Blog Post

Later life mortgages on the rise

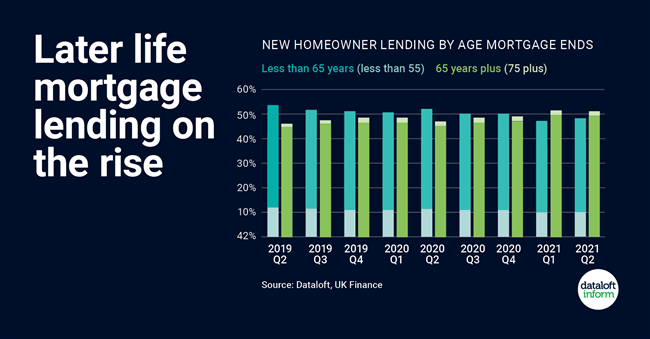

Mortgage lending in later life is on the rise. The age of first-time buyers, an increase in the length of mortgage terms and an ageing population all causes.

UK Finance report over half of new homeowner loans issued in the first six months of 2021 has an end date in excess of the borrowers 65th birthday.

While the average age of a First time buyer is 32, over 1 in 4 are aged 35-44. The mortgage term for nearly half (47%) of recent First-time Buyers was 30 years or more (English Housing Survey).

Such data indicates that in futures years the proportion of owner occupiers who own their property outright may well start to decline. Source Dataloft, UK Finance

Tom Simper

Sep 28, 2021, 13:00 PM

Tom Simper

Sep 28, 2021, 13:00 PM

Leave a comment