Blog Post

Swap rates show fall in borrowing costs

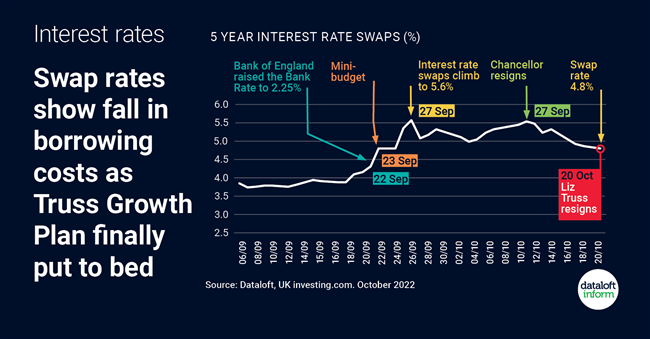

Recent political instability added to volatility in the financial markets and pushed up the cost of borrowing.

Swap rates are a good indicator of what to expect in borrowing costs because they reflect what borrowing costs for the lenders. 5-year swap rates rose to 5.6% after the mini budget but have since fallen back on the news of the Chancellor’s resignation and then again when the Prime Minister resigned.

Lower swap rates show financial market approval that the Truss Growth Plan was finally put to bed.

Overall, interest rates are definitely rising but recent volatility exaggerated the impact. Once the markets settle, there will be a clearer line of sight on interest rate expectations. Source: Dataloft, UK investing.com

Tom Simper

Oct 24, 2022, 12:30 PM

Tom Simper

Oct 24, 2022, 12:30 PM

Leave a comment