Blog Post

Mortgage arrears low and little appetite for repossessions

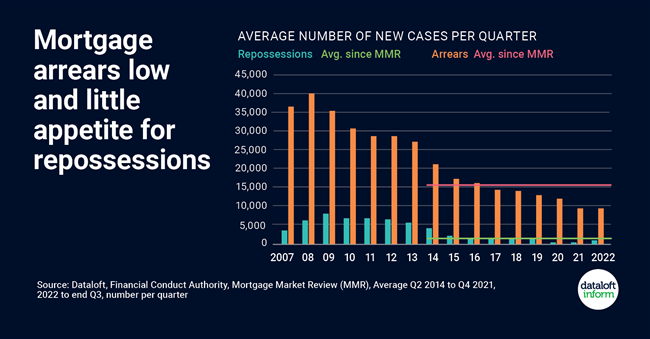

Mortgage rates have hit the headlines for the last 5 months but rates of arrears remain low by long-term standards. Just 0.88% of all mortgages are in arrears of 1.5% or more, according to the latest data from the Financial Conduct Authority (FCA).

At the height of the Global Financial Crisis there were more than 40,000 new arrears cases each quarter, the average since the implementation of the Mortgage Market Review in April 2014 just over 15,000. At the end of Q3 2022 the figure was just over 10,000.

Likewise, repossession numbers are far lower. Repossessions breached 8,500 in the first quarter of 2009, have averaged just below 1,800 since the MMR with the figure in 2022 was just over 1,000.

Swap rates, which rose considerably in the wake of the Growth Plan, continue to pare back, indicating longer-term stability in the market. Mortgage rates are anticipated to stabilise around 4%.Source: Dataloft, Financial Conduct Authority, Mortgage Market Review (MMR), Average Q2 2014 to Q4 2021, 2022 to end Q3, number per quarter

Tom Simper

Feb 11, 2023, 10:30 AM

Tom Simper

Feb 11, 2023, 10:30 AM

Leave a comment