Blog Post

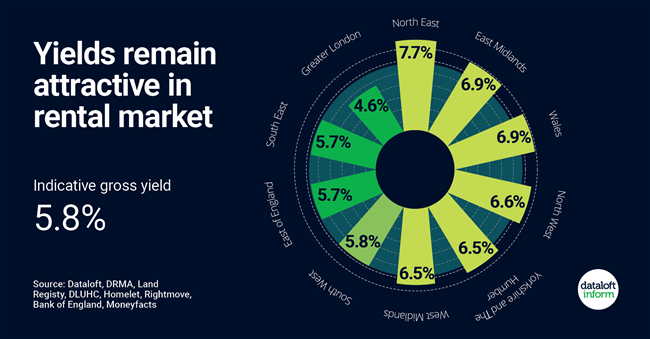

Yields remain attractive in rental market

Indicative gross yields remain attractive in the rental market. Based on an analysis of apartments sold and rented over the past 12 months the indicative gross yield is 5.8%. This is up from 5.1% 3 years ago.

Indicative gross yields have risen across all regions of England and Wales compared to three years ago.

A survey of over 1,000 landlords by Dataloft with Homelet found that the majority (73%) of landlords were planning for their portfolios to stay the same over the next year, 1 in 10 looking to expand.

Nearly half see their portfolio as their long-term pension, a further 25% consider property the best place to invest, and 17% hope to increase their monthly income.

At present the Bank of England base rate is 1.25%, the average interest rate on a 1-year fixed rate ISA in the region of 2.5%. Rightmove predict rental values will rise by 8% over the course of 2022, rental price growth set to outpace sales growth. Source: Dataloft, DRMA, Land Registy, DLUHC, Homelet, Rightmove, Bank of England, Moneyfacts

Tom Simper

Jul 25, 2022, 09:00 AM

Tom Simper

Jul 25, 2022, 09:00 AM

Leave a comment