Blog Post

First-time buyer mortgages

First-time buyer purchases fell by -13% in 2020, the result of a closed housing market in spring and stricter mortgage lending. First-time buyer transactions recovered in the second half of the year, down just -2% on the same period in 2019.

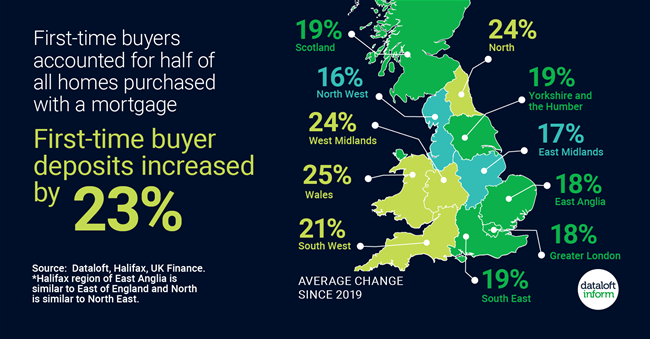

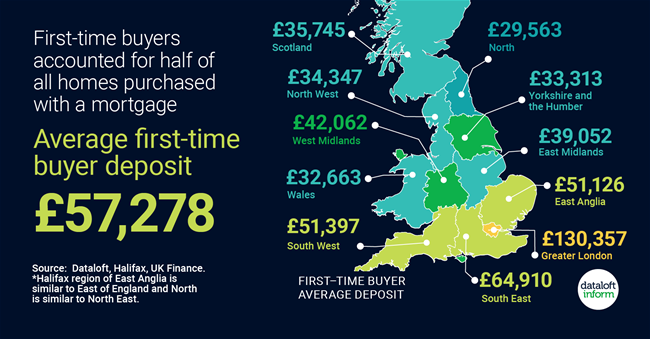

The average price paid by a UK first-time buyer in 2020 was £256,057, a 10% annual increase. Deposits also increased, the average first-time buyer deposit in 2020 was £57,278, a 23% annual increase.

Despite the need to raise an even bigger deposit, first-time buyers accounted for half of all homes purchased with a mortgage, in line with 2019 (51%) and 2018 (50%).

Source: Dataloft, Halifax, UK Finance. * Halifax region of East Anglia is similar to East of England and North is similar to North East.

Tom Simper

Feb 10, 2021, 12:00 PM

Tom Simper

Feb 10, 2021, 12:00 PM

Leave a comment