Blog Post

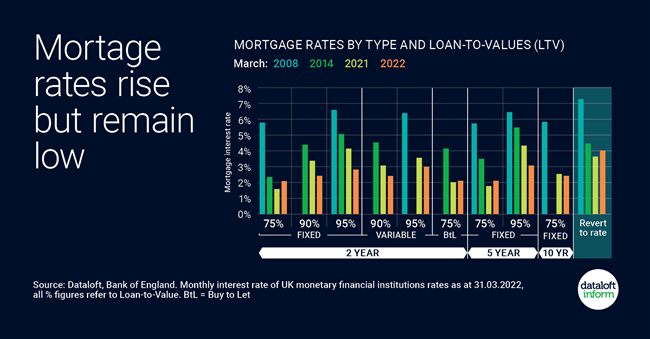

Mortgage rates rise but remain low

Since the start of 2022 interest rates have risen by 0.5%, however for those looking to purchase a home many mortgage rates remain attractive.

It is estimated over 1 in 4 households are on mortgage deals affected by changing interest rates (UK Finance), but the average 2 year variable rate published by the Bank of England is actually lower than a year ago.

At 3.99% the revert-to-rate is 0.37% higher year-on-year. For those with a 25% deposit the current 10-year fixed rate is just 0.33% above the 2-year fixed rate.

Back in 2008 when the base rate was last 0.75% and in 2014 when affordability tests were introduced, rates were far higher. The next meeting of the Banks Monetary Policy Committee is on Thursday 5th May. Source: Dataloft, Bank of England, For general information only. Specialist advice on investments must always be sought.

Tom Simper

Apr 8, 2022, 10:00 AM

Tom Simper

Apr 8, 2022, 10:00 AM

Leave a comment