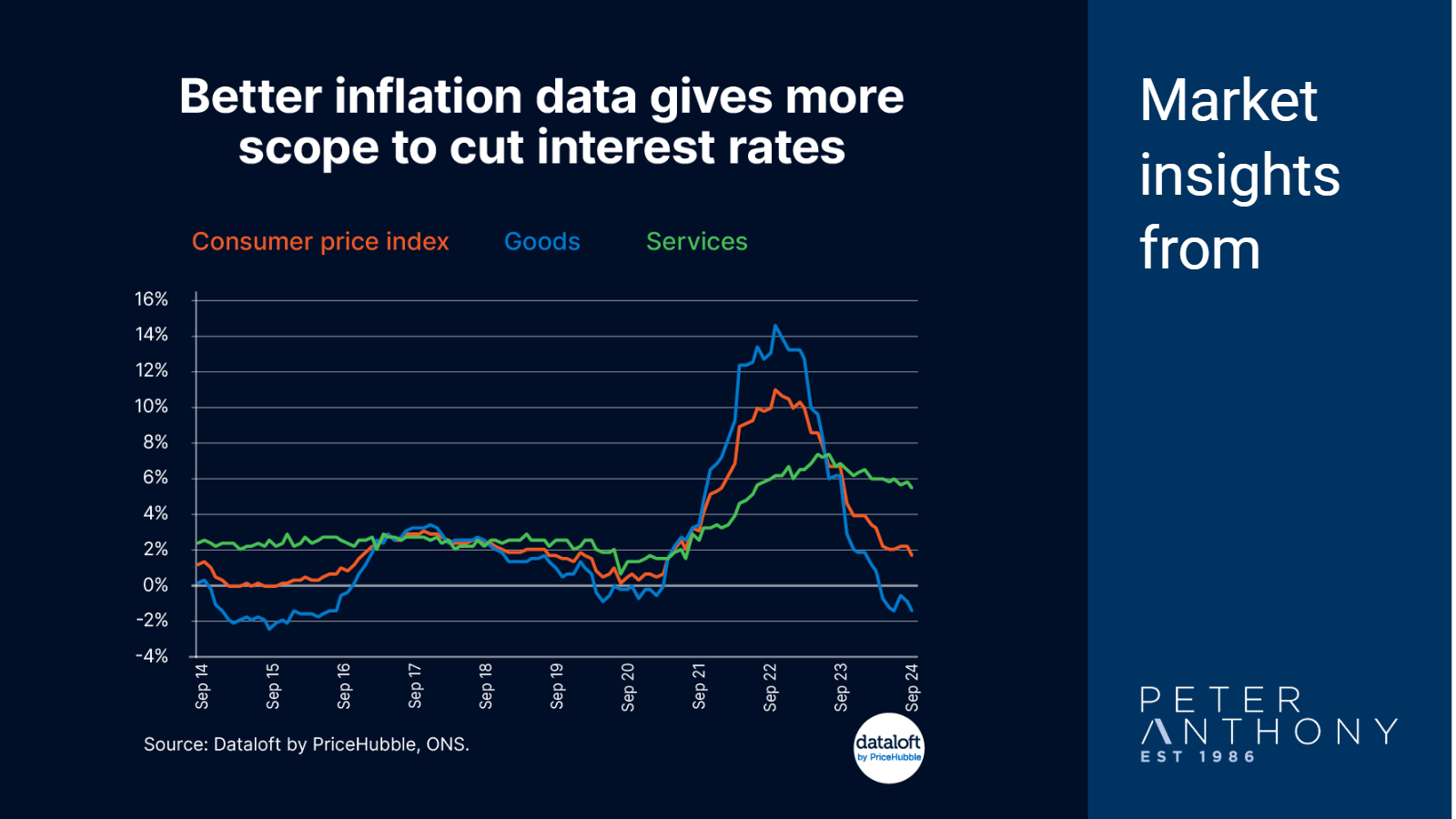

Better inflation data gives Bank of England more scope to cut interest rates

Read More

New inflation data showed the current rate is 1.7% (on the CPI measure). Inflation being back under target gives the Bank of England more scope on interest rates.

There are some elements that are still causing concern. The part of inflation that is proving ‘sticky’ ...

-

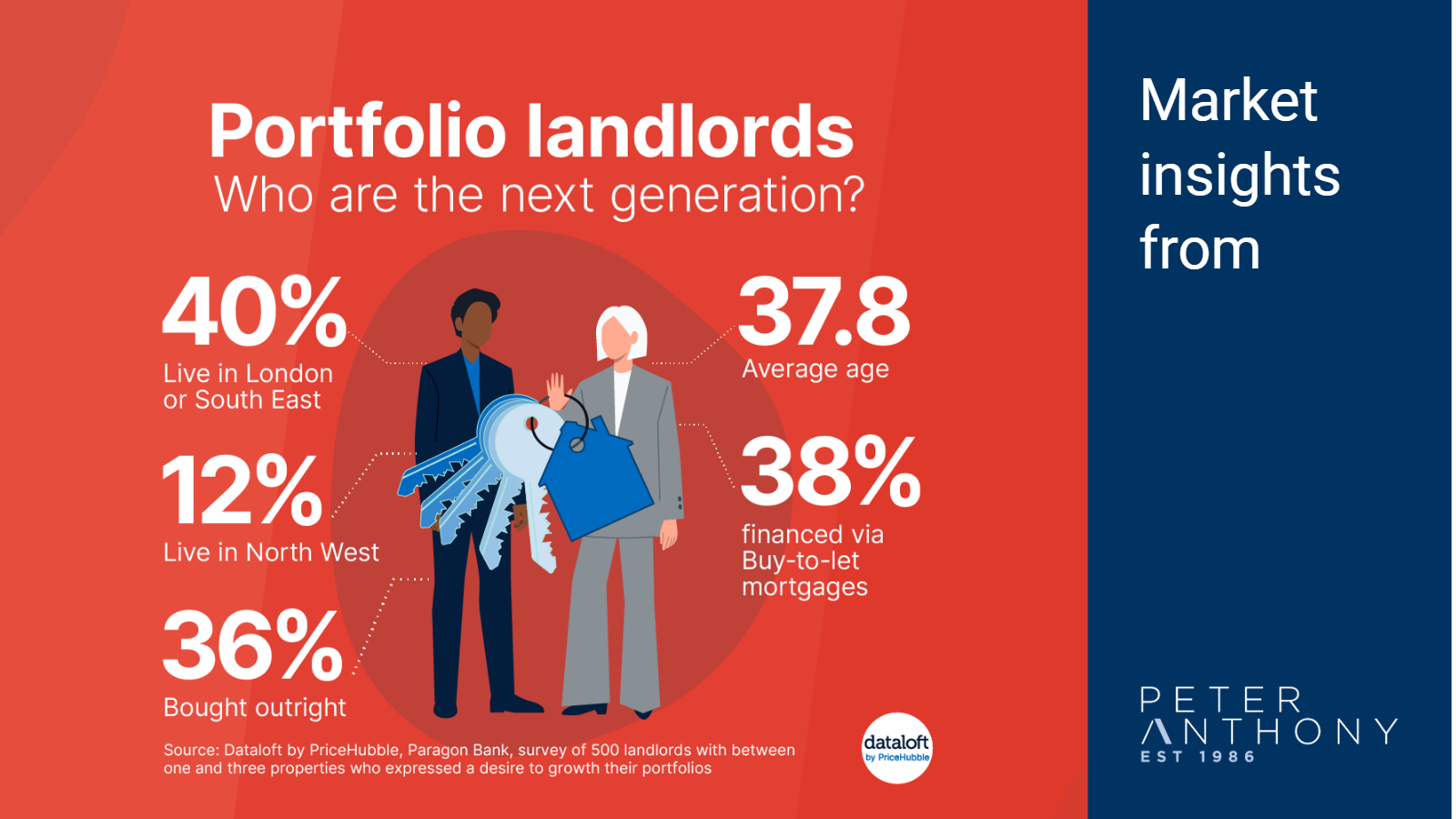

Who are the next generation of Portfolio Landlords?

Read More

Residential property has long been the investment choice for many in the UK, but as original buy-to-let landlords near retirement, a new generation must step up to meet the future demand for rental homes.

The average age of an 'aspirational portfolio landlord' (landlords with between ...

-

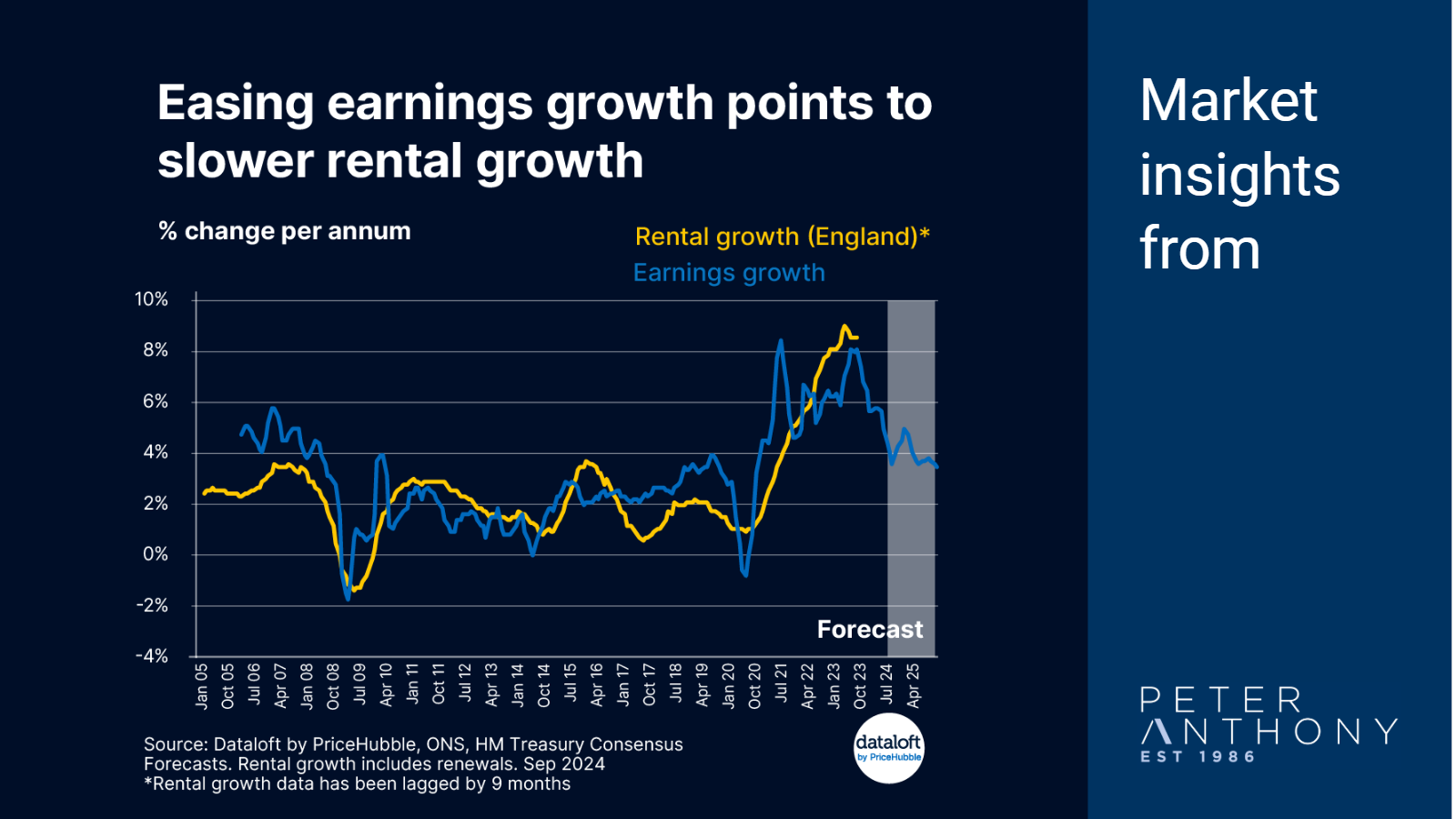

Easing earnings growth points to slower rental growth

Read More

There is a very strong relationship between earnings growth and rental growth. Over the long-term the two move very much in tandem.

Latest earnings data released this week showed a lower growth rate (annual average growth of 4.4%). The first time earnings growth has been ...

-

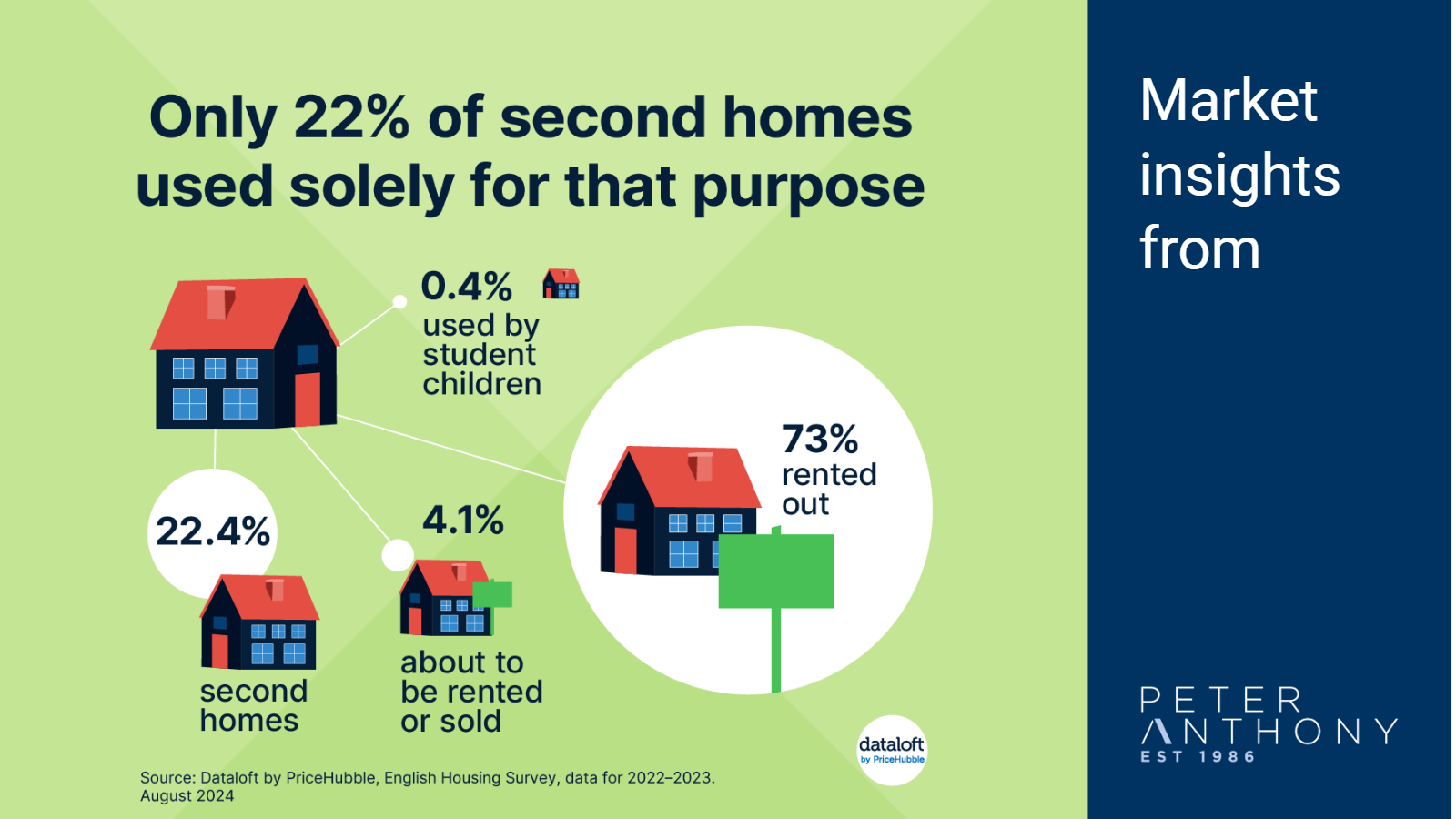

Second homes

Read More

Households in England own 4.3 million second homes, according to the 2022/23 English Housing Survey, up from 3.3 million a year earlier. Second properties can be owned or rented.

The greatest increase has been in those rented out which form the majority of second homes ...

-

Post-election honeymoon period

Read More

As the Starmers settle into Downing Street, homeowners across the nation might now being reconsidering their plans for moving house.

The lead up to a General Election typically creates uncertainty and a slowdown in the housing market. This year was no exception – although the ...

-

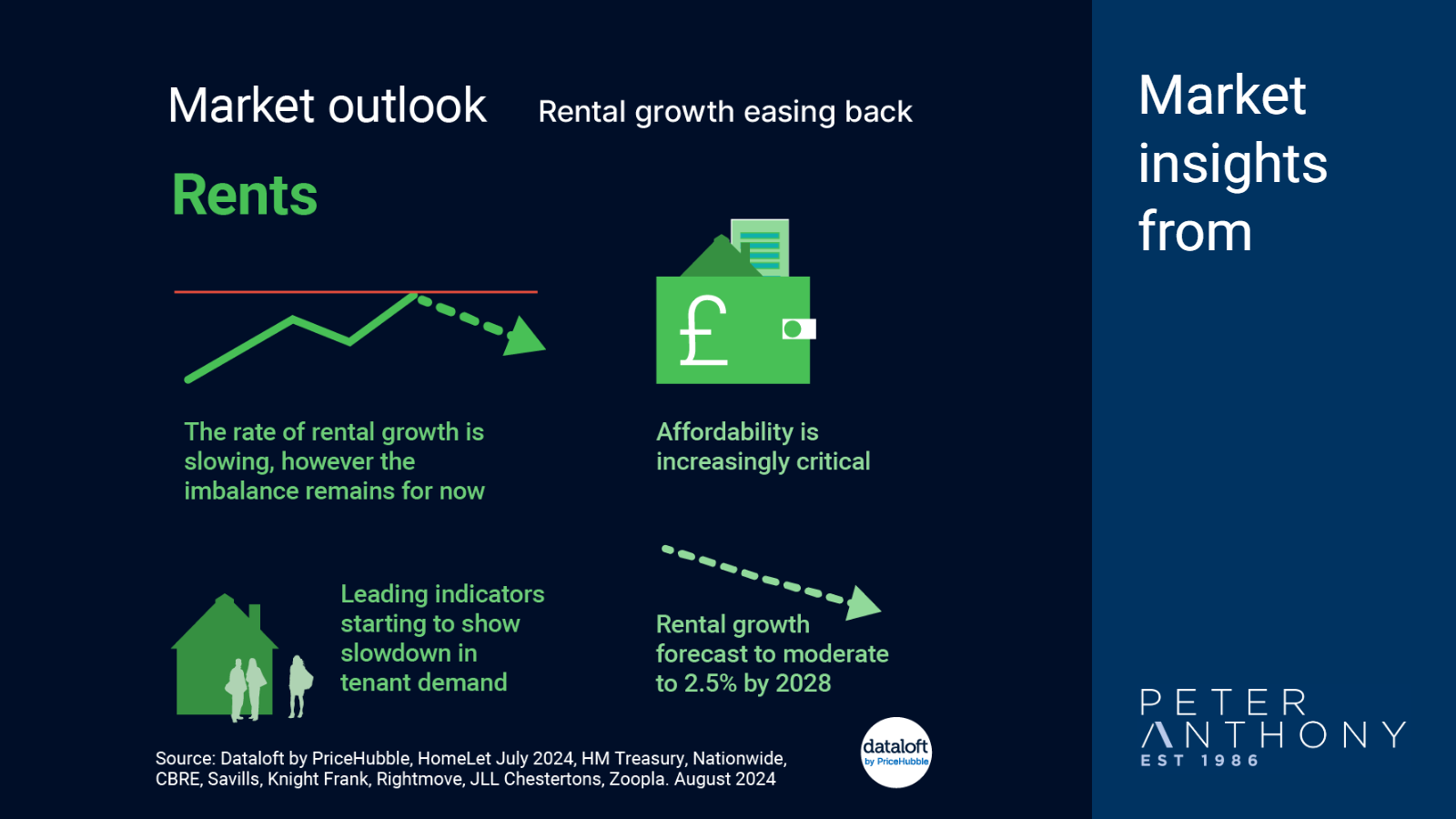

Market outlook: rents

Read More

Rental growth has been high in recent years, but the pace is now slowing. Leading indicators are starting to show slowdown in tenant demand and an improvement in supply.

UK annual rental growth is currently at 5.2%, however this has almost halved from 10.3% in ...

-

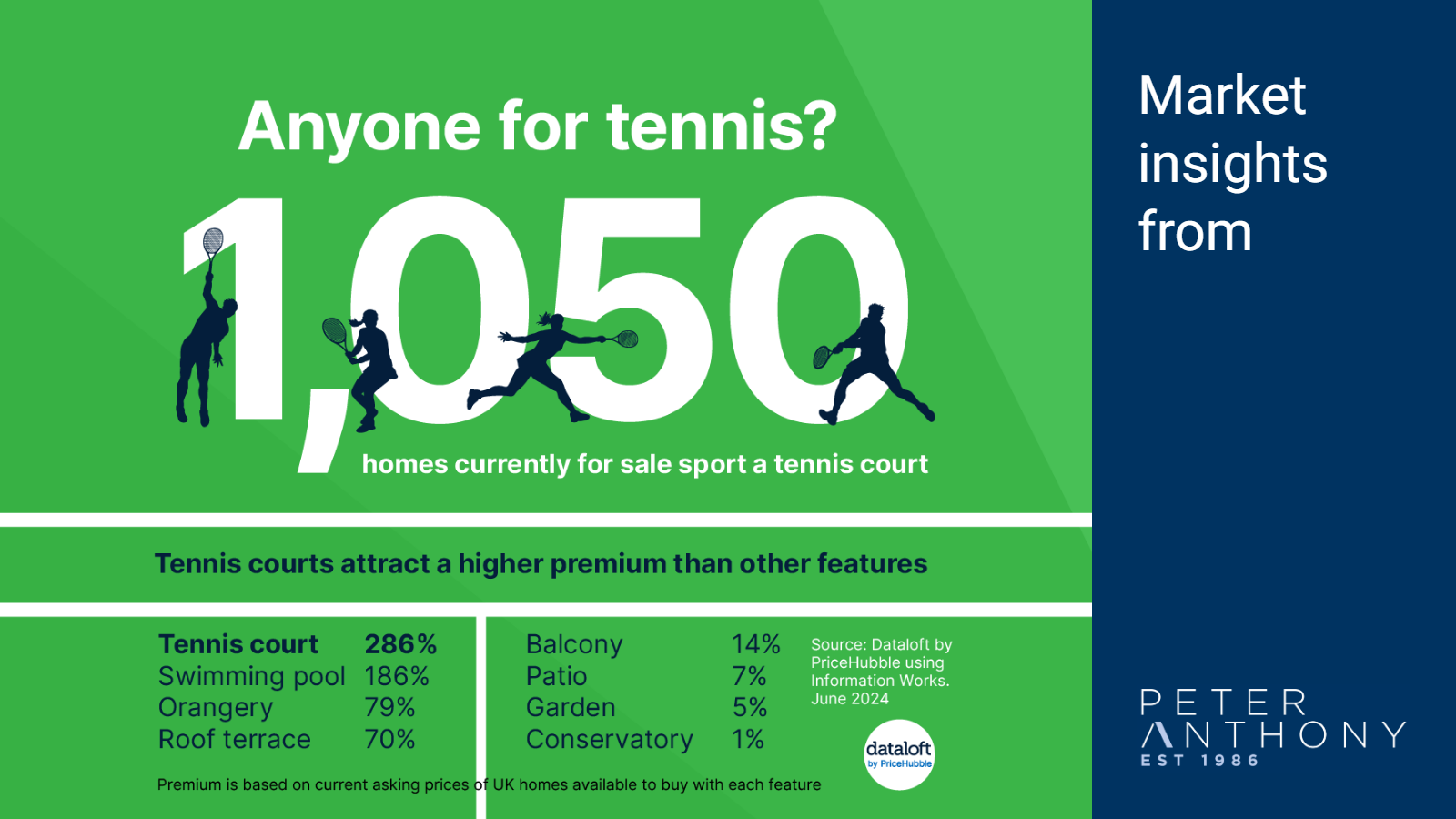

Anyone for tennis?

Read More

As the 137th Wimbledon Championship gets underway, those inspired to recreate their favourite match moments at home will find a choice of 1,050 homes currently available to buy across the country which come complete with their own tennis court.

With a median price tag of ...

-

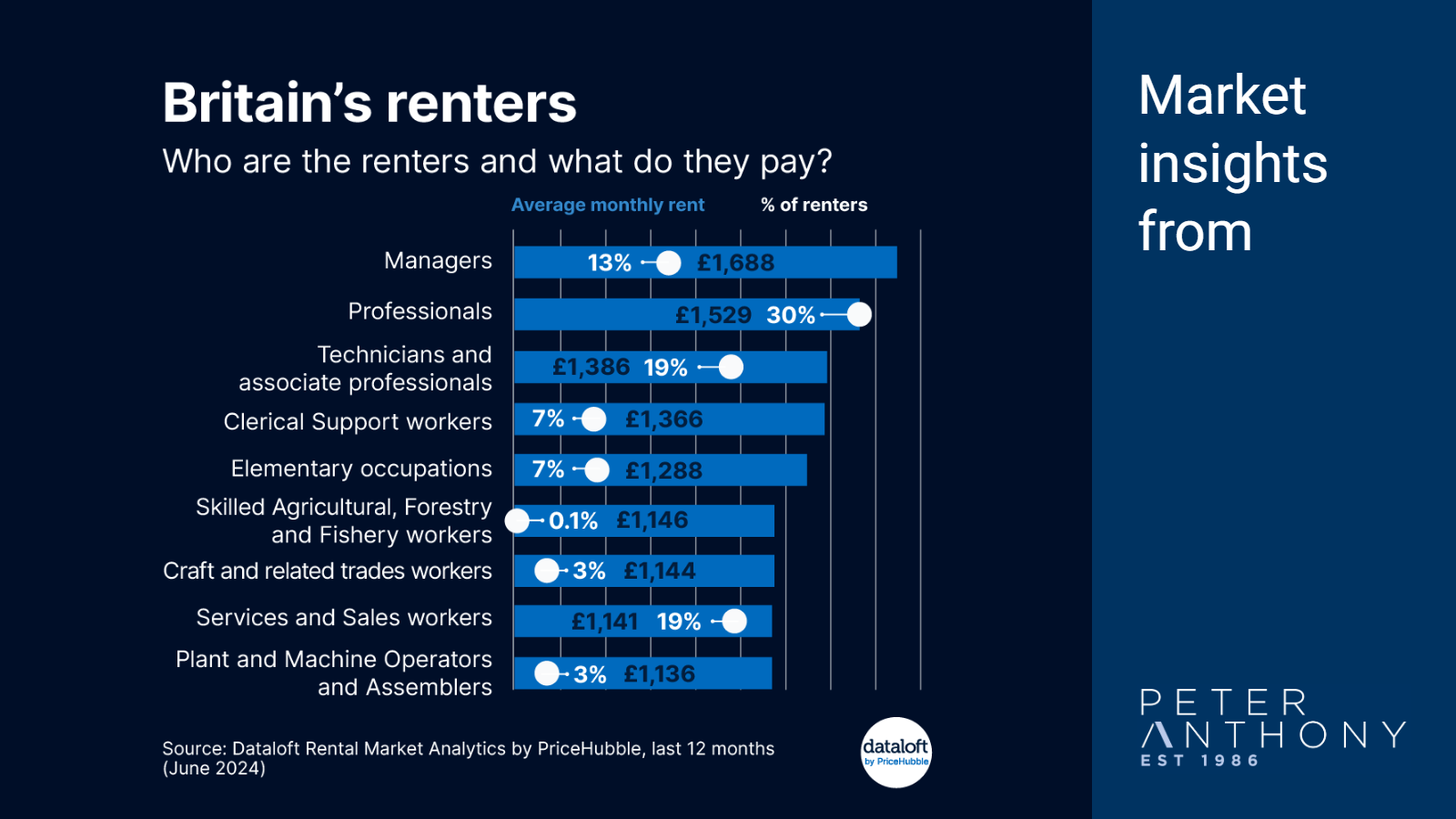

Britain's renters

Read More

The private rental sector now provides homes for 20% of all UK households, (30% in London), and it is growing year by year. As more people settle for longer in a rental home, the range of job roles has expanded too, as is clear from ...

-

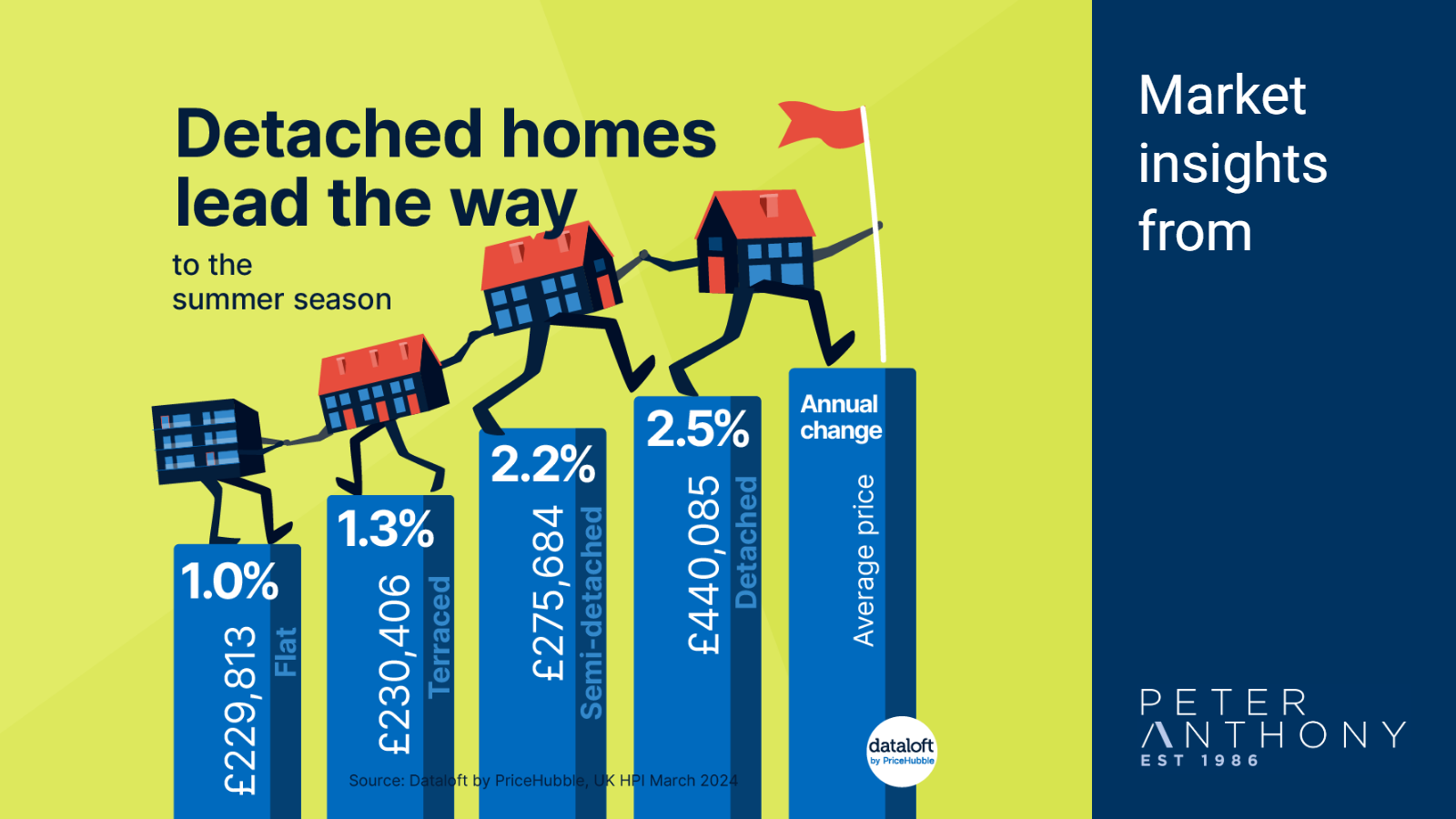

Detached homes lead the way

Read More

House prices rose by 1.8% in the year to March. House prices grew by 1.8% in the year to March, back in positive territory for the first time since last August – and stronger than at any time since April 2023.

Detached homes led the ...

-

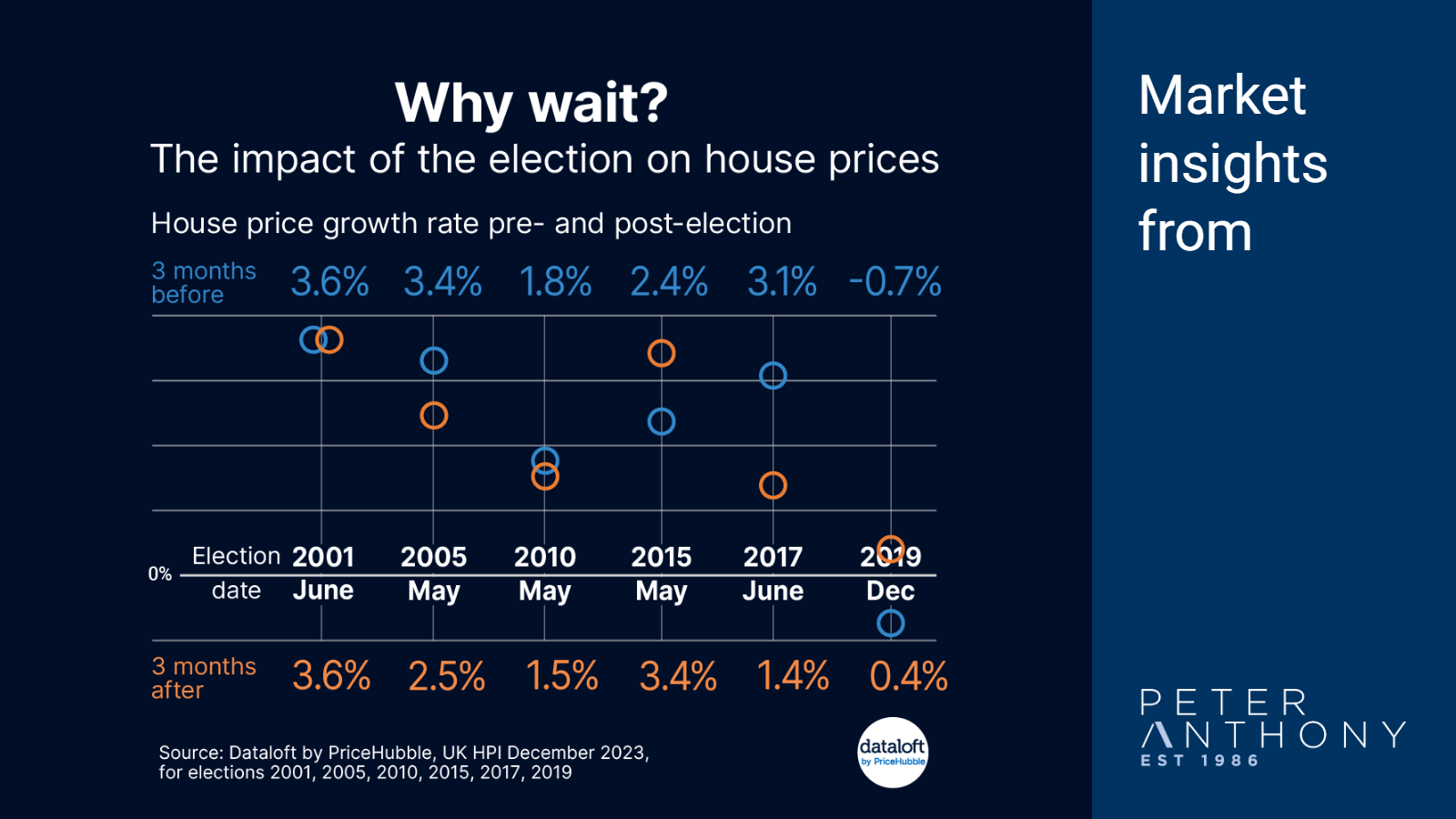

The impact of an election on house prices

Read More

With an upcoming election, we examined the impact of the past six elections on prices in the housing market.

The average price growth in the three months leading up to an election was 2.2%, whilst the three months following showed similar growth at 2.1%.

Price ...

-

Reeling in a rental home

Read More

65% of properties placed on the rental market are being snapped up by renters within a week of being listed, with 15% being let within just three days, according to the latest Dataloft poll of subscribers.

The proportion let in a week or less has ...

-

Growth in homes for sale boosts buyer choice

Read More

There are a fifth (20%) more homes available for sale compared to the same time last year, boosting buyer choice.

Encouraged by the usual spring bounce and a 9% annual increase in property sales, more people are putting their home on the market.

61% of ...

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Tom Simper Mar 20, 2025, 12:00 PM

Tom Simper Mar 20, 2025, 12:00 PM