Blog Post

Swap rates trend lowers after improvement in June inflation data

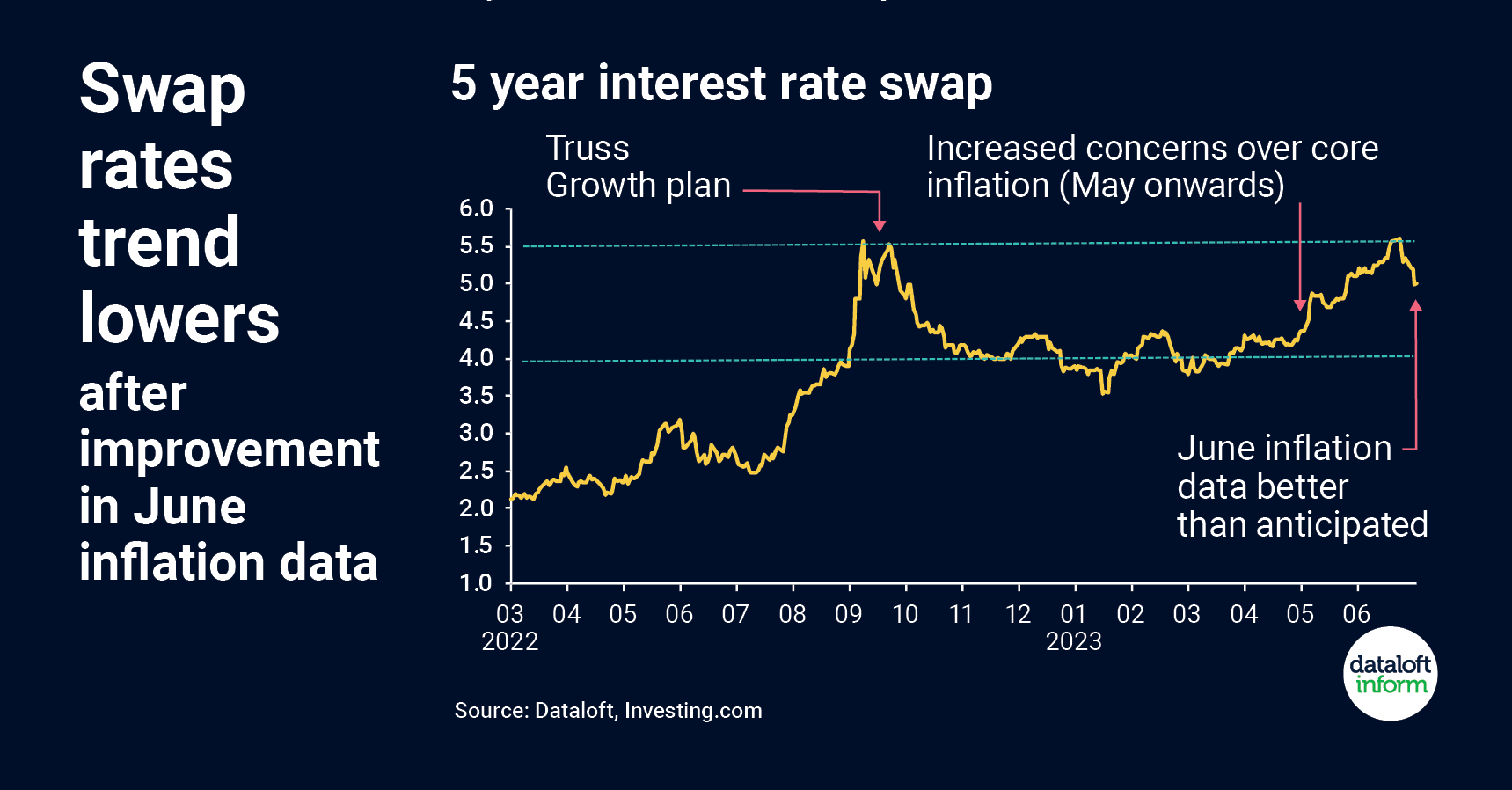

Swap rates give us a good indication of changes to come in mortgage costs – reflecting the cost of borrowing for lenders.

The 5-year swap rates had settled to around 4% for much of the first half of the year but from May it trended upward (peaking at 5.5%) over concerns about core inflation.

Data released on July 19th brought some relief to this upward trend. June inflation data was better than expected. Headline inflation was 7.3% and core inflation 6.4%.

This better news on inflation filtered through into lower interest rates on 5-year swaps, dipping back below 5%.

Data could be volatile over the next few months, but this is a good initial indication that inflation is starting to come down. Source: #Dataloft, Investing.com

Tom Simper

Jul 21, 2023, 13:00 PM

Tom Simper

Jul 21, 2023, 13:00 PM

Leave a comment