Blog Post

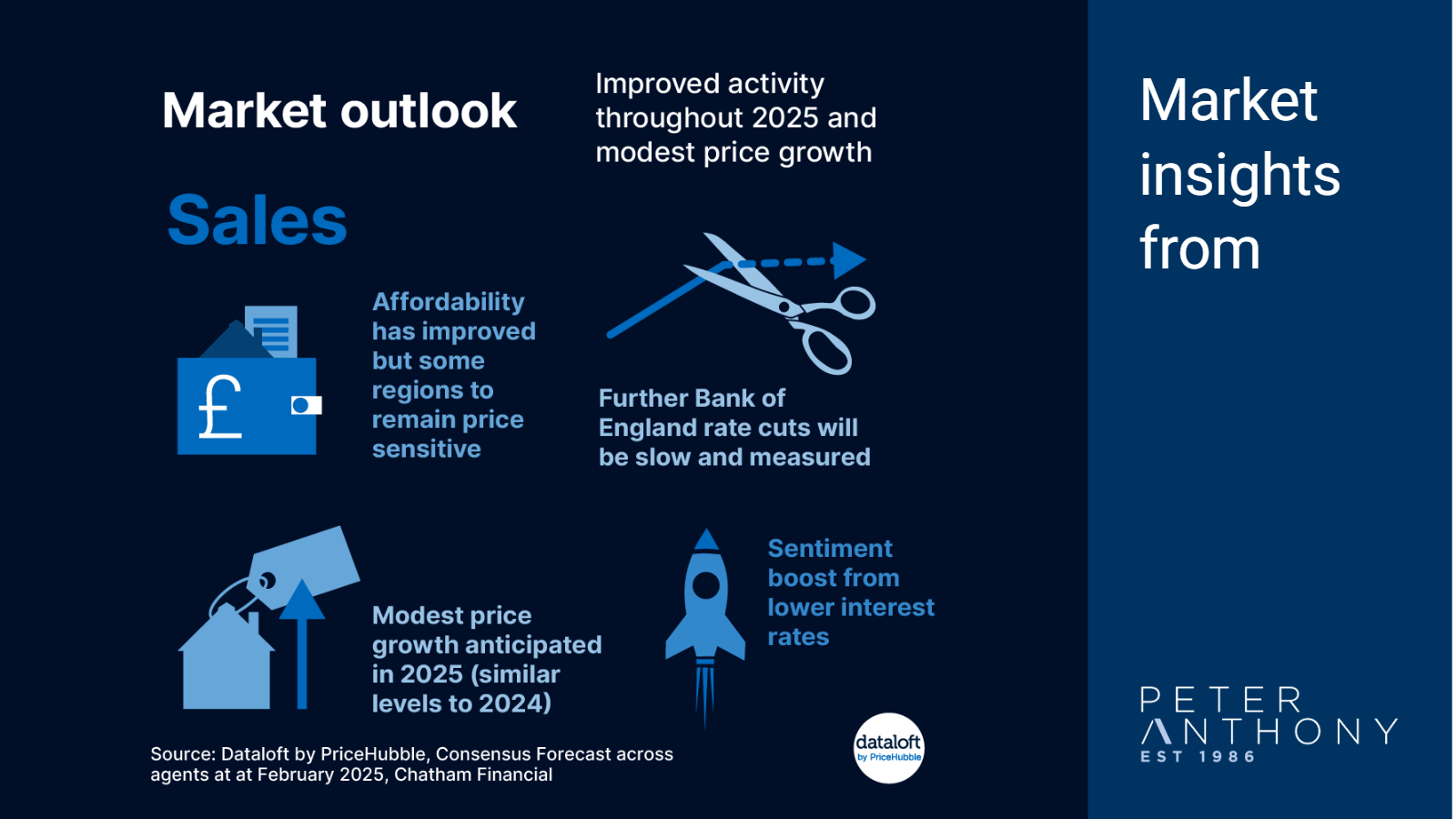

Market outlook: improved sales activity

The market started 2025 with solid foundations. Activity levels are expected to improve further throughout the year. Price growth forecasts in 2025 and 2026 (3.1% and 3.7%) are similar to price growth achieved in 2024.

Mortgage approval and transaction rates have normalised after weaker levels from end 2022 through to early 2024. Recent interest rate cuts have boosted sentiment, although longer-term mortgage rates could stabilise at 4% or just below (current 5-year swap rate off which mortgages are priced is 4.0%).

With persistent inflation above target, further cuts in interest rates by the Bank of England will be slow and measured. Rates of price growth will be influenced by affordability headroom. In more expensive regions like the South East and London, price sensitivity will remain for longer.

One of the big opportunities for the sector, alongside stronger market activity levels, is the new build market as the government make steps towards its house building targets. Source: Dataloft by PriceHubble, Consensus Forecast across agents as at February 2025, Chatham Financial

Dewi Jones

Mar 17, 2025, 11:15 AM

Dewi Jones

Mar 17, 2025, 11:15 AM

Leave a comment