Blog Post

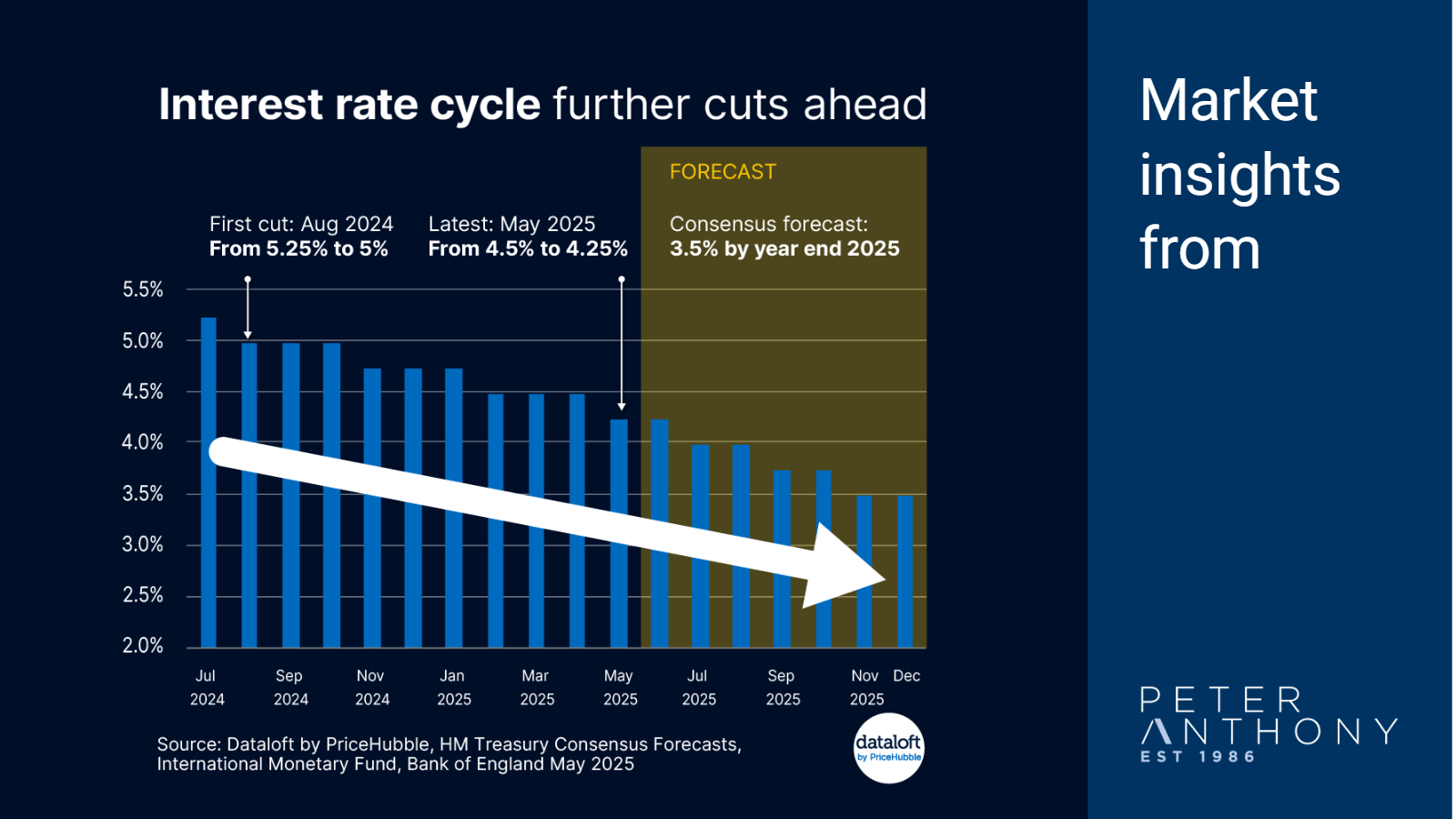

Interest rate cycle: further cuts ahead

The Bank of England has reduced its central bank rate from 4.5% to 4.25%, taking interest rates to their lowest in 2 years.

The Bank was quick to acknowledge that further rate cuts would be slow and measured and it wasn’t on a preset course to further cuts. Forecasts though (both from HM Treasury Consensus and the International Monetary Fund) agree that further rate cuts should be forthcoming, with another three cuts expected before year end.

There has already been a renewed flurry of activity from mortgage lenders, with some mortgage rates dipping below 4% again. Lower interest rates will help rebalance over-stretched affordability in many residential markets, particularly the more expensive London and the South East.

Unfortunately, though, it is a double-edged sword, with further rate cuts anticipated given the expected reduction in economic growth as trade tariffs take a toll on the growth outlook.

Inflationary pressures still persist and some modest increase in inflation rates is expected over the rest of 2025. Source: Dataloft by PriceHubble, HM Treasury Consensus Forecasts, International Monetary Fund, Bank of England May 2025

Tom Simper

May 10, 2025, 11:00 AM

Tom Simper

May 10, 2025, 11:00 AM

Leave a comment