Blog Post

Interest rate rise

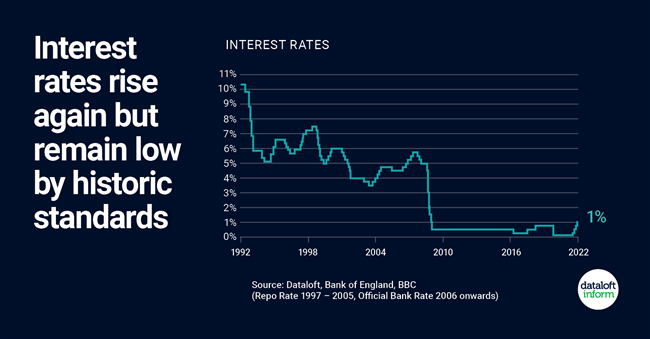

UK interest rates were raised for the fourth time since December (on 5th May 2022), by a quarter of a percentage point to 1%. This is the fastest increase in borrowing costs in 25 years.

Inflation is running at 7%, which is more than three times its target and is still rising. This is due to the post pandemic-surge in consumer demand and has been exacerbated by the Russian invasion of Ukraine.

The consensus among a poll of economists by Reuters is that the base rate will rise to 1.5% by early 2023, but will remain there for the rest of that year. This remains low by historic standards.

Many borrowers will be cushioned from any immediate impact by fixed-rate deals. The proportion of advances on such deals has risen each quarter since the market reopened in June 2020 (94.5% Q4 2021, FCA). Source: Dataloft, Bank of England

Tom Simper

May 10, 2022, 13:00 PM

Tom Simper

May 10, 2022, 13:00 PM

Leave a comment