Salford Property News

-

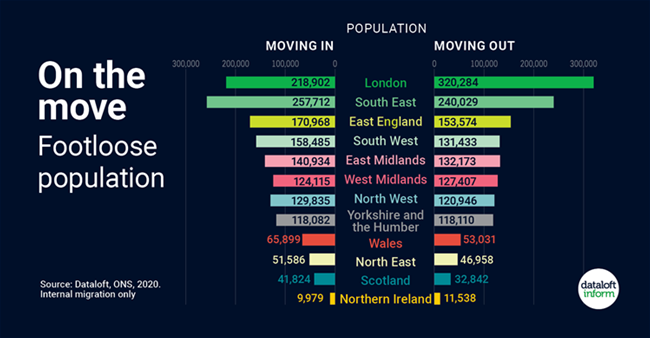

On the move – Footloose population

Read More

Nearly 1.5 million people changed region in the UK even before the pandemic.

Since the pandemic housing market demand has increased significantly, with people making lifestyle decisions, balancing distance to work, family and hobbies.

Proportionally Scotland, Wales and the South West witnessed the most significant ...

-

Why Sell with Peter Anthony Salford

Emily Utratny Jun 17, 2021, 09:36 AMRead More.png?Status=Master&sfvrsn=29171c30_1)

Why choose to sell with us?

- No Sale No Fee - You only pay us once your property has sold.

- No Tie in - If you're not happy you can cancel your contract at any time!

- No Cancellation fees - If you cancel your contract ...

-

First Home Scheme Launched in England

Read More

First-time buyers in England, in particular key workers, will have the chance to buy homes within their local area for a discount under the government's First Home Scheme launched this month.

The scheme will offer selected new build properties (houses and flats) to first-time buyers ...

-

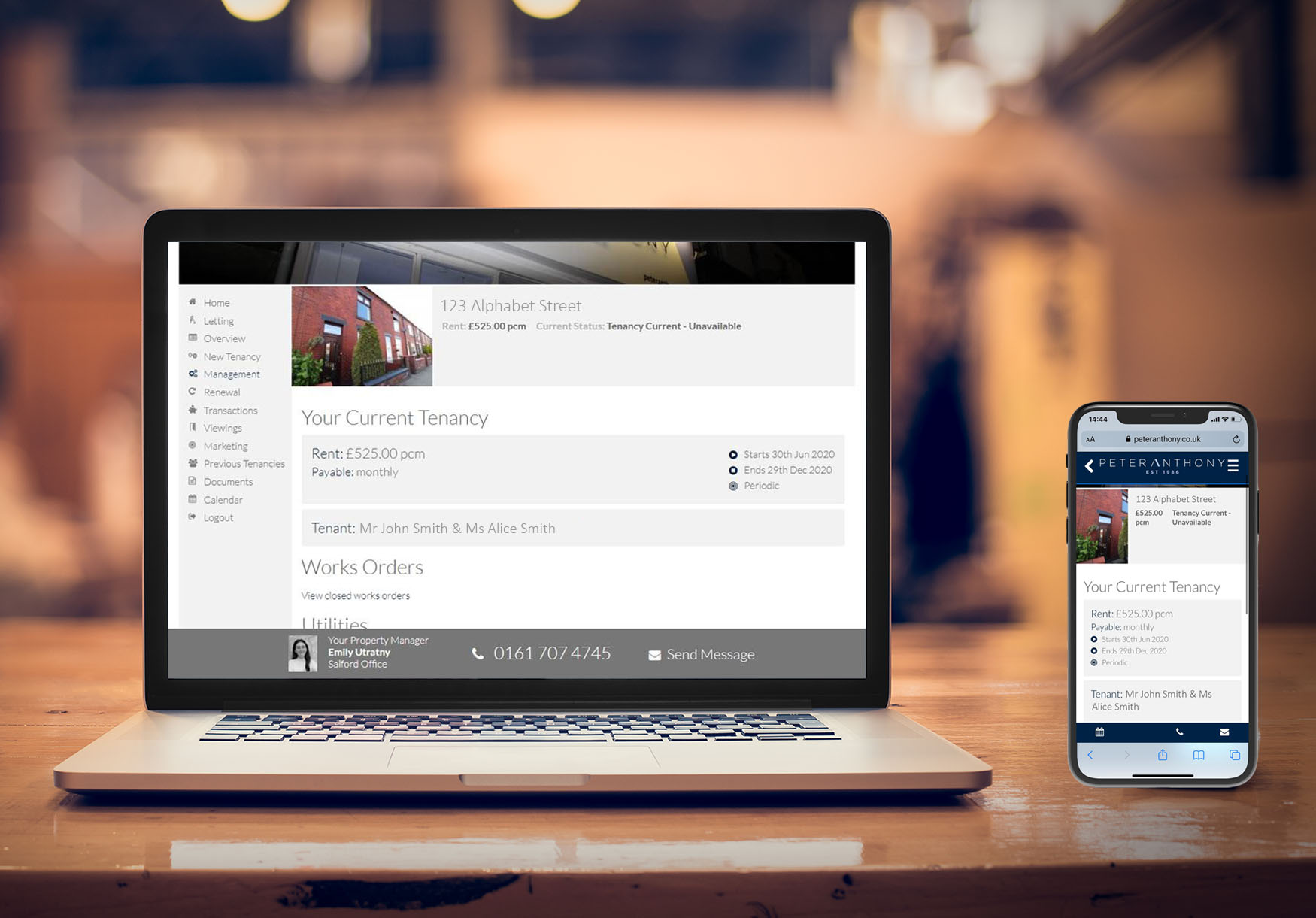

Landlord Portal, Access to your property 24/7

Read More

With our new software update we are able to provide our landlords with their own personal portal which gives them access to all their property needs 24/7 7 days ...

-

Important Changes to Notices and Evictions You Need to be Aware of

Read MoreCoronavirus changed the rules for evicting a tenant in England.

The current ban on bailiff-enforced evictions, introduced as an emergency measure during lockdown, ended on 31 May. Bailiffs have been asked not to carry out an eviction if anyone living in the property has ...

-

Properties fly off the shelves

Read More

Newly listed properties are flying off the shelves. The majority (78%) of agents in the latest Dataloft subscriber poll said that homes, once listed, are selling in less than 28 days.

22% of agents state the majority of homes are selling in less than a ...

-

New Additional HMO Licensing rules in Salford

Read More

(google images)

ATTENTION LANDLORDS IN SALFORD

Salford City Council has designated an additional HMO licensing scheme in Salford. Under the scheme, private landlords who rent out a three or four person small HMO property in Salford, will be required to obtain a licence from ...

-

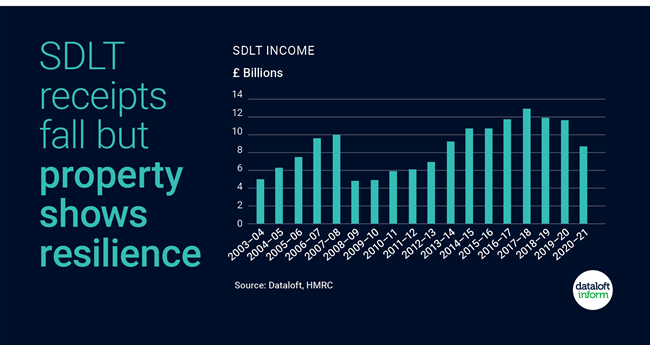

SDLT receipts fall

Read More

£8.7 billion was netted by the Chancellor in residential Stamp Duty receipts over the course of 2020–21, the lowest in eight years, however receipts in March 2021 were the 5th highest ever recorded.

Nearly £1.2 billion was collected in March, up 28% year-on-year, as many ...

-

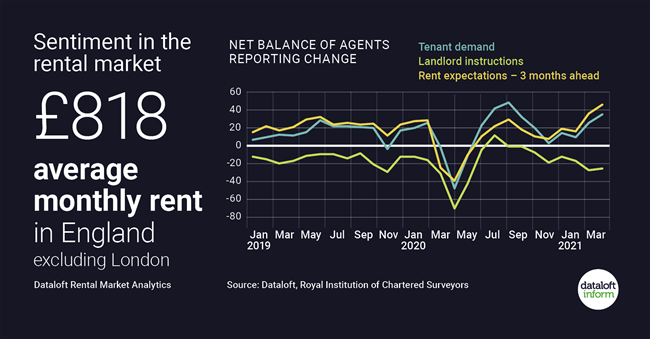

Sentiment in the rental market

Read More

The RICS March survey, gauging the mood of agents, showed continued improvement in the lettings market.

Tenant demand has continued to increase, with a net balance of +36%. In contrast, landlord instructions continue to fall, with a net balance of -25%.

The imbalance between demand ...

-

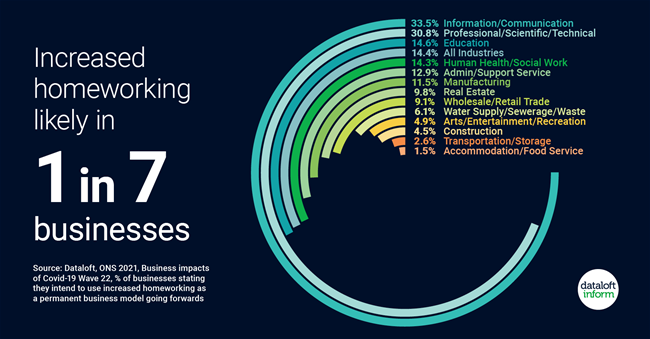

Increased home working likely in 1 in 7 businesses

Read More

As restrictions start to ease across areas of the UK, just 1 in every 7 businesses proposes using increased home working as a permanent business model, a further 19% of businesses 'unsure'.

During lockdown 3, 28% of businesses had more staff working from home as ...

-

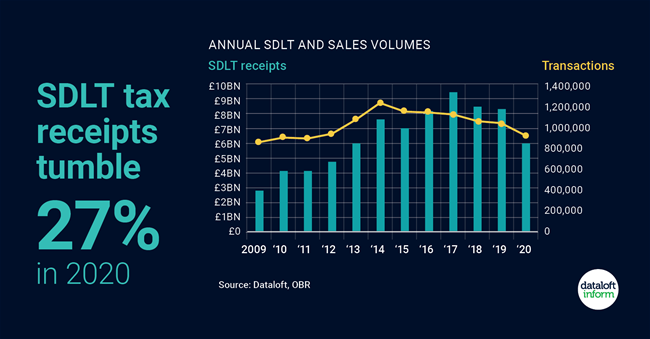

SDLT receipts tumble

Read More

Just over £6 billion was collected by the Treasury in England in SDLT property tax in 2020. This is £2.2 billon less than in 2019, a 27% fall.

Over 300,000 property transactions were ineligible for tax in the final 6 months of the year, the ...

-

Homes without access to outside space

Read More.png?sfvrsn=67ff0c30_1)

One in eight households (12%) in Great Britain have no access to a private or shared garden during the coronavirus lockdown.

Private outdoor space was the strongest design-based predictor of comfort during lockdown and the most valued quality of a home during the pandemic.

It ...

-

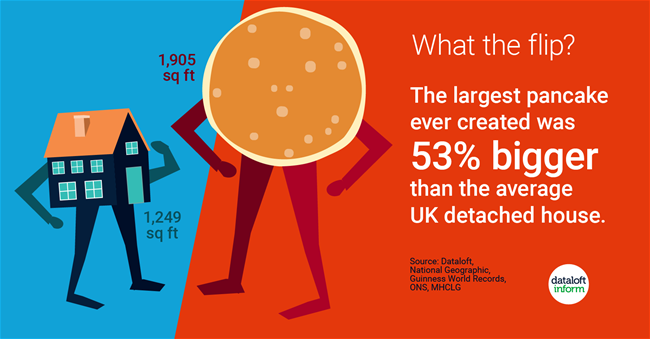

Pancake day

Read More

Pancakes have become such a popular Shrove Tuesday tradition that on 16th February, a whopping 52 million eggs will have been used in the UK. That is 22 million more than your average day, eggciting stuff!

With the average egg costing 19p, this equates to ...

-

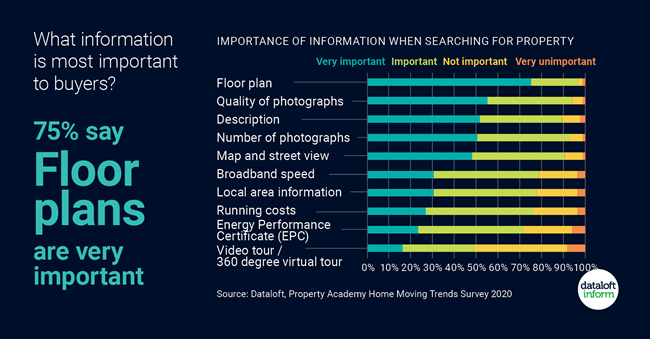

What information is most important for buyers?

Read More

Three quarters (75%) of buyers said a floor plan was very important information when searching for a property, according to the 2020 Property Academy Home Moving Trends Survey analysed by Dataloft.

Quality of photographs (55%), description (52%) and number of photographs (50%) were also very ...

-

How do you choose your agent?

Read More

Capability and market knowledge top the list of how prospective home buyers choose their agent according to results of the 2020 Property Academy Home Moving Trends Survey analysed by Dataloft.

Confidence in ability was rated by more homemovers than any other single quality and far ...

-

Dataloft Days of Christmas - Day 10

Read More

Nearly 1 in 4 housing transactions in 2020 will have been backed by the Bank of Mum and Dad, an estimated £50bn worth of property. Source: Dataloft, Legal and General

-

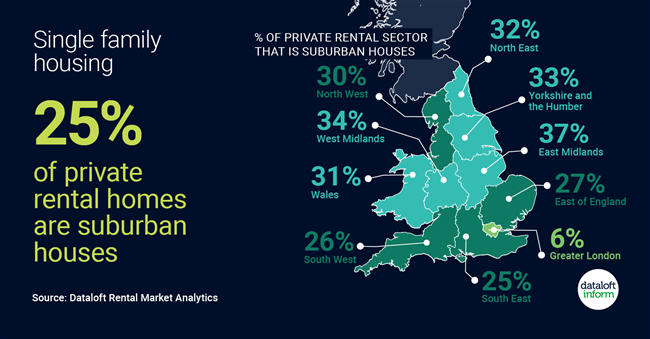

Single family housing

Read More

Across England and Wales, almost half (43%) of all private rental sector properties (both houses and flats) fall within Dataloft's definition of suburban areas, 41% urban and 16% rural.

Suburban renters are more likely to live in houses (58%) than urban renters (32%). As an ...

-

Dataloft Days of Christmas - Day 3

Read More

54,760 houses were completed in the first half of 2020. If we assume the same number of completions in the second half of 2020 as 2019, another 92,410 will complete, adding an estimated 147,00 homes to Santa's list. Source: Dataloft, Ministry of Housing, Communities and ...

-

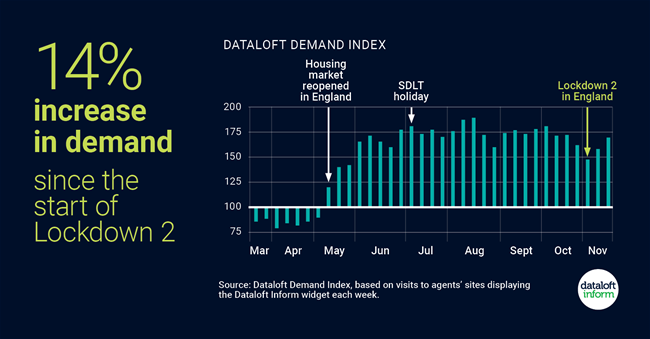

Increase in demand during second Lockdown

Read More

The Dataloft Demand Index shows a +14% increase in housing market demand since the start of Lockdown 2. More time at home means more time spent browsing properties.

Demand dropped from 5th October, reflecting uncertainty in the new Tier system and the looming Lockdown 2 ...

-

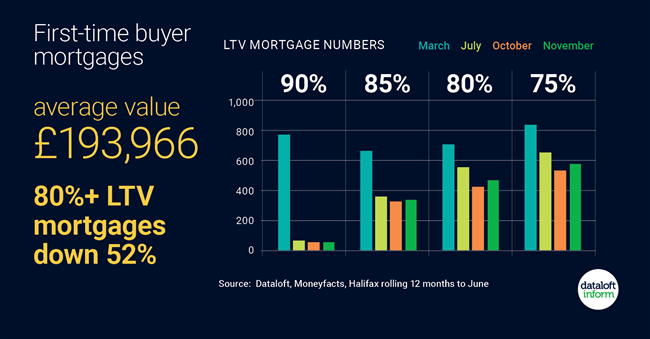

First-time buyer mortgages

Read More

The average mortgage for a first-time buyer across the UK is just shy of £194,000, as FTB numbers fell 29% in the first half of 2020 versus 2019.

The average deposit for a FTB is now £47,059, purchasers requiring a mortgage at 80% LTV. There ...

About The Blog

This Blog looks at what is happening in the Salford and Eccles property market. We report on events and community news along with investment ideas and tips for those loosing to invest in the area.

Dewi Jones - Editor

Salford is fast becoming one the most exciting areas of development in North West. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience

and local knowledge to help.

T: 0161 707 4745

E: [email protected]