Blog Post

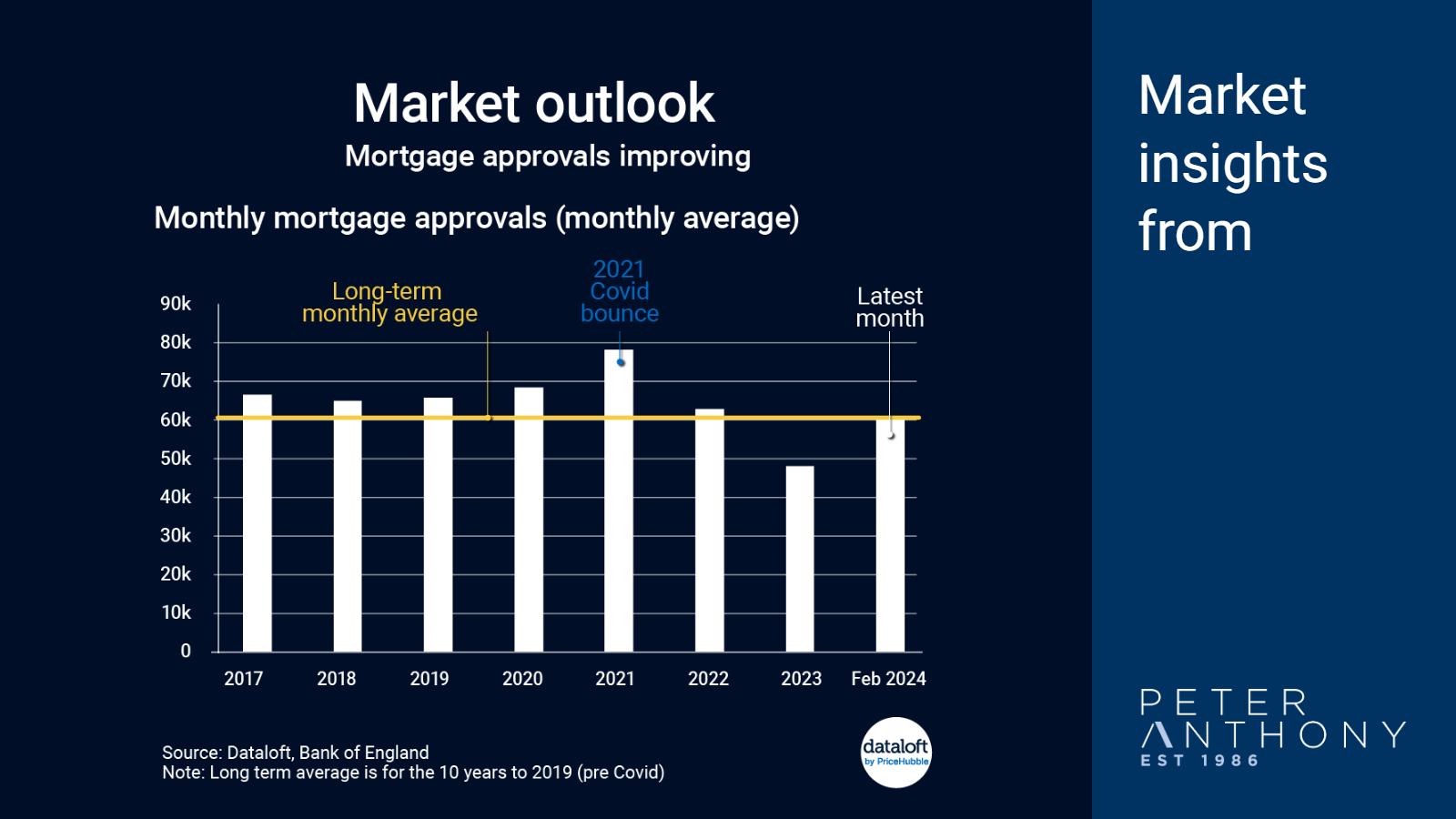

Market outlook: Mortgage approvals improving

February 2024 mortgage approvals levels were 40% above their level in February 2023.

A year ago mortgage approvals hit their lowest levels (39,900) since the Global Financial Crisis (with the exception of Covid). Latest data shows that has recovered to 60,400, in line with the long-term monthly average.

Mortgage approvals are a good leading indicator for market activity. Further sustained improvement should feed through to transaction activity.

Affordability still needs to rebalance further for a more widespread recovery in the market but recent market signals continue to support a tentative recovery. Source: #Dataloft, Bank of England. Note: Long-term average is for the 10 years to 2019 (pre Covid)

Tom Simper

Apr 5, 2024, 13:00 PM

Tom Simper

Apr 5, 2024, 13:00 PM

Leave a comment