Blog Post

Affordability could hit historic levels

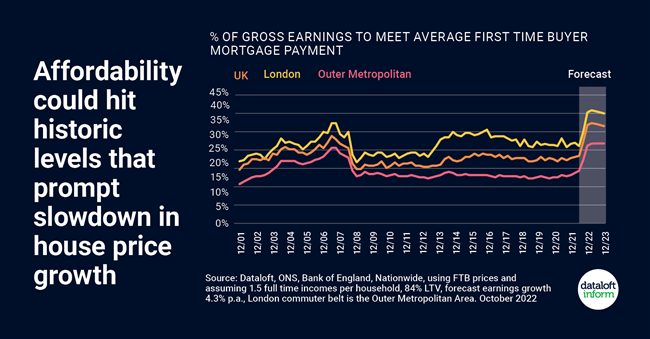

Significant rises to mortgage interest rates will mean fewer first time buyers able to get on the housing ladder. New borrowers won’t have the luxury of existing low rates.

We tracked ‘affordability’ over the past 20 years – based on the proportion of gross income needed to meet mortgage payments. Interest rate rises drive up monthly payments.

While it is possible that interest rates will subside if the financial markets settle, it seems unlikely and the expected rise takes affordability to levels that normally trigger a slowdown in house price growth and transactions.

In London, the average first time buyer will need another £500 pcm if mortgage rates rise to 6% as forecast. That comes on top of a similar increase earlier this year.

Outside the more expensive parts of the UK housing market, there may be more headroom to afford interest rate increases. Source: Dataloft, ONS, Bank of England, Nationwide.

Tom Simper

Oct 17, 2022, 10:30 AM

Tom Simper

Oct 17, 2022, 10:30 AM

Leave a comment