Liverpool Property News

Housing and wider economic outlook

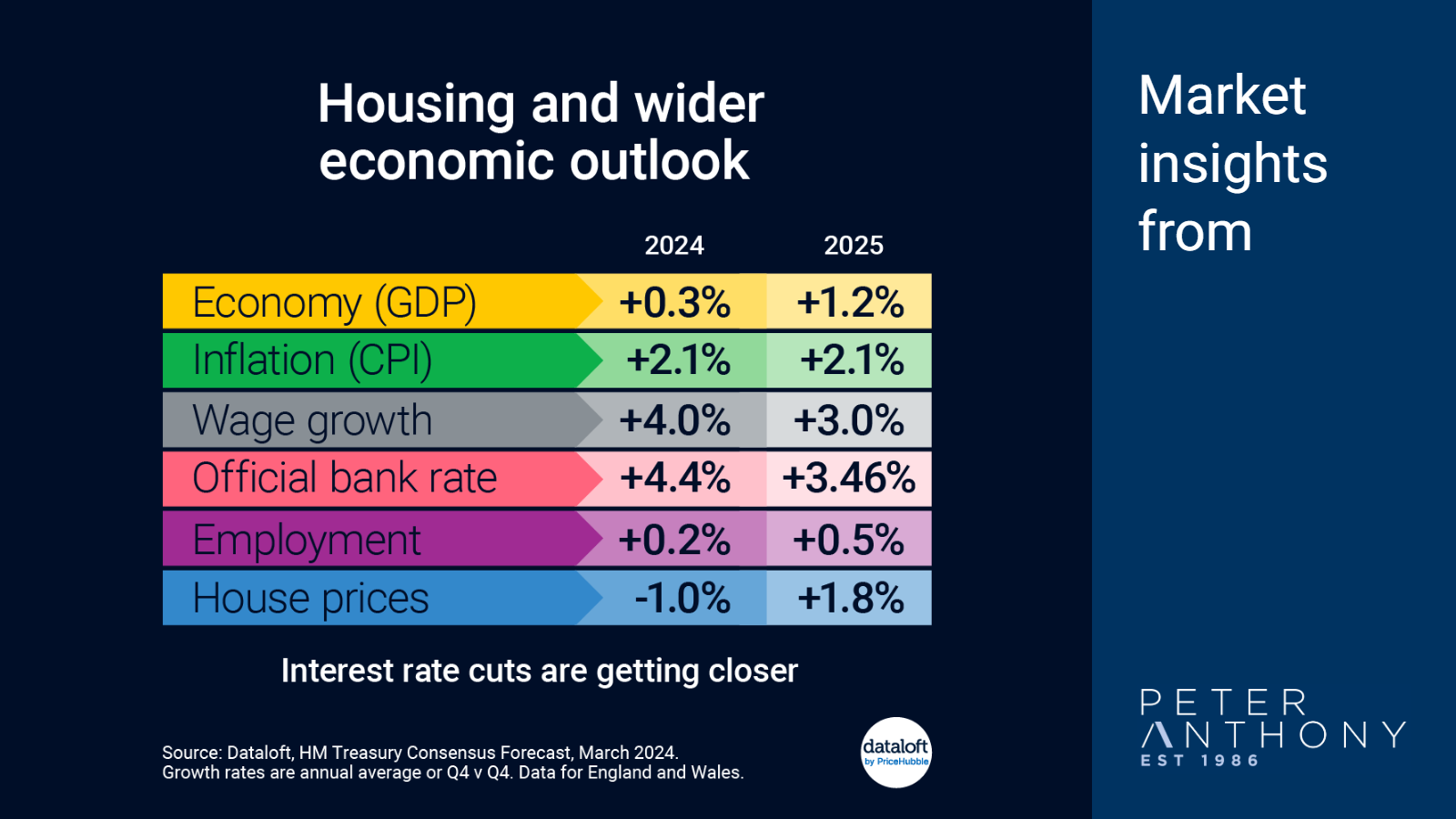

Monitoring the outlook for various economic indicators gives us a good view on both the current and future direction of the housing market.

At the Bank of England March meeting the bank rate was held at 5.25% but the governor announced "We are on the way" to interest rate cuts. This aligns with consensus forecasts for the bank rate to be 4.4% by Q4 2024.

Better news on inflation is helping build the case for lower interest rates. The February inflation data showed a headline CPI rate of 3.4% from 4.0% a month before.

Consensus forecasts suggests inflation will be very close to the target rate of 2.0% by Q4 2024. Source: #Dataloft, HM Treasury Consensus Forecast, March 2024. Growth rates are annual average or Q4 v Q4

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell

Mar 22, 2024, 10:00 AM

Gillian Bell

Mar 22, 2024, 10:00 AM

Leave a comment