Blog Post

Housing and wider economic outlook

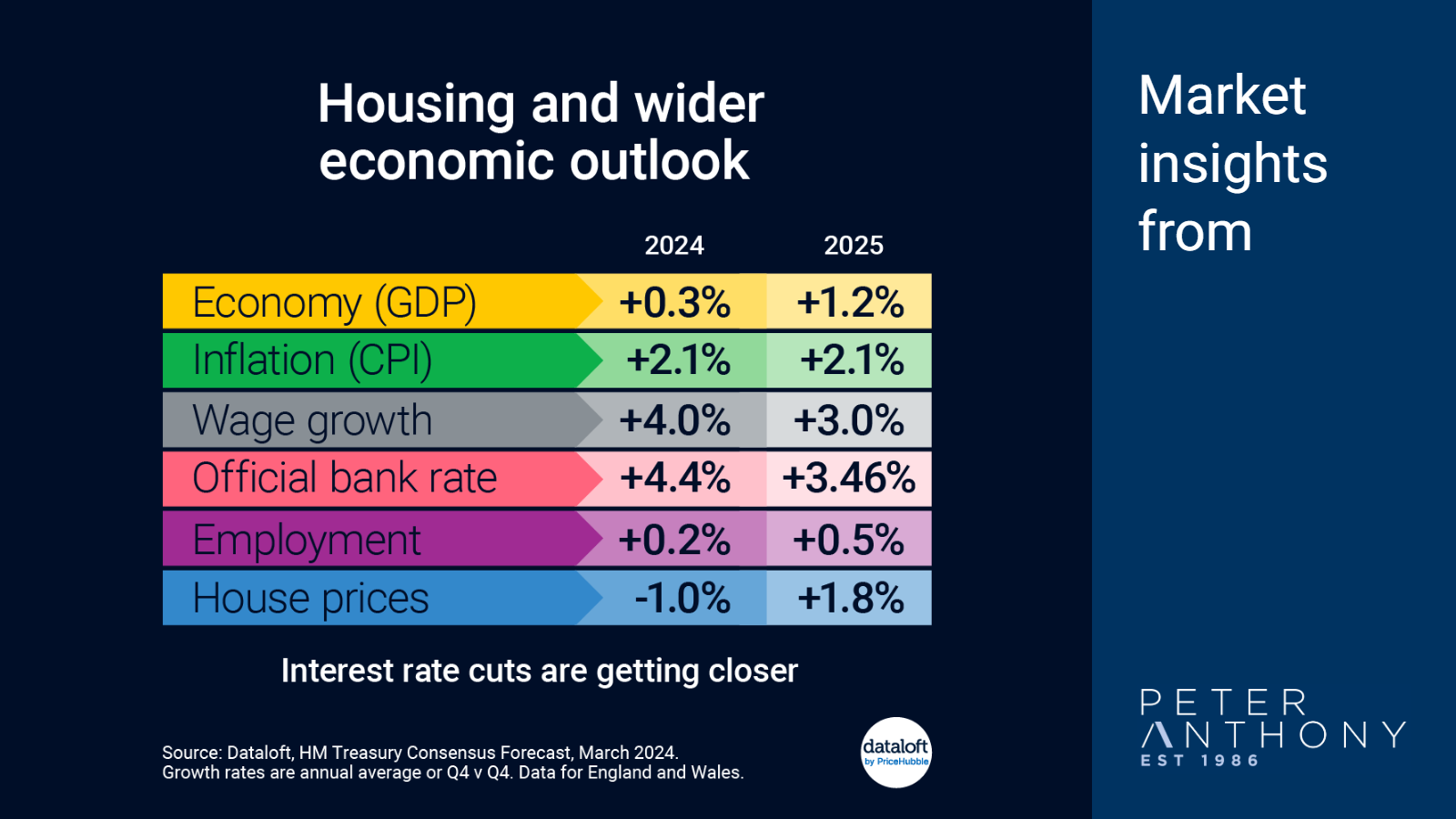

Monitoring the outlook for various economic indicators gives us a good view on both the current and future direction of the housing market.

At the Bank of England March meeting the bank rate was held at 5.25% but the governor announced "We are on the way" to interest rate cuts. This aligns with consensus forecasts for the bank rate to be 4.4% by Q4 2024.

Better news on inflation is helping build the case for lower interest rates. The February inflation data showed a headline CPI rate of 3.4% from 4.0% a month before.

Consensus forecasts suggests inflation will be very close to the target rate of 2.0% by Q4 2024. Source: #Dataloft, HM Treasury Consensus Forecast, March 2024. Growth rates are annual average or Q4 v Q4

Gillian Bell

Mar 22, 2024, 10:00 AM

Gillian Bell

Mar 22, 2024, 10:00 AM

Leave a comment