Blog Post

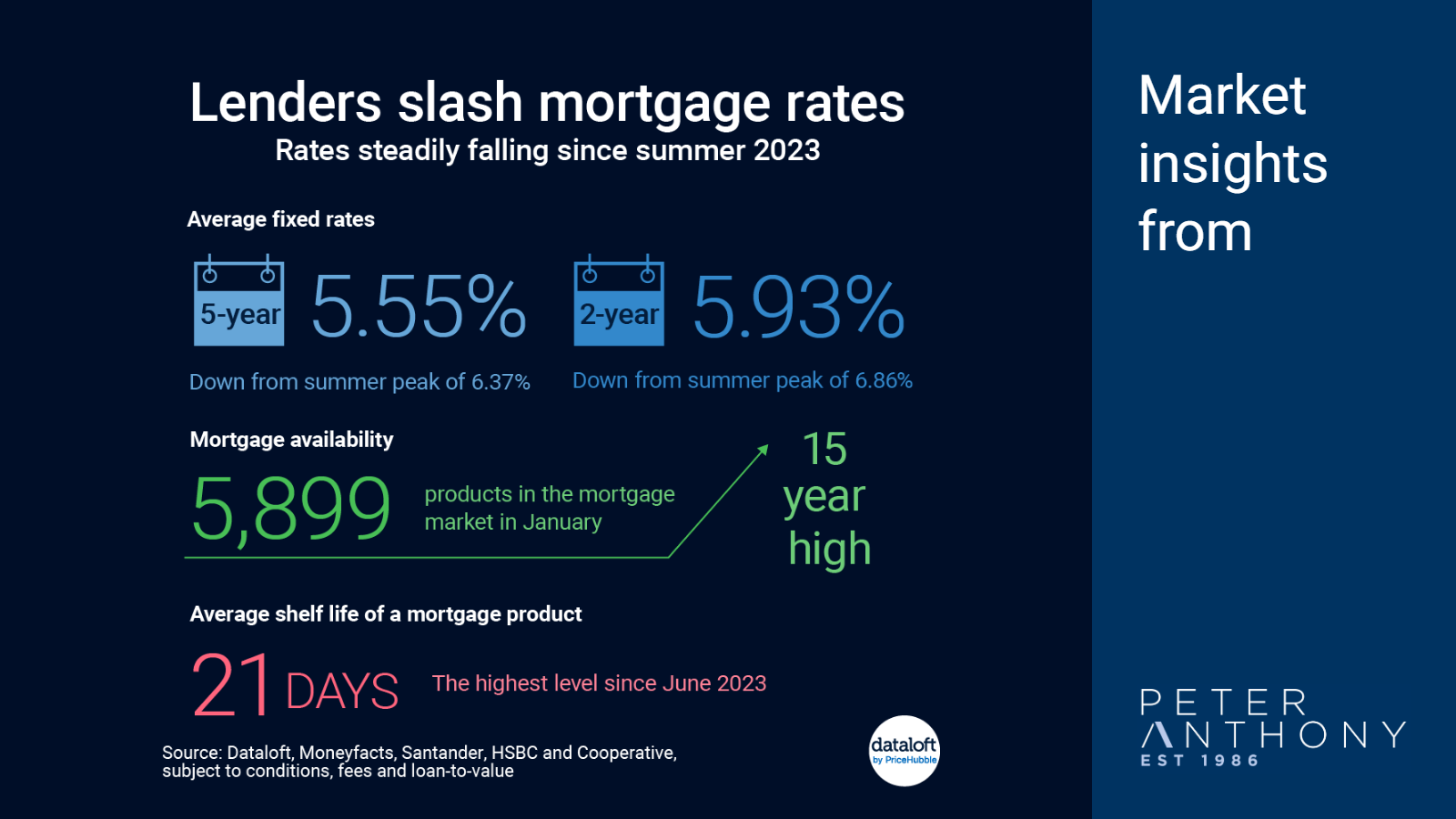

Lenders slash mortgage rates

Many big mortgage lenders are in fierce competition and slashing rates. The average five-year fix is now 5.55%, down from its peak of 6.37% in August, while the two-year stands at 5.93%, down from 6.86% in July.

Santander and HSBC are the latest to join the sub 4% club for a five-year fix, whilst Barclays have unveiled two-year deals within touching distance of the 4% threshold.

Product choice rose for the sixth month in a row, reaching 5,899 options, a 15-year high. The average shelf life of a product has lengthened to 21 days, the highest level since June, indicating increasing stability in the market.

Forecasters at three leading institutions suggest the inflation rate will halve to 2% by April, potentially meaning the Bank of England could bring forward the date of its first interest rate cut. Source: #Dataloft, Moneyfacts, Oxford Economics, Investec, Deutsche Bank, Santander, HSBC and Barclays, subject to conditions, fees and loan-to-value

Tom Simper

Jan 15, 2024, 11:00 AM

Tom Simper

Jan 15, 2024, 11:00 AM

Leave a comment