Liverpool Property News

-

Market Quarterly Barometer

Read More.png?sfvrsn=124d6931_1)

This quarterly Opinion Poll tracks sentiment in the housing market, based on the experience of estate agents across the UK.

The Bank of England held interest rates at 4.5% in its second meeting of the year, amid persistent inflation. However the housing market continues to ...

-

The rise of co-living

Read More

Many of us have embraced new ways of working in the last few years and now housing providers are offering us a new way to live. Welcome to the idea of ‘Co-living’.

< id='graphic_188'>The London Plan defines co-living as large-scale purpose-built shared living developments of at ...

-

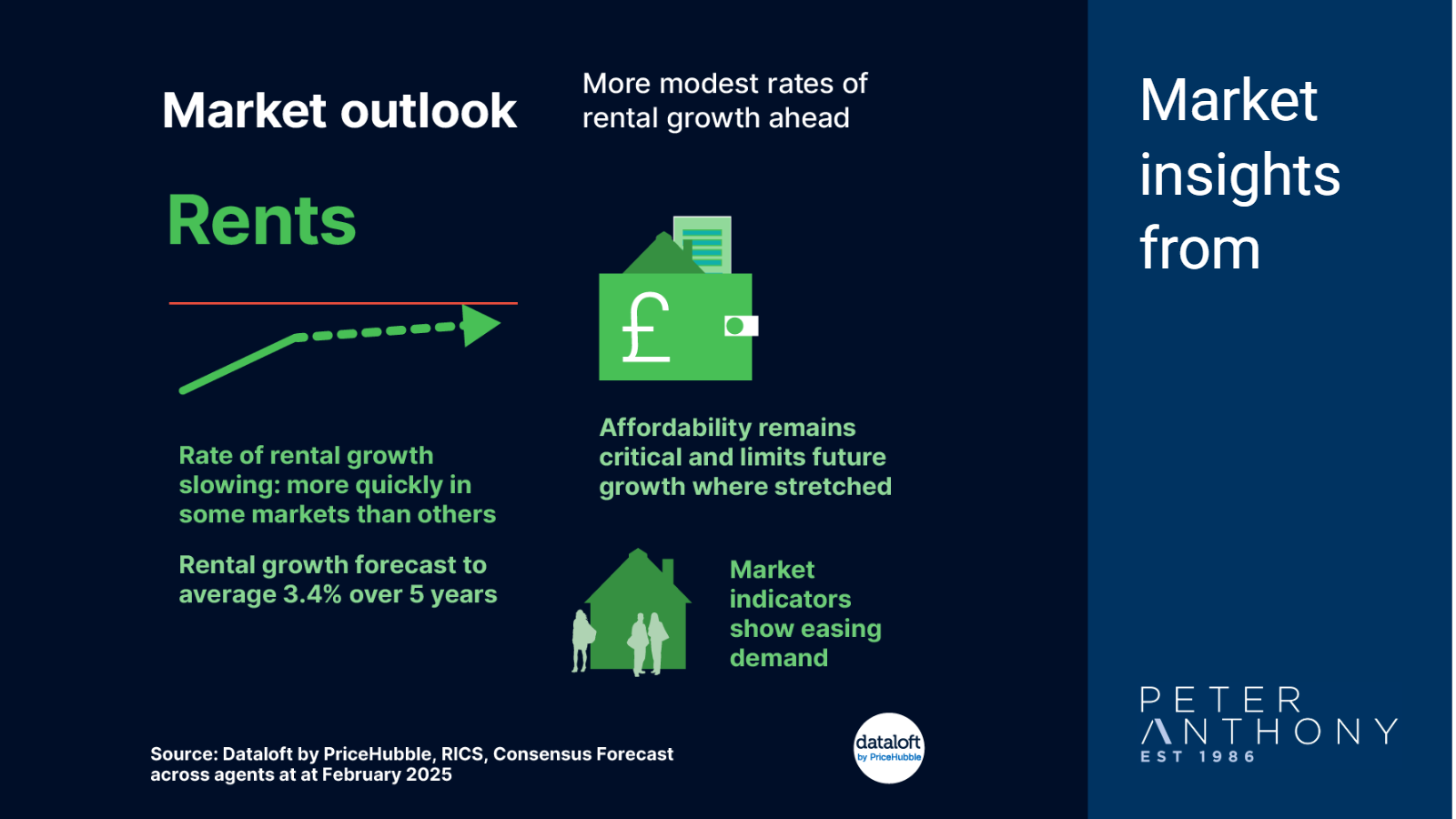

Market outlook: More modest rates of rental growth ahead

Read More

After a few years of high rental growth being the norm, rental growth rates on achieved new market lets are slowing. This slowdown in happening more quickly in some markets than others.

Affordability remains critical and limits potential future growth where stretched. For instance, in ...

-

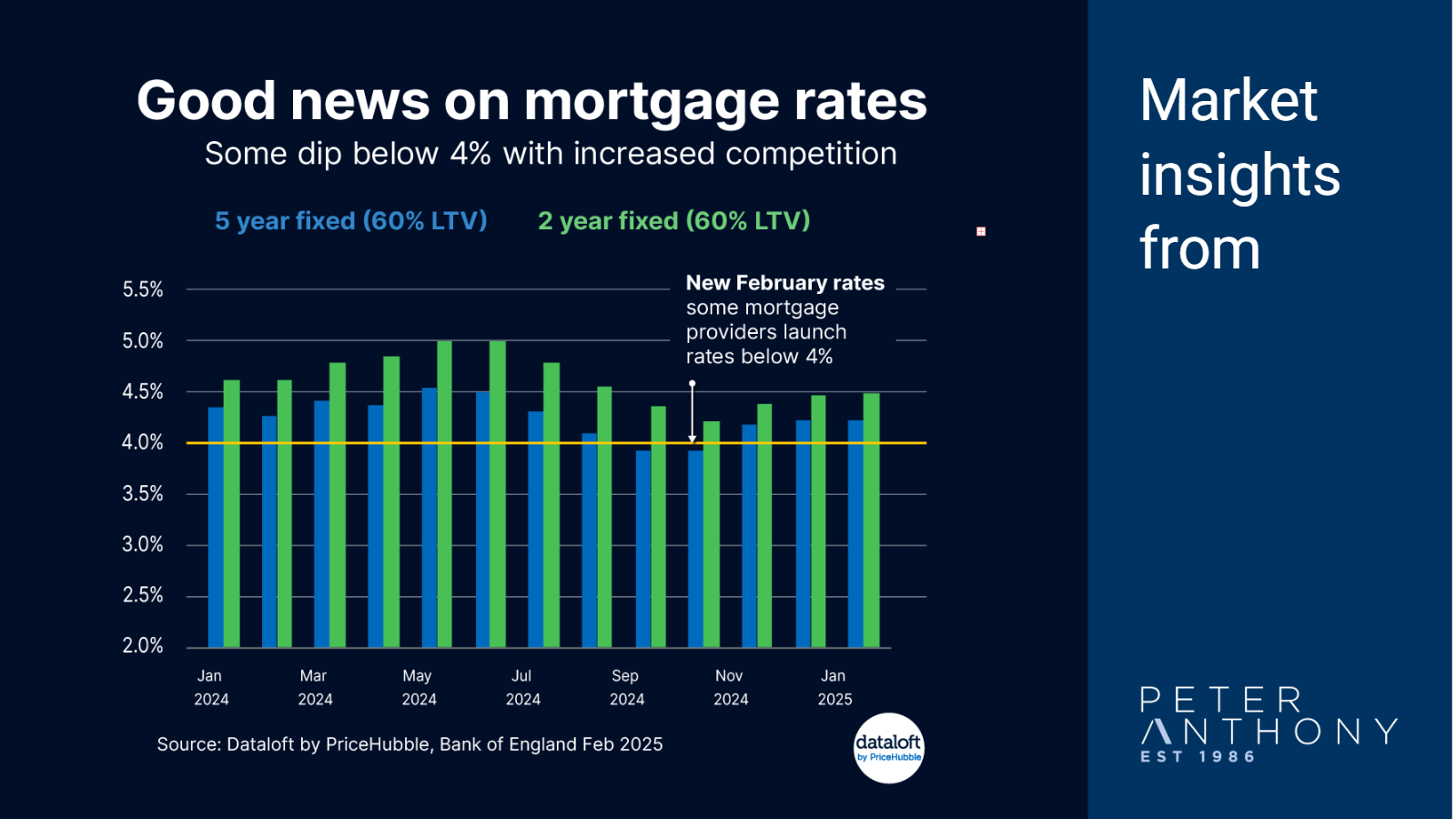

Good news on mortgage rates

Read More

A couple of the major lenders have launched mortgage deals with interest rates of less than 4% (60% loan to value).

Interest rates are typically lower for people with larger deposits, but even in this scenario, rates have been sitting stubbornly at over 4% for ...

-

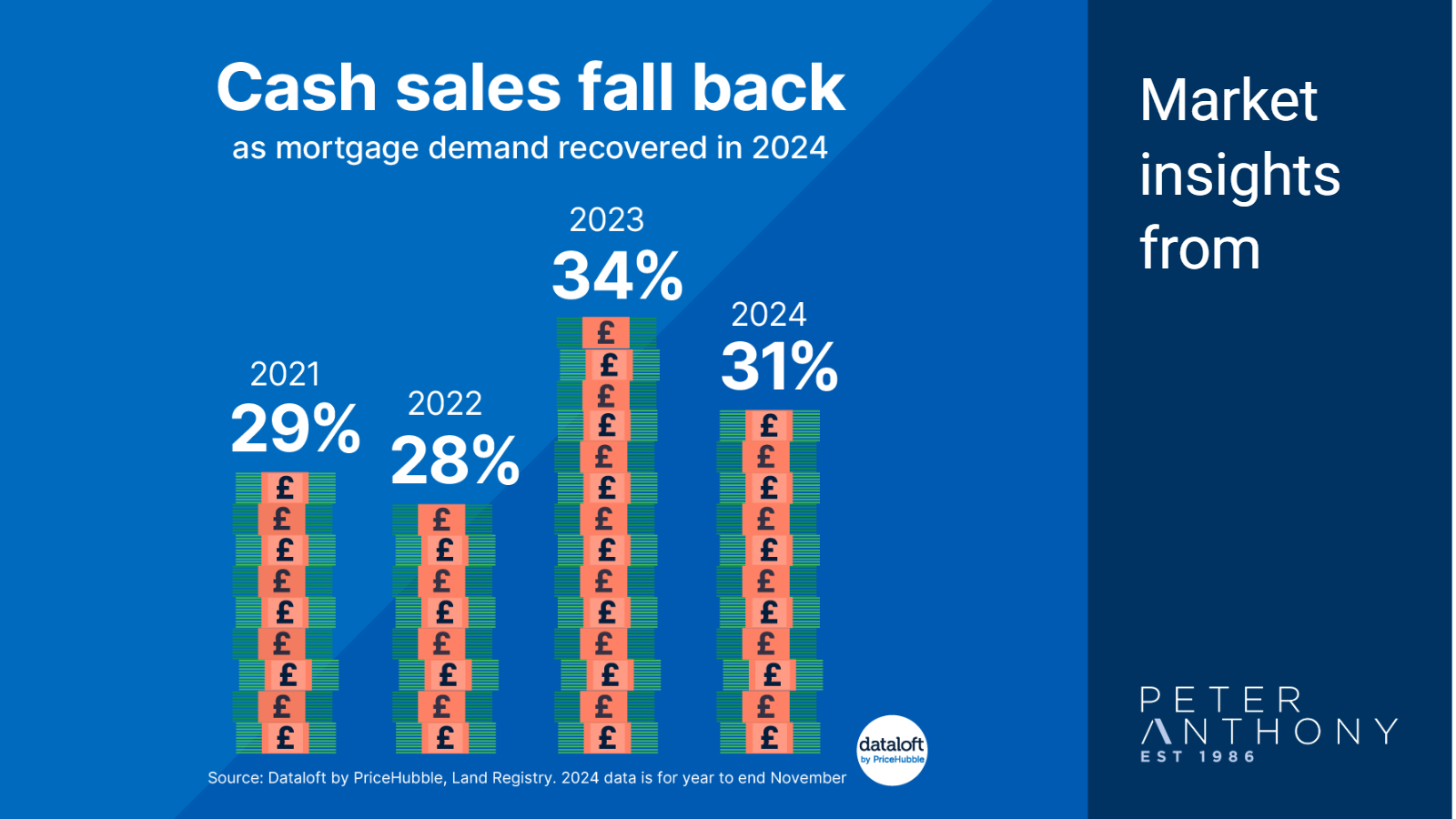

Cash sales fall back

Read More

In 2023, there was a particularly strong presence of cash buyers (not requiring a mortgage): 34% of sales England and Wales were for cash, compared to 28%, the average for the 5 years prior to that. This trend has largely reversed in 2024, as mortgage ...

-

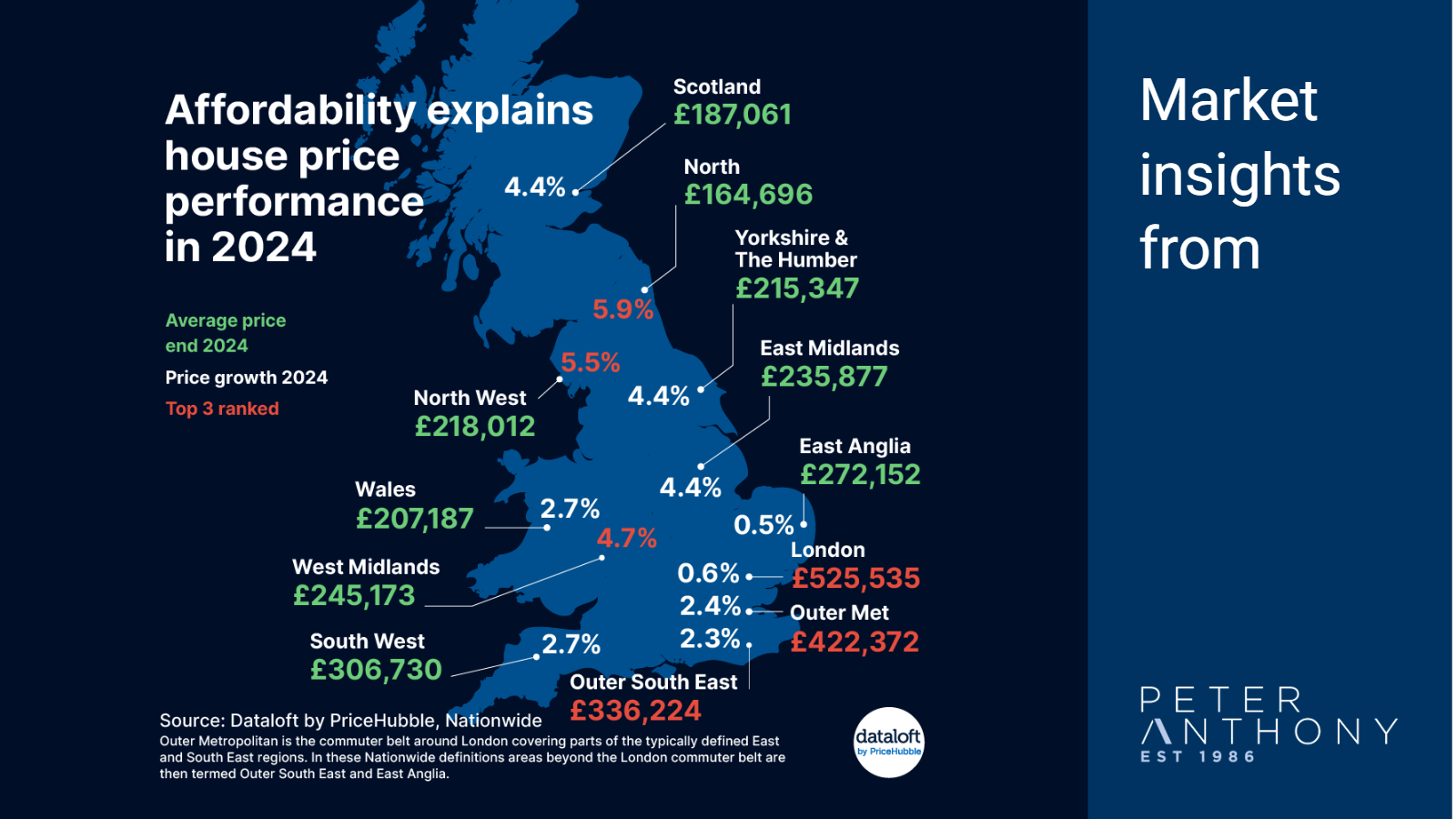

Affordability explains regional house price performance in 2024

Read More

We now know how different regions performed over 2024. While across the UK average prices grew by 3.6%, the North was the top performing region up 5.9%, through to East Anglia at the lowest, where prices grew by just 0.5%.

A key reason for the ...

-

Christmas wish list

Read More

A cherished holiday tradition that brings a touch of magic to the season is crafting Christmas wish lists. Each year, many people write a list, hoping to receive the gifts of their dreams.

At the top of home movers' wish lists for their agent are ...

-

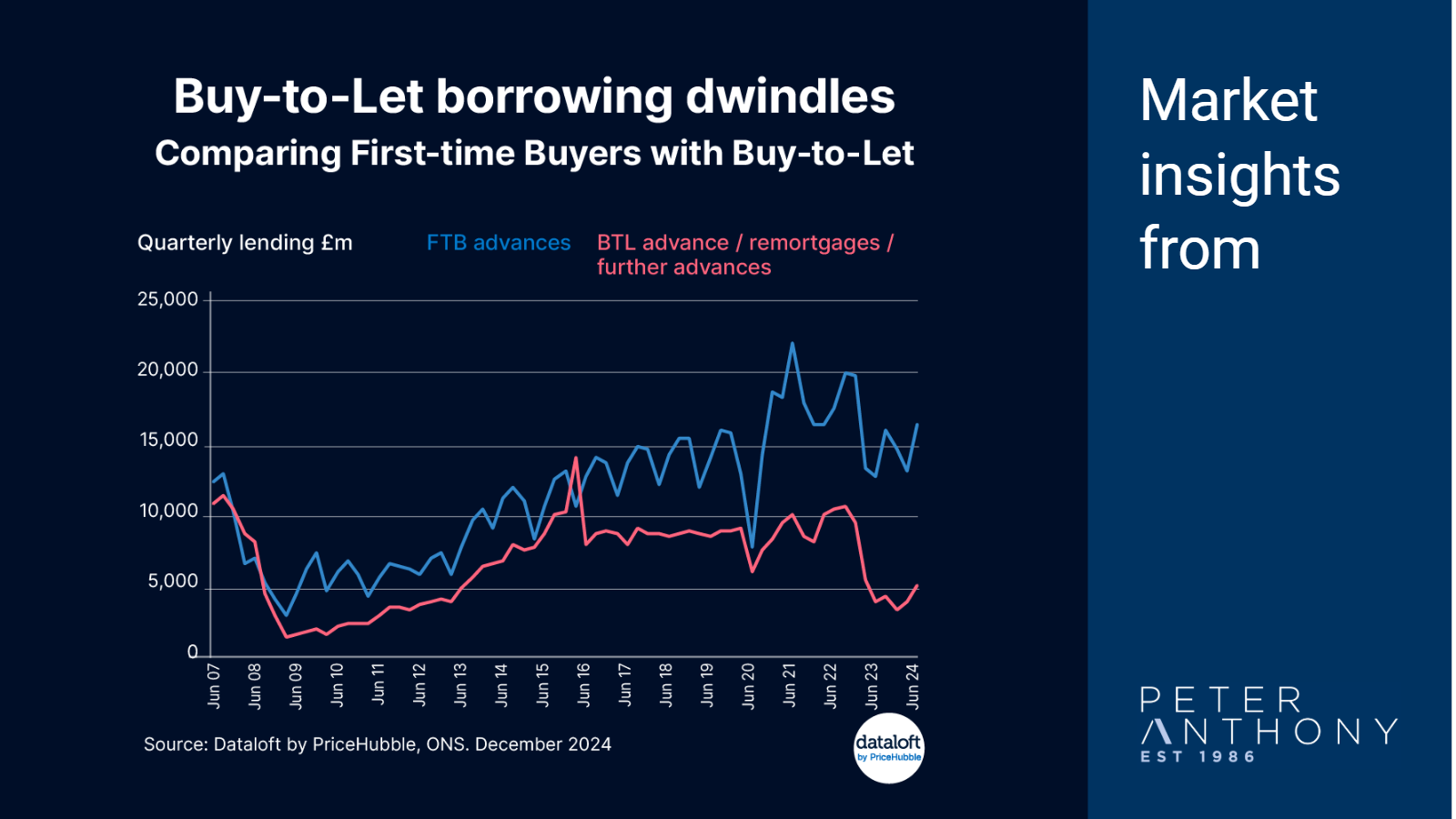

Buy-to-Let borrowing dwindles

Read More

Property has long been considered an attractive home for capital in the UK because it has consistently out-performed inflation over a very long time – and there is no tax charged on any capital gain from a primary home.

First-time Buyers have also been incentivised ...

-

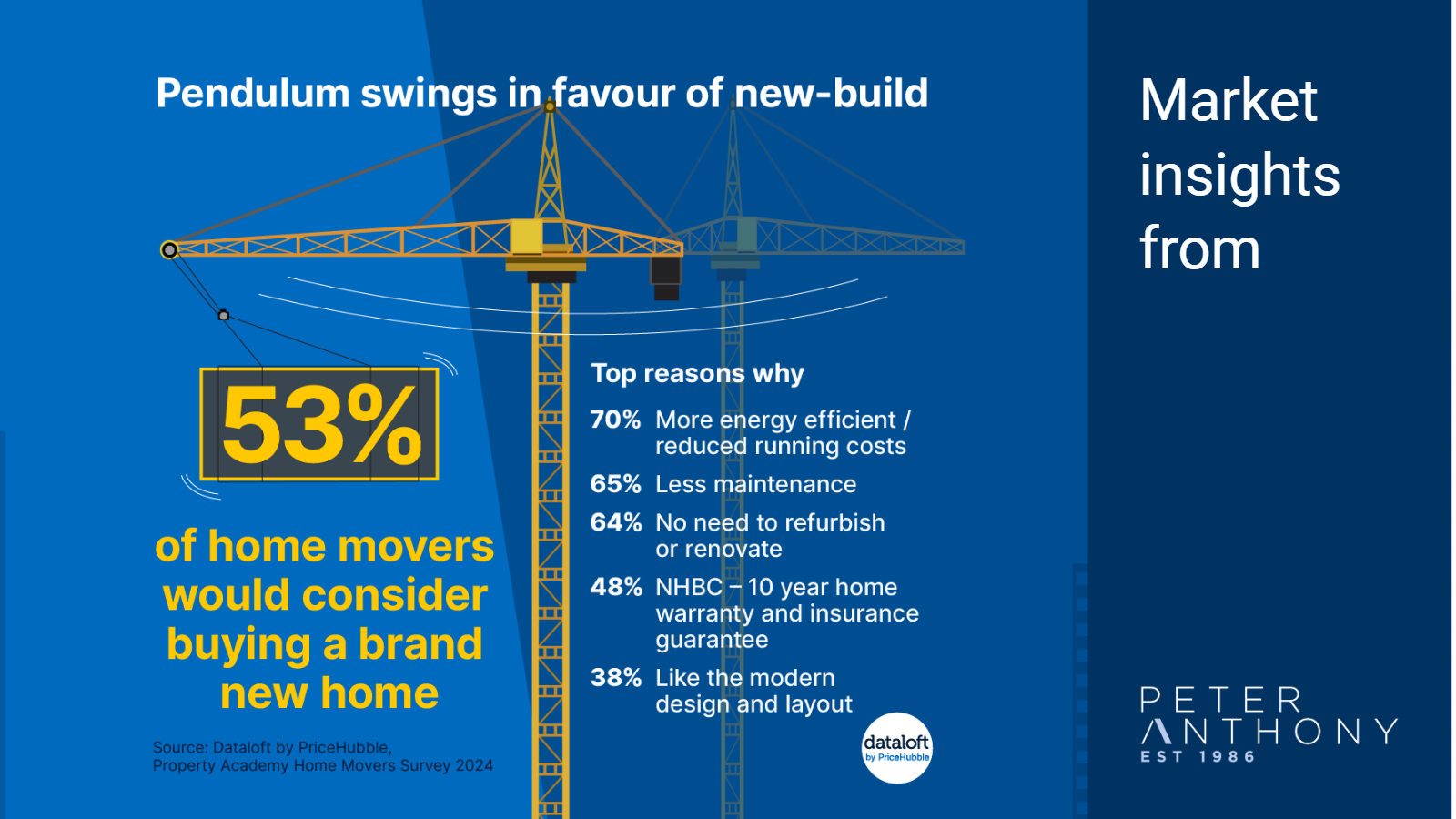

Pendulum swings to new-build

Read More

With rising energy costs a concern, 53% of home movers would consider buying a brand new home, up from 47% last year.

This is consistent across all age groups showing new-builds appeal to everyone, not just for first-time buyers or those who don’t like maintenance....

-

Rental growth is slowing

Read More

After the last couple of years of high growth, latest evidence shows that rental growth rates are slowing.

Across the largest cities in the UK then the average rate of rental growth slowed to 8% from 10% a year earlier. In London the slowdown has ...

-

Student renters – huge scale of student demand

Read More

With a new academic year just getting underway; it makes a good time to reflect on the huge scale of student demand and how many live in purpose built student accommodation (PBSA) or in the wider private rental market (PRS).

Overall in the private rental ...

-

Mortgage rates have improved significantly

Read More

The Bank of England voted to keep rates at 5% in the September meeting, having cut them in August, stating more cuts are on the cards if inflation stays low.

The latest consensus forecast for the Bank rate is to be 4.7% in Q4 2024, ...

-

Uptick in mortgage approvals

Read More

July data just released by the Bank of England saw a pick-up in mortgage approvals to just shy of 62,000, the highest monthly rate since the Truss mini budget in September 2022.

This July mortgage data precedes the Bank of England's first interest rate cut ...

-

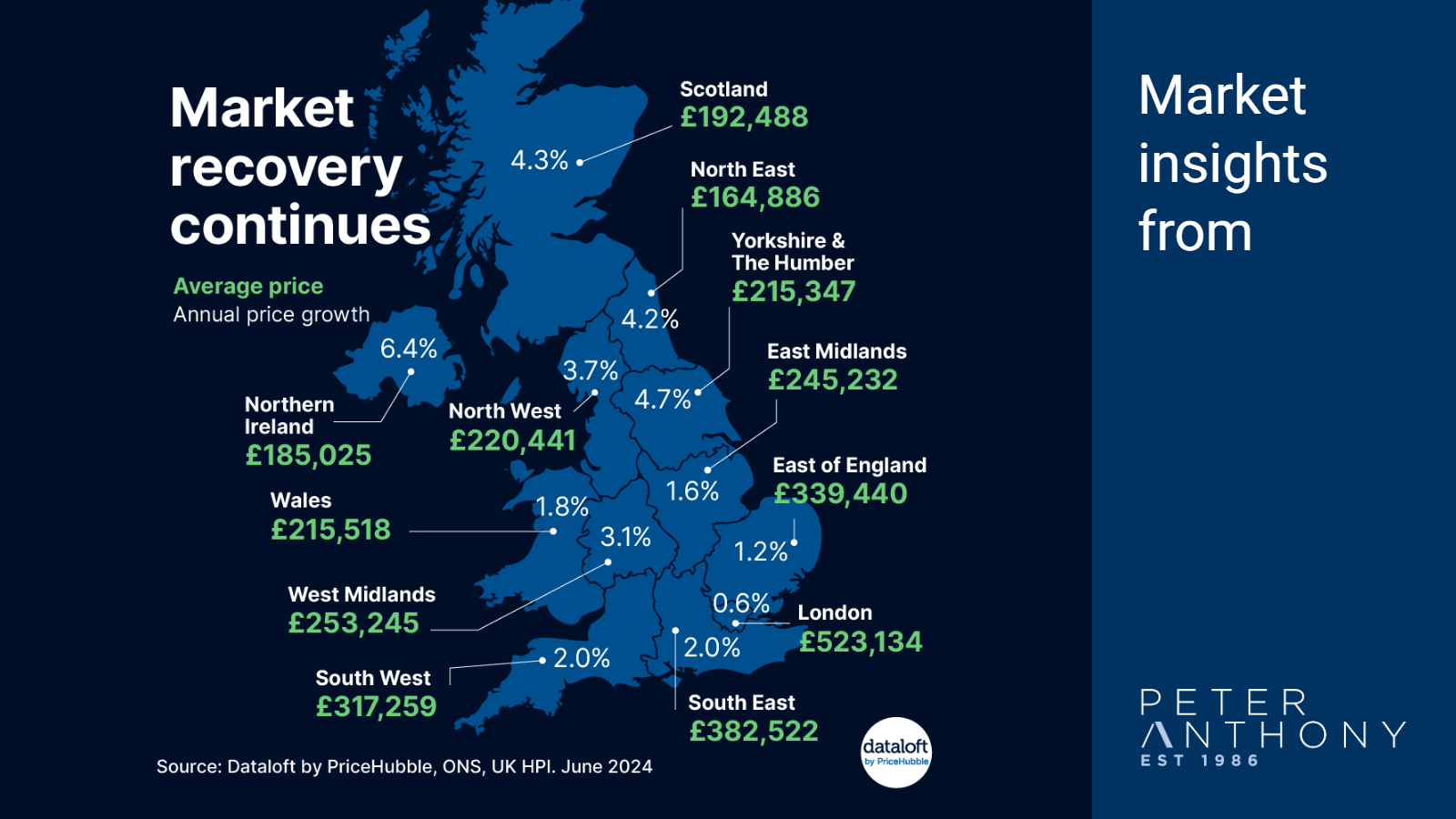

Market recovery continues

Read More

After starting the year with a moderation of -1.7%, annual house price growth has recovered to 2.7% in June, bringing the average price of a property to £287,927.

This is the first month since April 2023 that all UK regions are recording positive annual price ...

-

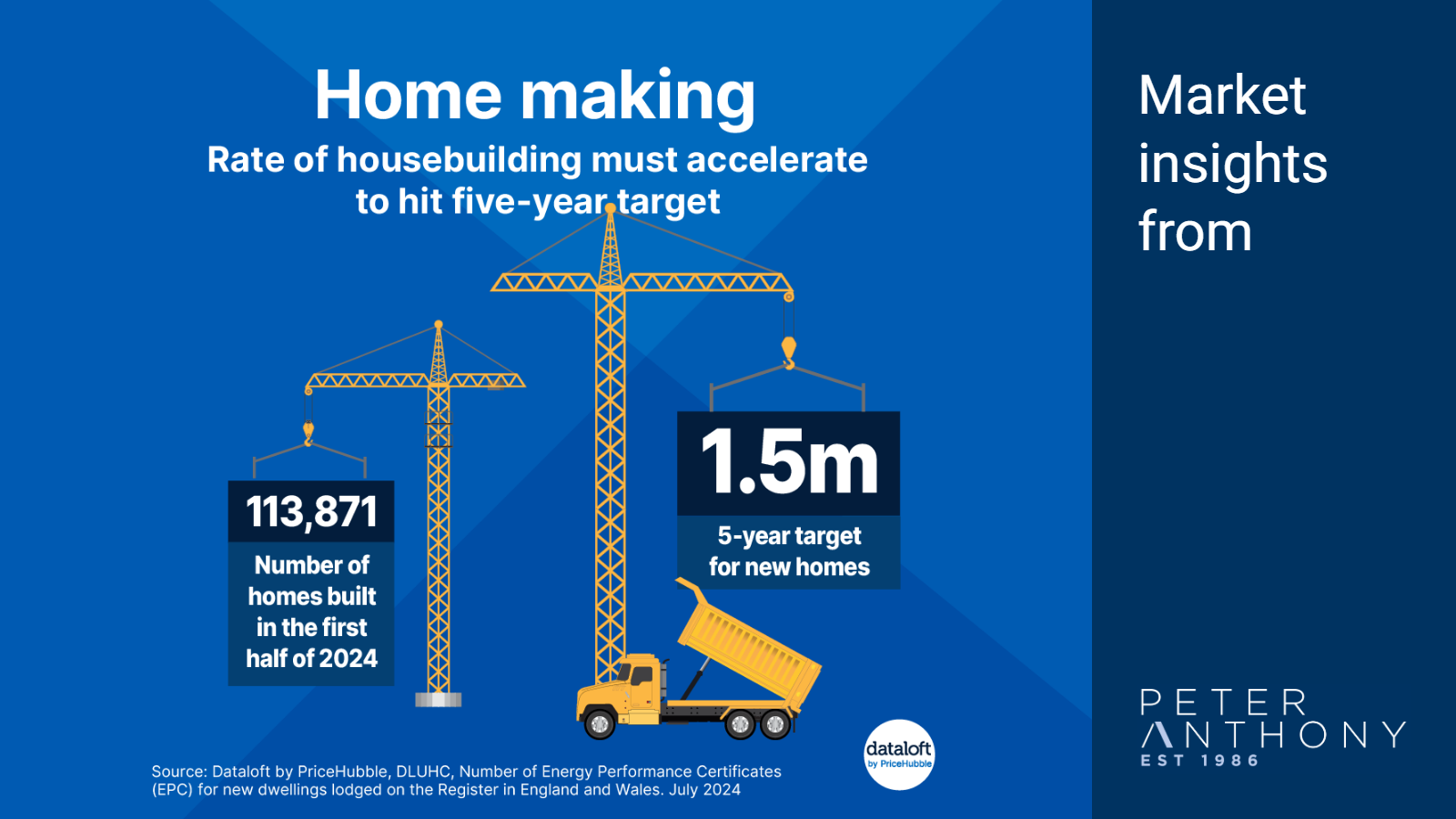

Rate of housebuilding must accelerate

Read More

The government has made clear its commitment to getting new homes built to address the housing crisis and surveys show that growing numbers of people are on-side with the idea of new developments.

But, it will be challenging. Only 114,000 new homes were built in ...

-

The race to rent

Read More

With peak rental season underway, homes to rent continue to be in high demand and are renting quickly. The median time on the market from listing to finding a renter is just 12 days meaning that over half of all homes are being rented in ...

-

Medium-term outlook – sales price forecasts have improved

Read More

Mid year is a good time to reflect on the market outlook for the rest of 2024 and beyond. Notably, recent revisions to house price forecasts show a more optimistic outlook for this year.

Whilst cuts in the Bank of England bank rate have yet ...

-

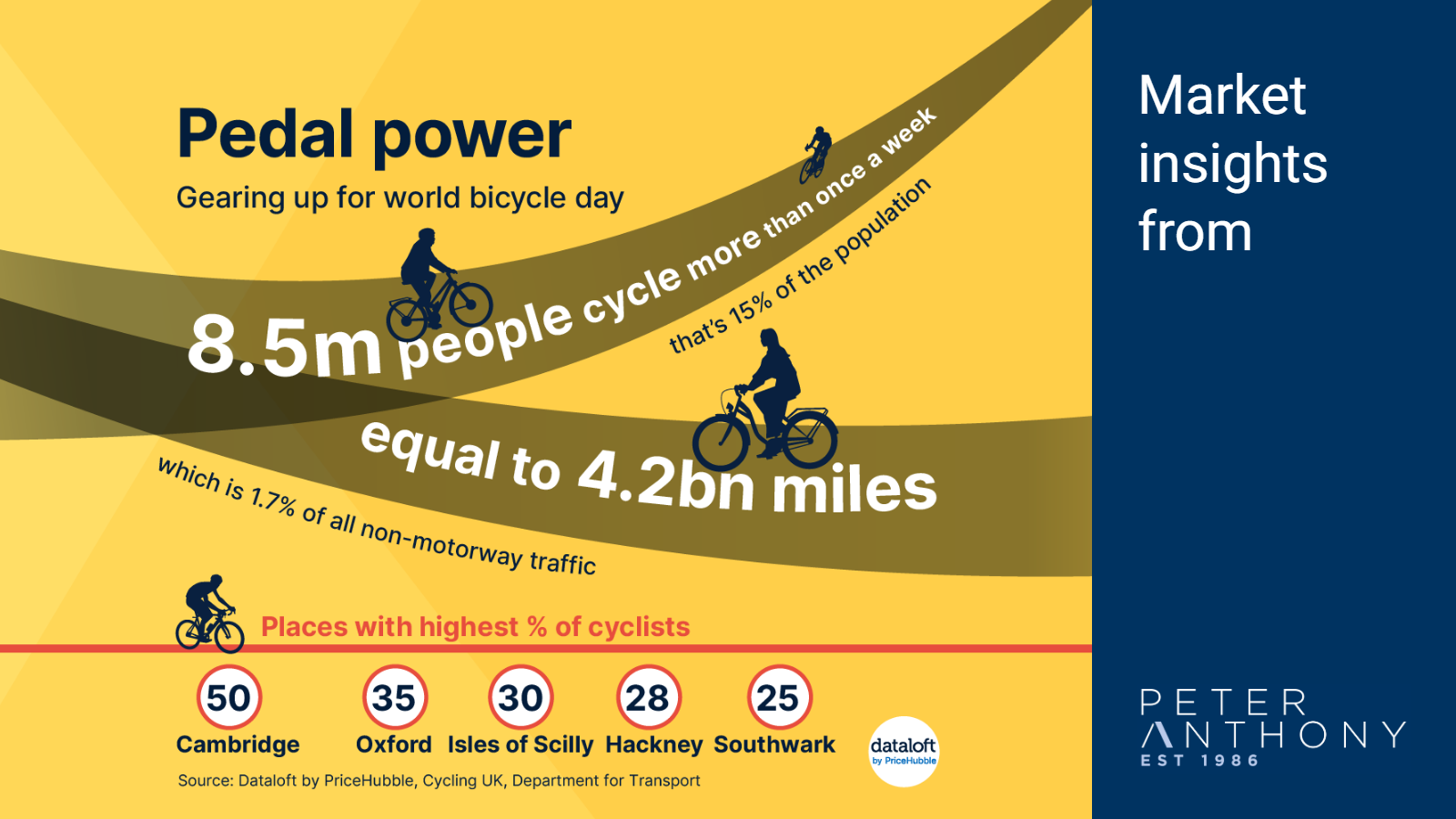

Gearing up for world bicycle day

Read More

Cycling is good for our health and wellbeing and, because it is one of the most sustainable modes of transport, it's good for the planet too. That's why we mark World Bicycle Day every June, to encourage more people to take to two wheels.

The ...

-

City ranking

Read More

The top 3 places best placed to experience rental growth are: Reading, Bristol, and Milton Keynes, according to new data from PriceHubble.

Reading has recently benefited from the opening of the Elizabeth Line (Crossrail), drawing in a new demographic of renter and also is well ...

-

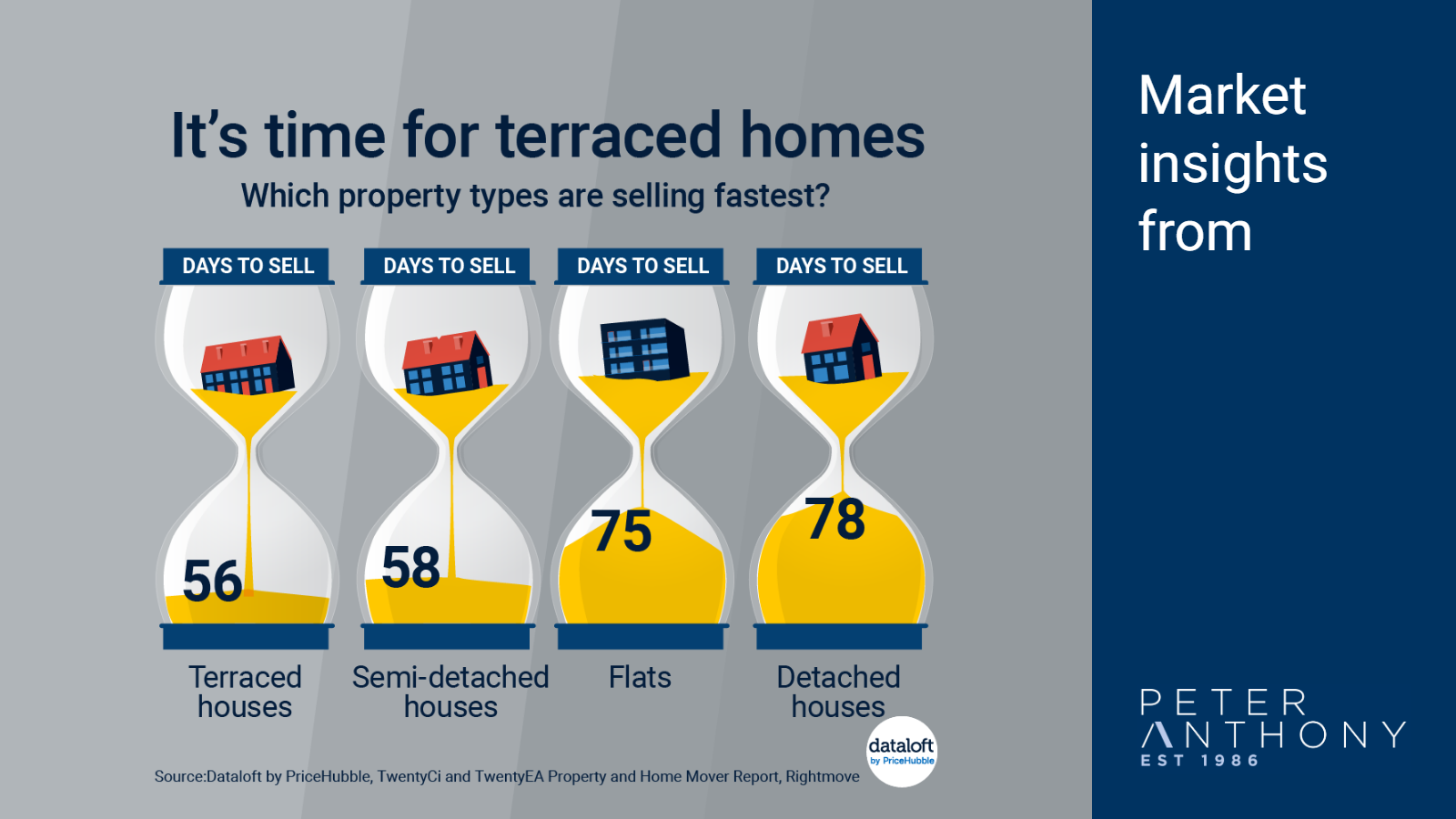

It's time for terraced homes

Read More

Terraced houses are the property type selling the quickest across the UK, at an average of just 56 days, followed closely by semi-detached houses at 58 days.

Flats are taking an average of 75 days, while detached houses are taking the longest to sell at ...

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell Apr 14, 2025, 10:30 AM

Gillian Bell Apr 14, 2025, 10:30 AM