Liverpool Property News

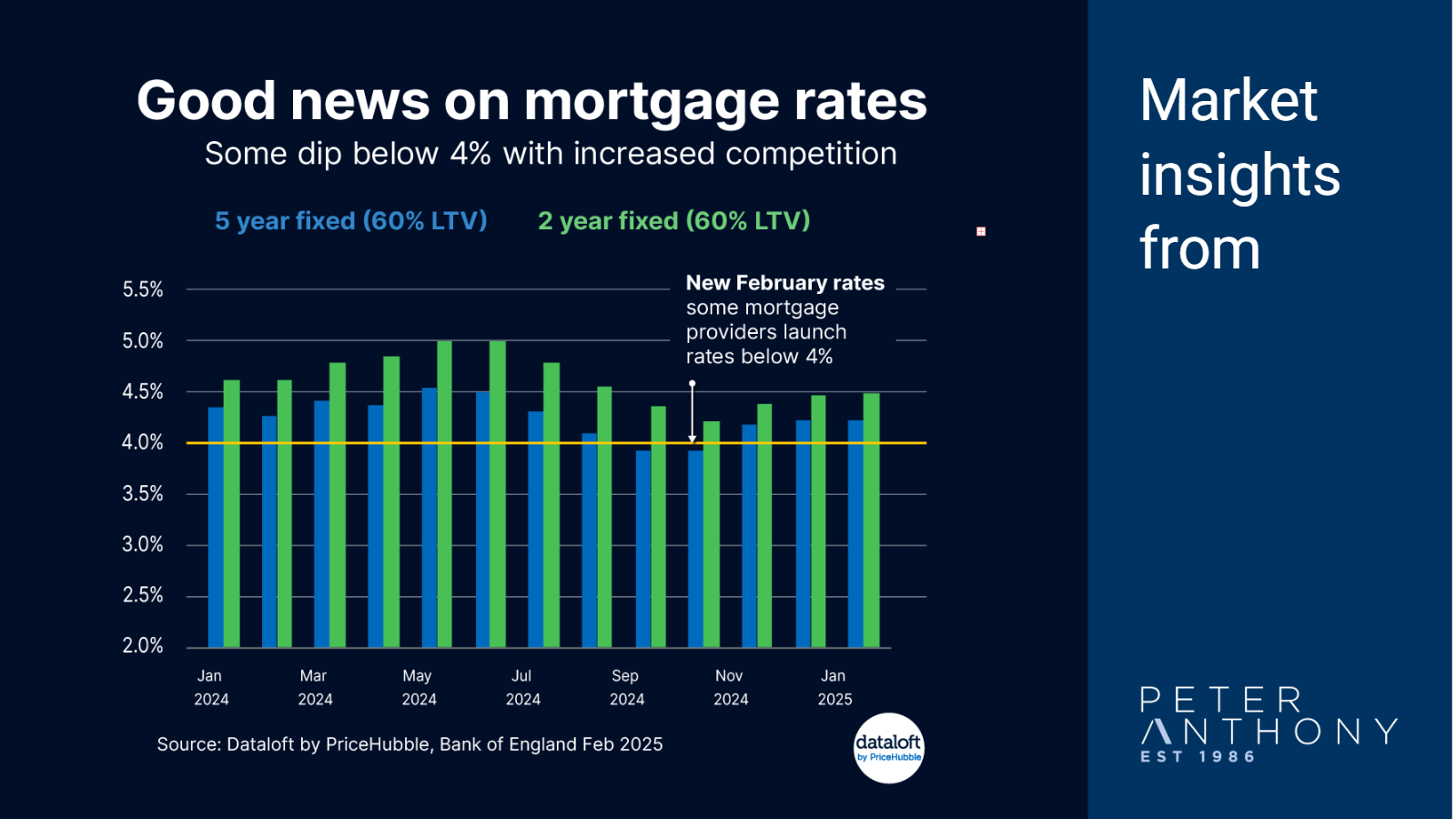

Good news on mortgage rates

A couple of the major lenders have launched mortgage deals with interest rates of less than 4% (60% loan to value).

Interest rates are typically lower for people with larger deposits, but even in this scenario, rates have been sitting stubbornly at over 4% for the last year, particularly for 2-year fixed deals. The Bank of England's rate cuts have been slower to materialise than originally expected.

With the Bank of England reducing rates in its February meeting (from 4.75% to 4.5%) and the consensus forecasts suggesting rates of 3.75% by year end, this has given lenders the confidence to get more competitive.

While the sub-4% rates are currently only available for those with larger deposits, this still represents a positive shift in market sentiment and shows where rates on other products might move over the next few months.

This flurry of increased competition in the mortgage market is welcome news for borrowers. Source: Dataloft by PriceHubble, Bank of England, Santander, Barclays

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell

Feb 14, 2025, 10:00 AM

Gillian Bell

Feb 14, 2025, 10:00 AM

Leave a comment