Salford Property News

Mortgage lending metrics

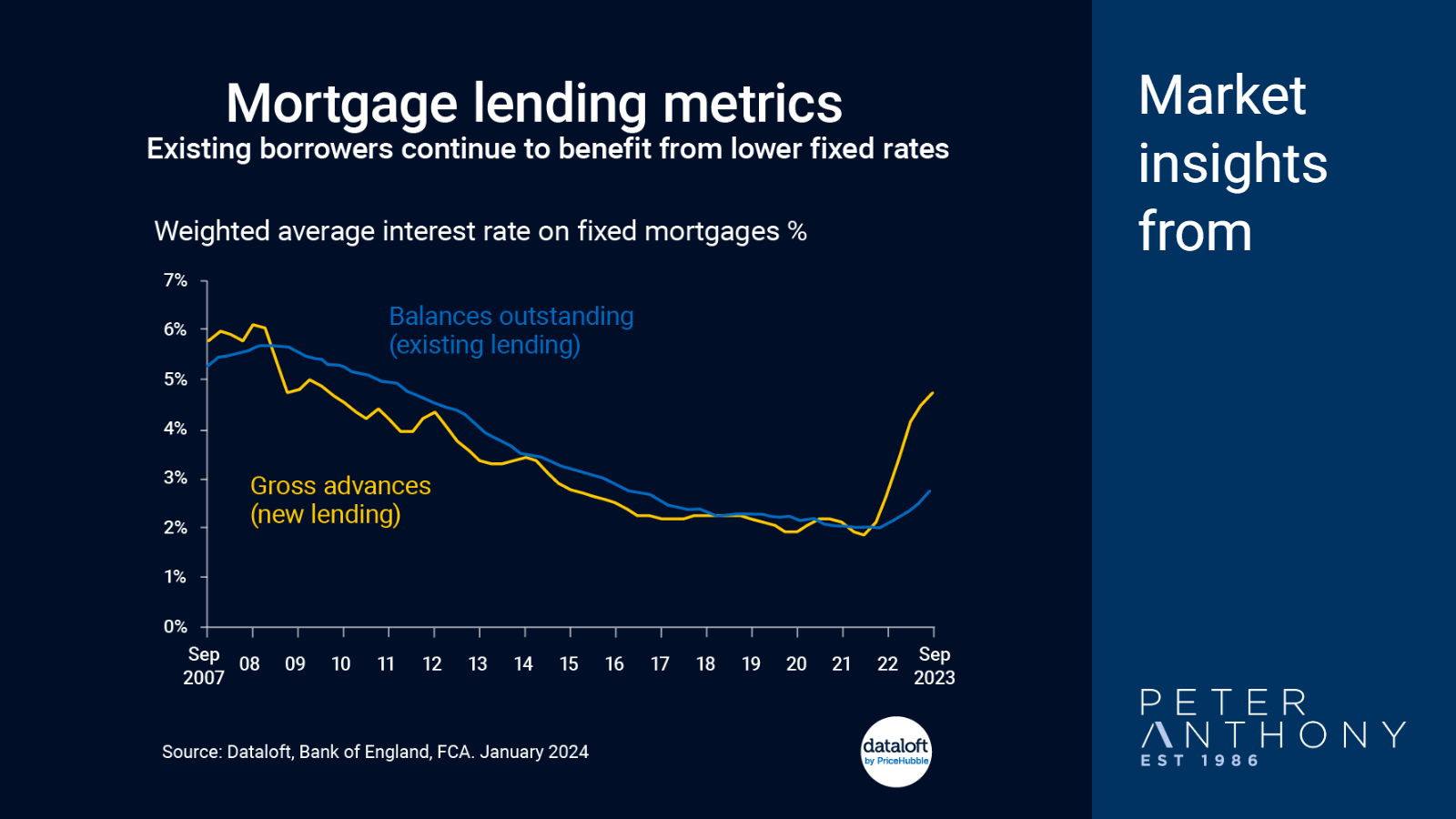

Mortgage borrowers on fixed rates have already escaped the worst of the interest rate rises and the direction of travel for rates is currently downwards.

But 1.5 million homeowners will come to the end of their fixed-rate mortgage deals in 2024 and at the moment there still remains a wide gulf between the interest rates on new lending (gross advances) and existing lending (balances outstanding).

On latest data the average fixed rate for new lending was 4.73% whilst the average for existing borrowers was 2.76% (data to end Q3).

These borrowers will almost certainly face an uplift in their monthly mortgage costs but it is worth shopping around for deals because, unless there is a dramatic change, swap rates and mortgage rates are on a downward trend. Source: #Dataloft, Investing.com, Bank of England, FCA

About The Blog

This Blog looks at what is happening in the Salford and Eccles property market. We report on events and community news along with investment ideas and tips for those loosing to invest in the area.

Dewi Jones - Editor

Salford is fast becoming one the most exciting areas of development in North West. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience

and local knowledge to help.

T: 0161 707 4745

E: [email protected]

Dewi Jones

Jan 22, 2024, 10:00 AM

Dewi Jones

Jan 22, 2024, 10:00 AM

Leave a comment