Levenshulme and Burnage Property News

Interest rate rise

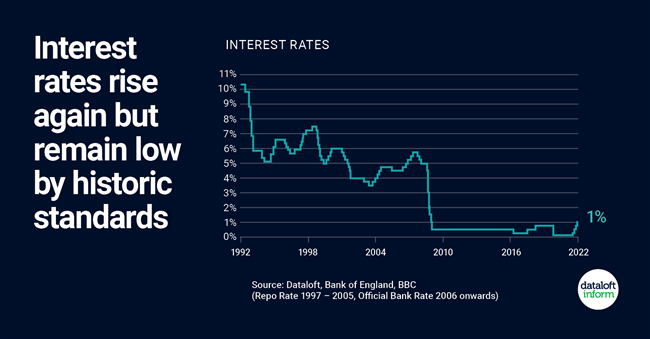

UK interest rates were raised for the fourth time since December (on 5th May 2022), by a quarter of a percentage point to 1%. This is the fastest increase in borrowing costs in 25 years.

Inflation is running at 7%, which is more than three times its target and is still rising. This is due to the post pandemic-surge in consumer demand and has been exacerbated by the Russian invasion of Ukraine.

The consensus among a poll of economists by Reuters is that the base rate will rise to 1.5% by early 2023, but will remain there for the rest of that year. This remains low by historic standards.

Many borrowers will be cushioned from any immediate impact by fixed-rate deals. The proportion of advances on such deals has risen each quarter since the market reopened in June 2020 (94.5% Q4 2021, FCA). Source: Dataloft, Bank of England

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Tom Simper

May 10, 2022, 13:00 PM

Tom Simper

May 10, 2022, 13:00 PM

Leave a comment