Blog Post

Bank of England considers removing Affordability Test

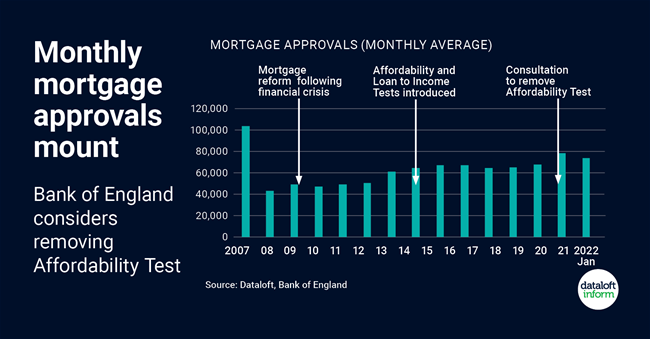

Mortgage approvals, which surged in 2021 on the back of demand from home-movers, have sustained a high level into 2022, continuing to outpace any period since 2008.

Meanwhile, the Bank of England is considering removing the ‘affordability test’ which tests a borrower’s ability to service their mortgage as interest rates rise.

However the Loan to Income (LTI) multiple of 4.5 times income will remain and this is proved to be more effective at curbing risk during a housing 'boom'.

The removal of the affordability test would make it easier for some first-time buyers to get a mortgage although, for an estimated 83% of renters finding a 5% deposit remains a barrier. Source: Dataloft, Bank of England

Tom Simper

Mar 10, 2022, 10:30 AM

Tom Simper

Mar 10, 2022, 10:30 AM

Leave a comment