Blog Post

Mortgage rates by year end

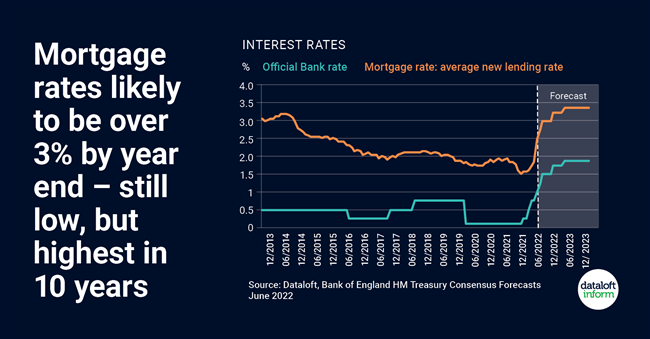

With inflation running high, the Bank of England increased its base rate to 1.25% in June, with another 0.5 percentage point rise forecast before the end of 2022 and potential for a further 0.25 percentage point rise in 2023.

The typical margin between mortgage rates and the bank rate (1.5 percentage points over the last year) suggests the average new lending mortgage rates will be over 3% by the end of 2022.

The vast majority of new mortgage borrowers are on fixed rates (representing 92% of new loans over the last 5 years) offering protection from rising payments, at least until the fixed term expires.

House prices are largely driven by what people can borrow and at what cost, so with rising rates this does start to drive affordability the wrong way. Source: Dataloft, Bank of England HM Treasury Consensus Forecasts June 2022

Tom Simper

Jun 25, 2022, 09:30 AM

Tom Simper

Jun 25, 2022, 09:30 AM

Leave a comment