Blog Post

Market outlook: Interest rate cuts

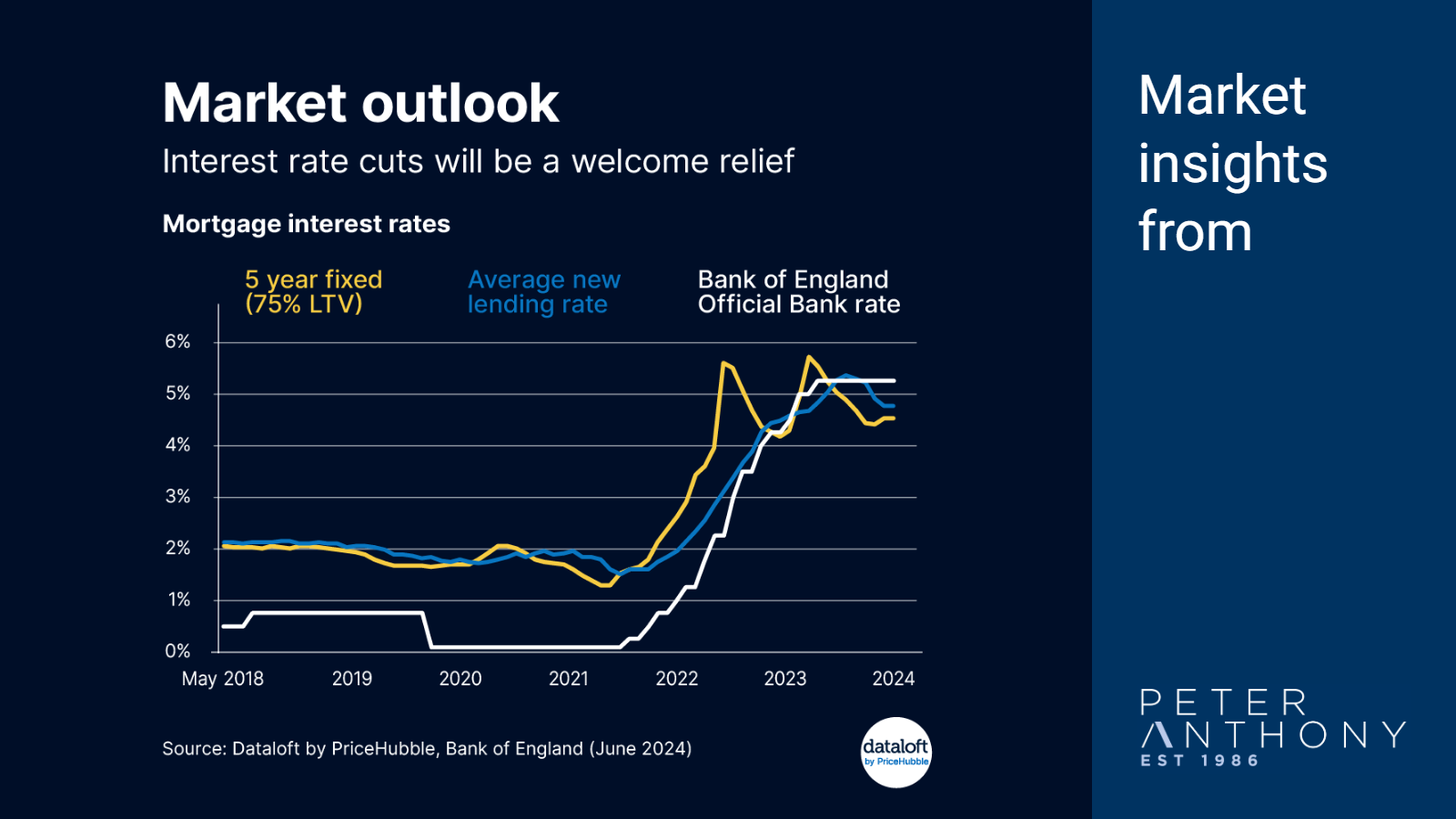

The European Central Bank cut its central bank rate on 6th June. It is the first cut in nearly 5 years and ahead of the US which, like the UK, is yet to reduce rates.

For the UK, inflationary pressures have been easing. The latest data for April showed the headline CPI rate at 3% but there remain pressures in parts of the economy. The Bank of England next meets on 20th June, and this month might prove still a little too early to make a move, but cuts are expected before the end of the year.

Consensus forecasts, compiled by HM Treasury, suggest that by the end of 2024 the bank rate will be 4.5% (from current 5.25%).

Mortgage rates did fall slightly at the start of the year, but have more recently plateaued as interest rate cuts were pushed back into the second half of the year. Source: #Dataloft by PriceHubble, HM Treasury Forecasts May 2024.

Dewi Jones

Jun 7, 2024, 11:00 AM

Dewi Jones

Jun 7, 2024, 11:00 AM

Leave a comment