Manchester Property News

Interest rates rise to 1.75%, but fixed rates will protect borrowers

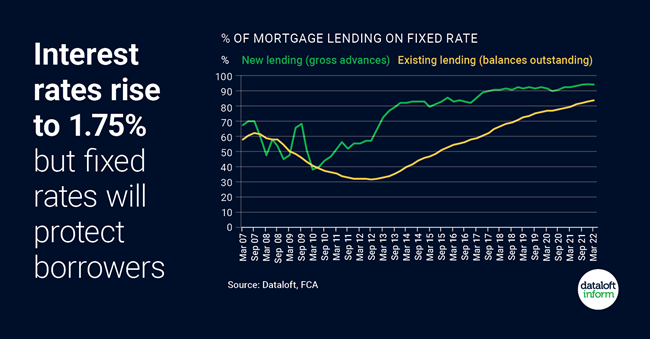

In its August meeting, the Bank of England increased its base rate to 1.75%. Its sixth consecutive rise and its highest single rise in 27 years.

Many borrowers are protected from any immediate payment increase by fixed mortgage rates. 94% of new mortgages in Q1 2022 (gross advances) were on fixed rates.

And 84% of all existing outstanding mortgage lending was on a fixed rate by the end of Q1 2022.

This is quite different from 10 years ago when only 57% of new lending and 32% of existing lending were fixed rates.

For new borrowers, lending is getting more expensive. The average 5-year fixed rate in June was 2.9% for those with a 25% deposit and 3.5% for those with a 5% deposit according to the Bank of England. Source: Dataloft, FCA

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Tom Simper

Aug 8, 2022, 13:00 PM

Tom Simper

Aug 8, 2022, 13:00 PM

Leave a comment