Blog Post

Liverpool Homeowners Have Made an Annual Profit of £5,281 Since the Millenium

As we go full steam ahead into 2019, it’s certain that the Liverpool housing market in 2018 was a little more restrained than 2016 and 2017 and I believe this will continue into 2019. Property ownership is a medium to long term investment so, looking at the long-term, the average Liverpool homeowner, having owned their property since the Millennium, has seen its value rise by more than 177%.

This is important, as house prices are a national obsession and tied into the health of the UK economy as a whole. The preponderance of that historical gain in Liverpool property values has come from the growth in Liverpool property values, while some of it will have been enhanced by extending, modernising or developing their Liverpool home.

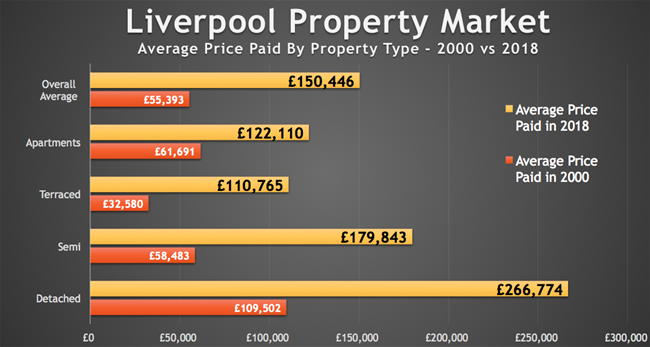

Taking a look at the different property types in Liverpool, and the profit made by each type, makes interesting reading..

|

| Average Price | Average Price | Average Total Profit in last 20 years in Liverpool | Average Householder Profit per Year in Liverpool | Average Annual % Increase in Liverpool |

| Detached | £109,502 | £266,774 | £157,272 | £8,737 | 7.9% |

| Semi | £58,483 | £179,843 | £121,360 | £6,742 | 11.7% |

| Terraced | £32,580 | £110,765 | £78,185 | £4,344 | 13.4% |

| Apartments | £61,691 | £122,110 | £60,419 | £3,357 | 5.5% |

| Overall Average | £55,393 | £150,446 | £95,053 | £5,281 | 9.8% |

However, we can’t forget there has been just over 60% inflation over those 18 years, which eats into the ‘real’ value (or true spending power of that profit) … so if we take into account inflation since 2000, the true spending power of that profit has been lower.

|

| Total 'REAL' Profit | ‘Real' Annual |

| Detached | £96,015 | £5,334 |

| Semi | £74,090 | £4,116 |

| Terraced | £47,732 | £2,652 |

| Apartments | £36,886 | £2,049 |

| Overall | £58,030 | £3,224 |

So the ‘real’ value of the profit, after inflation, in Liverpool has been £3,224 per year.. still nothing to sniff at.

I wanted to show you that even though we had the 2008/09 Credit Crunch property market crash where, depending on the type of Liverpool property, property values dropped between 15% and 20% in 18 months … Liverpool homeowners over the long term are still better off than those renting.

Moving forward, the question I get asked time and again is what will happen in the future to the Liverpool Property market? Irrespective of what is happening in the World, Europe or even Central London, the biggest factor over the medium to long term to ensure that this level of house price growth is maintained in Liverpool is the building of new homes both locally and in the country as a whole. Whilst we haven’t had the 2018 stats yet, Government sources suggest this will be nearer 180,000 to 190,000, a decrease from the 2017 figure of 217,350 new households being created. When you consider that we need to build 240,000 households to equal demand (immigration, people living longer, higher divorce rates and people co-habiting later in life etc) … demand will outstrip supply and unless the Government start to spend billions building council houses .. this trend will continue for years (and decades to come).

Another factor is that whilst Liverpool landlords have been hit with higher taxes to enable them to actually be a landlord most, in every national survey, still intends to increase their portfolio in the medium to long term. The youngsters of Liverpool see renting as a choice, giving them flexibility and options that being tied to a home cannot give… thus meaning demand will continue to grow and landlords will be able to enjoy increased rents and capital growth, although those very same Liverpool buy to let landlords will have to work smarter in the future to continue to make decent returns (profits) from their buy to let investments. Even with the tempering of house price inflation in Liverpool in 2018, most Liverpool buy to let landlords (and homeowners) are still sitting on a copious amount of growth from previous years.

The question is, how do you, as a Liverpool buy to let landlord, ensure that continues?

Since the 1990’s, making money from investing in buy to let property was as easy as falling off a log. Looking forward though, with all the changes in the tax regime and balance of power, making those similar levels of return in the future won’t be so easy. Over the last ten years, I have seen the role of the forward thinking agents evolve from a person collecting the rent to a more all-inclusive role; I call it, ‘strategic portfolio leadership’. Thankfully, along with myself, there are a handful of agents in Liverpool whom I would consider exemplary at this landlord portfolio strategy where they can give you a balanced structured overview of your short, medium and long-term goals, in relation to your required return on investment, yield and capital growth requirements. If you would like such advice, speak with your current agent – whether you are a landlord of ours or not – without any cost or commitment, feel free to drop me a line.

Gillian Bell

Jan 9, 2019, 11:51 AM

Gillian Bell

Jan 9, 2019, 11:51 AM

Leave a comment