Blog Post

Investing in HMOs

Letting your property as an HMO (House in Multiple Occupancy) is a viable alternative to more traditional buy-to-let properties. Generally more profitable, HMOs provide multiple streams of income by letting out individual rooms at a higher rate than you would the entire property. This can also reduce the impact of void periods.

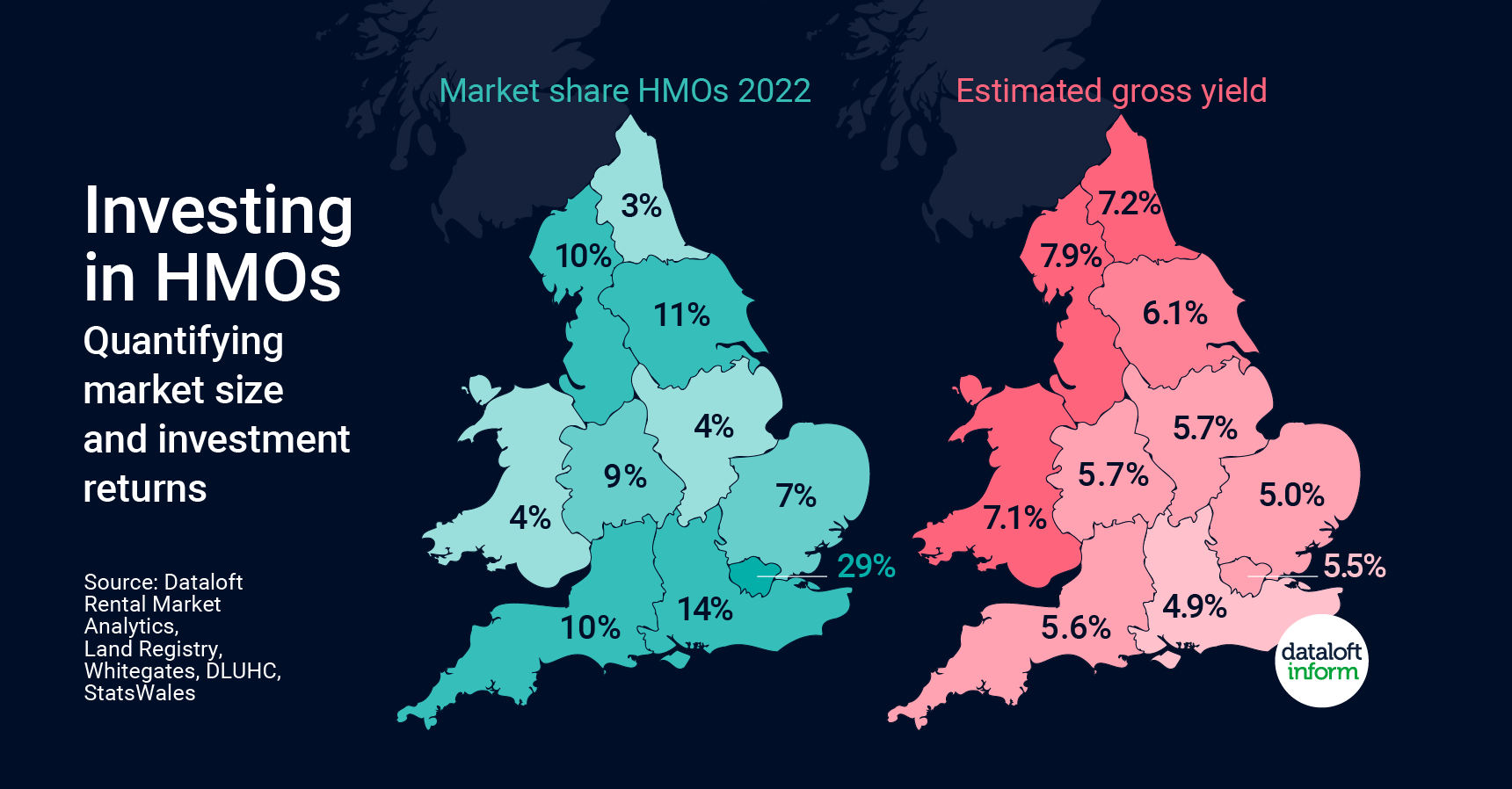

Average gross estimated yields of up to 7.9% are achievable in the North West, where student populations are high and demand for more afforable housing is strong.

Of the estimated half a million HMOs in England and Wales, by far the most (29%) are found in London. The scarcity principle applies, and places with the lowest number of HMOs such as Wales (4%) have strong average yields of 7.1%.

This clear demand for HMOs, coupled with attractive yields, provides a convincing argument for considering this method of letting. Source: #Dataloft Rental Market Analytics, Land Registry, Whitegates, DLUHC, StatsWales

Tom Simper

Sep 25, 2023, 10:00 AM

Tom Simper

Sep 25, 2023, 10:00 AM

Leave a comment