Blog Post

Rental affordability

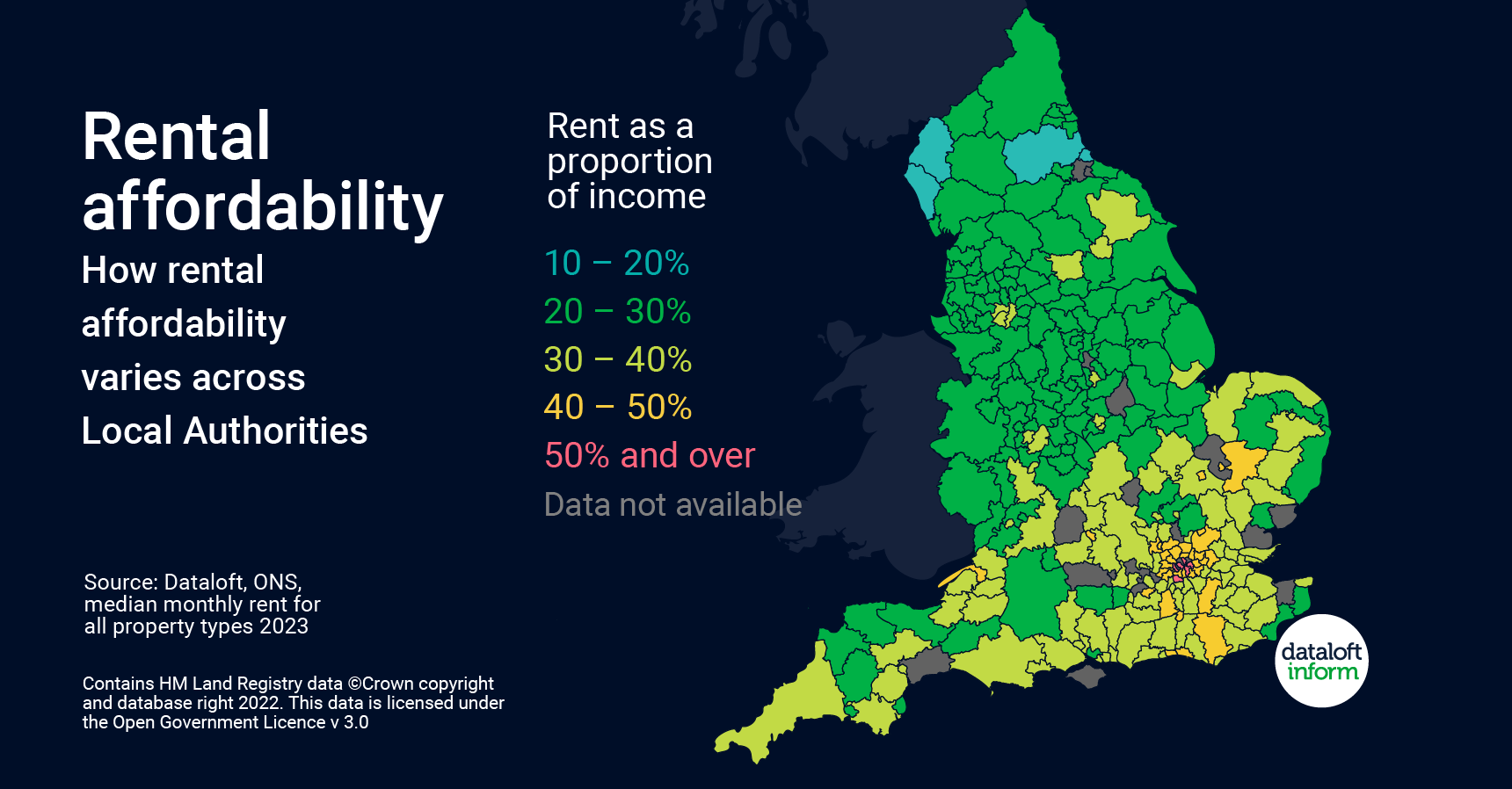

Although earnings in the south of England are generally higher than in other parts of the country, anyone needing to rent a home, will have to give up a higher proportion of their income just to cover the rent.

‘Rental affordability’ is a good indicator of the pressure in any local rental market. It is calculated by taking average rent as a proportion of average earnings in an area – in this case Local Authorities.

The situation is most acute in London. A Londoner on an average London salary would have to allocate more than 40% of their earnings to cover the average rent, while in much of the rest of the country the equivalent is between 20% and 30%.

Of course, if the earnings are higher, that may still leave more money left over for other expenses and fortunately for many, whilst rent has increased, salaries have too.

Surprisingly, there are still areas of the home counties where only 20–30% of incomes are spent on rent such as East and North Hertfordshire, Dover and Folkestone. Source: #Dataloft Rental Market Analytics, Information Works, Land Registry

Gillian Bell

Oct 21, 2023, 13:00 PM

Gillian Bell

Oct 21, 2023, 13:00 PM

Leave a comment