Blog Post

Maximising first-time buyer purchasing power

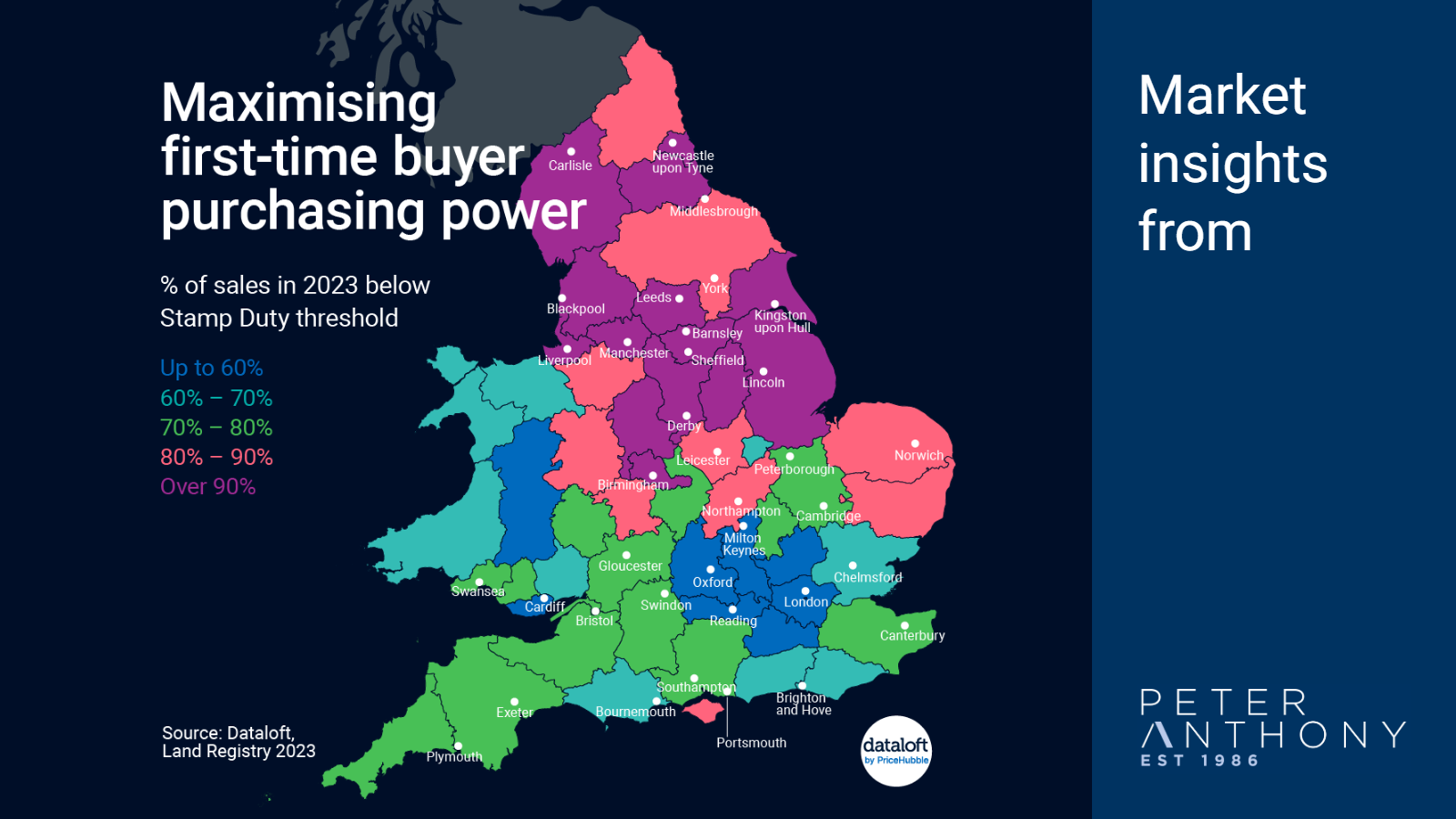

Stamp Duty Land Tax has hit the headlines again recently with Rightmove urging the Chancellor of the Exchequer to reform Stamp Duty in the Spring Budget. There is a Stamp Duty threshold of £250,000 in England (£425,000 for first-time buyers) and £225,000 in Wales (Land Transaction Tax).

Regional price variations mean that first-time buyers may have to factor Stamp Duty into their often tight budget. First-time buyers can maximise purchasing power by reducing Stamp Duty liability and this could mean widening the search areas for their first home.

Analysis by Dataloft reveals that throughout 2023, 75% of homes across England and Wales were sold at prices below the Stamp Duty threshold for first-time buyers. However, there was a large regional variation and this figure was as low as 35% (Greater London) in some areas and as high as 98% (County Durham) for others.

Our map shows that a distinct north-south divide remains across the country and with hybrid working becoming a more permanent style, there is still a great opportunity for first-time buyers in the south to consider relocating further north. Source: #Dataloft, Land Registry 2023

Tom Simper

Mar 1, 2024, 11:00 AM

Tom Simper

Mar 1, 2024, 11:00 AM

Leave a comment