Stockport Property News

Improvements in affordability

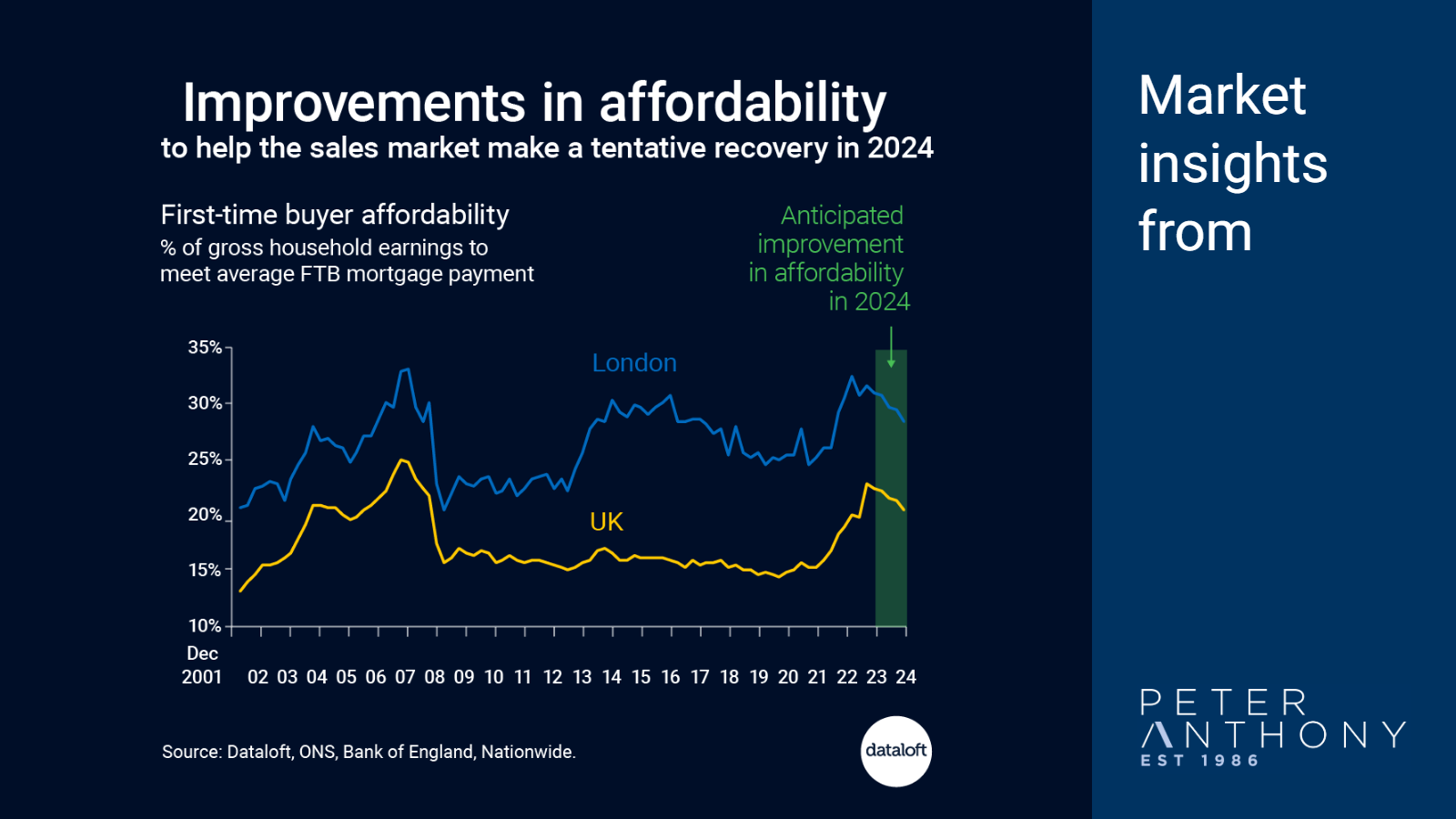

Comparing affordability levels through time helps us understand when a market needs to slow down (affordability is overstretched) or when a recovery can take hold (improved affordability).

A combination of factors (chiefly the expectation of better mortgage rates) will see affordability improve in 2024 and help drive a tentative recovery in buyer confidence.

Lower recent 5-year swap rates (4.4% at the end of November) point to further improvement in mortgage rates.

Affordability, as measured here, represents the proportion of household earnings it takes to meet mortgage payments. Source: #Dataloft, ONS, Bank of England, Nationwide. Affordability is based on FTB prices, assuming 1.5 full time incomes per household; 80% loan to value and average new lending mortgage rate; forecast earnings growth of 3.4% for 2024; average new lending rate to improve to 4.5% by end 2024; FTB price fall of -1% for remaining quarter of 2023 and then stabilised.

About The Blog

This Blog looks at what is happening in Stockport, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper

Dec 11, 2023, 11:00 AM

Tom Simper

Dec 11, 2023, 11:00 AM

Leave a comment