Blog Post

January volatility in bond markets

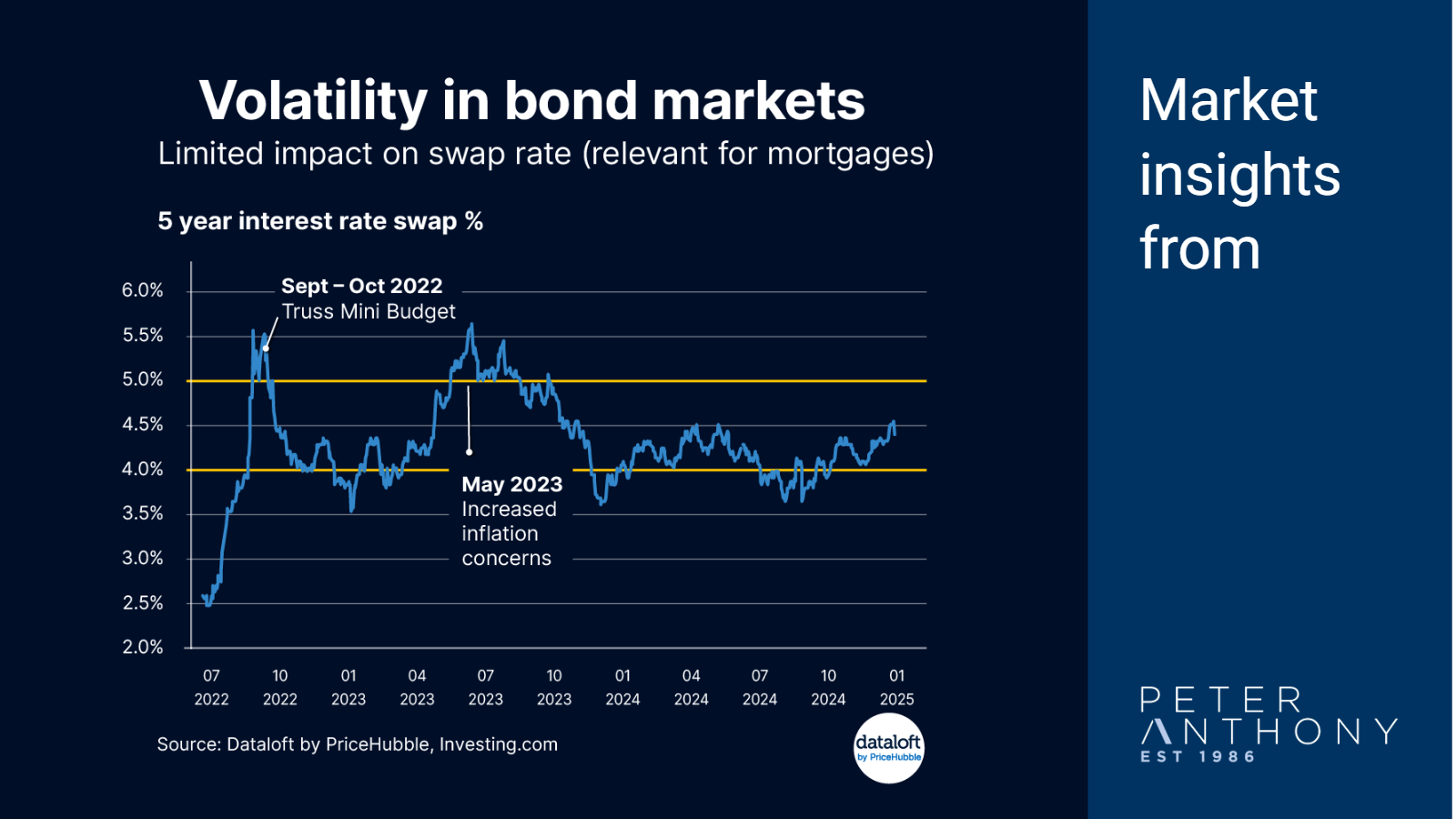

As we begin 2025, a wave of headlines has emerged, highlighting rising UK bond yields, driven by investor concerns over economic growth and the UK’s debt burden.

This bond market volatility carries the risk of affecting other interest rate products. To judge any potential impact on mortgages the swap rate — used to price mortgages — serves as a key indicator.

Although the swap rate has risen slightly since the start of the year, the increase has been modest and far less significant than the sharp rises seen following the Truss budget or during the heightened inflation concerns in 2023, when the swap rate exceeded 5%.

From the beginning of January 2025, the swap rate climbed from 4.3% to a peak of 4.6% on January 14. However, better-than-expected inflation data for December has since helped reduce the rate to 4.4% as of January 16.

Bond market volatility, hasn’t particularly altered expectations of what the Bank of England is likely to do to rates. The next Bank of England meeting is scheduled for February 6, with current consensus forecasts predicting the Bank Rate will be 3.8% by the end of 2025. Source: PriceHubble, Investing.com, HM Treasury Consensus Dec 2024

Dewi Jones

Jan 17, 2025, 11:00 AM

Dewi Jones

Jan 17, 2025, 11:00 AM

Leave a comment