Blog Post

Interest rates expectations have jumped, but improved a little

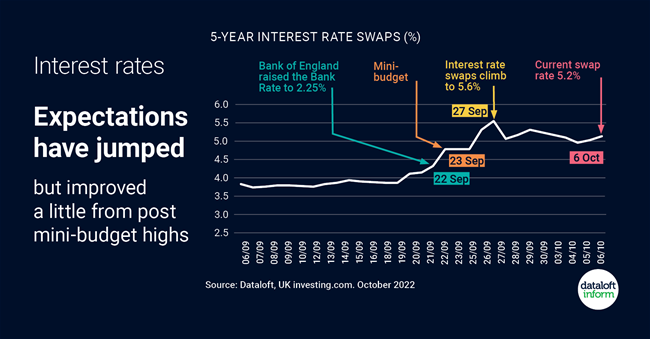

As widely reported, the Chancellor's mini-budget spooked markets and resulted in the value of the pound sliding and interest rate expectations jumping up.

Swap rates are often used as an early warning of where mortgage interest rates are heading. Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since improved a little to 5.2%.

The next few weeks leading up to the Bank of England's next meeting and the Chancellor's budget are likely to be volatile for interest rate expectations.

Interest rates are definitely rising but with current volatility the extent they will need to rise is still unclear. Source: Dataloft, UK investing.com

Tom Simper

Oct 10, 2022, 12:15 PM

Tom Simper

Oct 10, 2022, 12:15 PM

Leave a comment