Levenshulme and Burnage Property News

-

Growth in homes for sale boosts buyer choice

Read More

There are a fifth (20%) more homes available for sale compared to the same time last year, boosting buyer choice.

Encouraged by the usual spring bounce and a 9% annual increase in property sales, more people are putting their home on the market.

61% of ...

-

Market outlook – RICS survey results

Read More

With interest rates peaking and a lower inflation rate, there have been more reasons for cautious optimism in the market outlook.

There are a number of leading indicators we can look to on how the market is faring. One of these is the Royal Institution ...

-

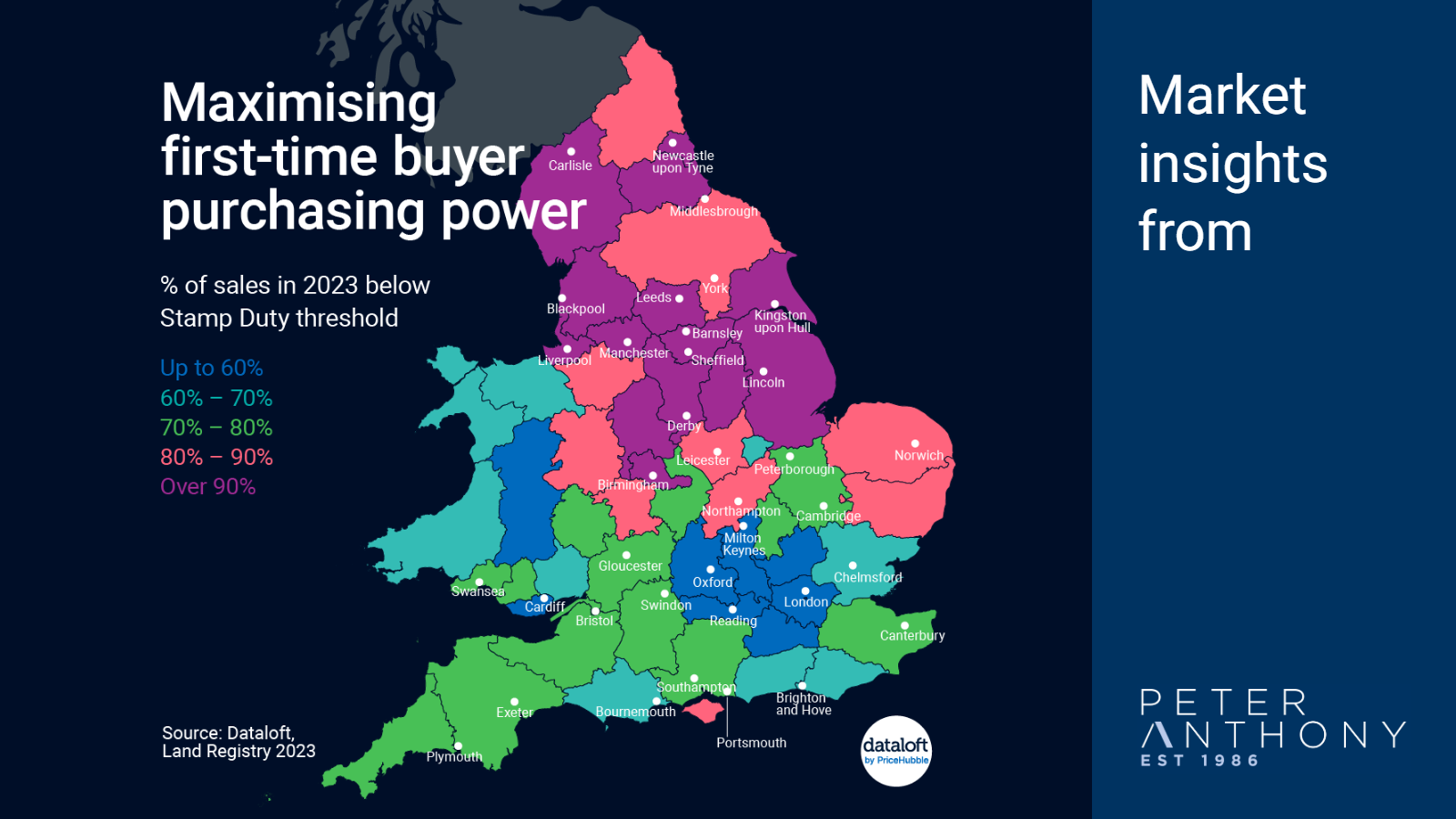

Maximising first-time buyer purchasing power

Read More

Stamp Duty Land Tax has hit the headlines again recently with Rightmove urging the Chancellor of the Exchequer to reform Stamp Duty in the Spring Budget. There is a Stamp Duty threshold of £250,000 in England (£425,000 for first-time buyers) and £225,000 in Wales (Land ...

-

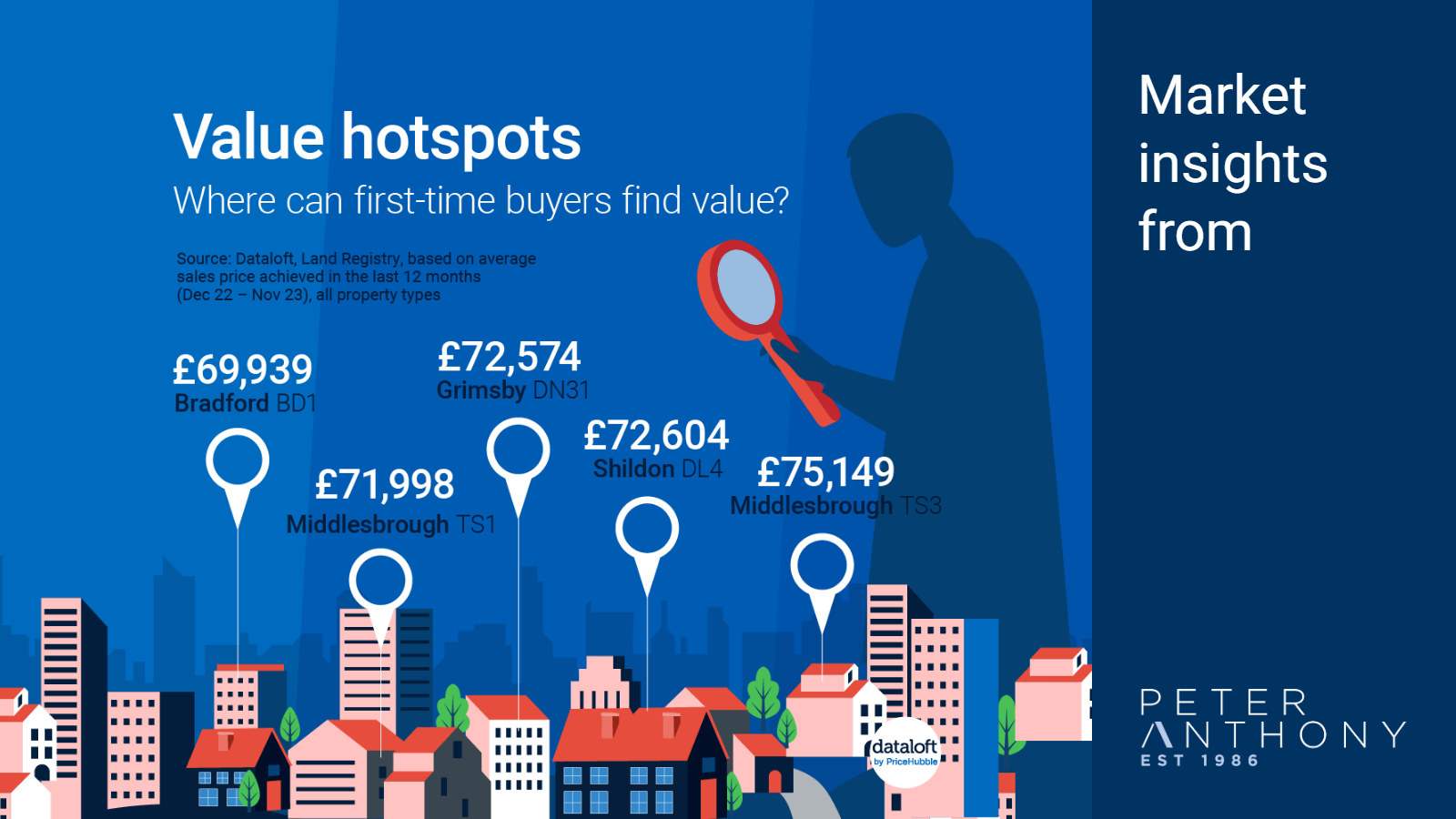

Value hotspots

Read More

The number of first-time buyers in 2023 fell by 21% compared with the year earlier, to 293,339. This would be due in part to rising affordability pressures.

Focussing on an area can highlight local value hotspots. The BD1 postcode in Bradford offers an average ...

-

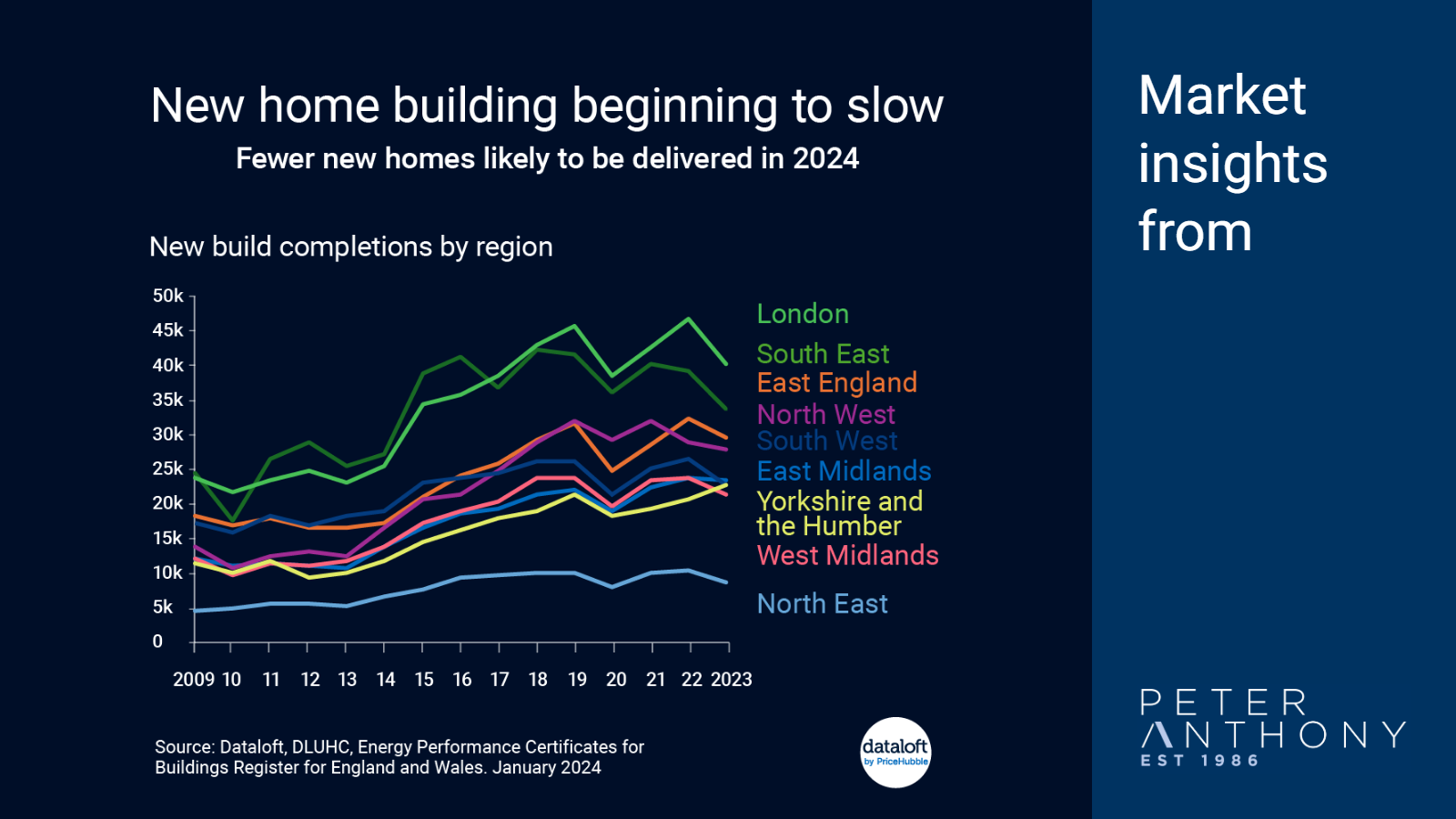

New home building beginning to slow

Read More

In 2023 there were close to 240,000 new build completions, showing that new build supply held up relatively well, albeit short of the government’s 300k target. With the exception of Covid, it has been above 240,000 since 2018.

In a slower sales market, we would ...

-

Going solo: the changing demand for detached homes

Read More

The latest data shows over 900,000 property transactions across England and Wales took place in the last 12 months. Terraced houses continue to have the highest volume of sales but 2023 has seen a sudden change for detached and semi-detached houses.

12 months ago, semi-detached ...

-

Days of Christmas | When Santa got stuck ...

Read More

Father Christmas has a huge workload! With 8.2 million households in the UK with dependent children, he has to visit 325 households per second during the night of Christmas Eve.

Despite the workload, it is a less precarious task nowadays. The recent census shows us ...

-

Days of Christmas | Christmas no 1

Read More

LadBaby has been the UK Christmas number 1 single for the past five years, with hits: 'Food Aid’, 'Sausage Rolls for Everyone’, 'Don’t Stop Me Eatin', 'I Love Sausage Rolls' and 'We Built This City’.

The last time someone else held the top spot was ...

-

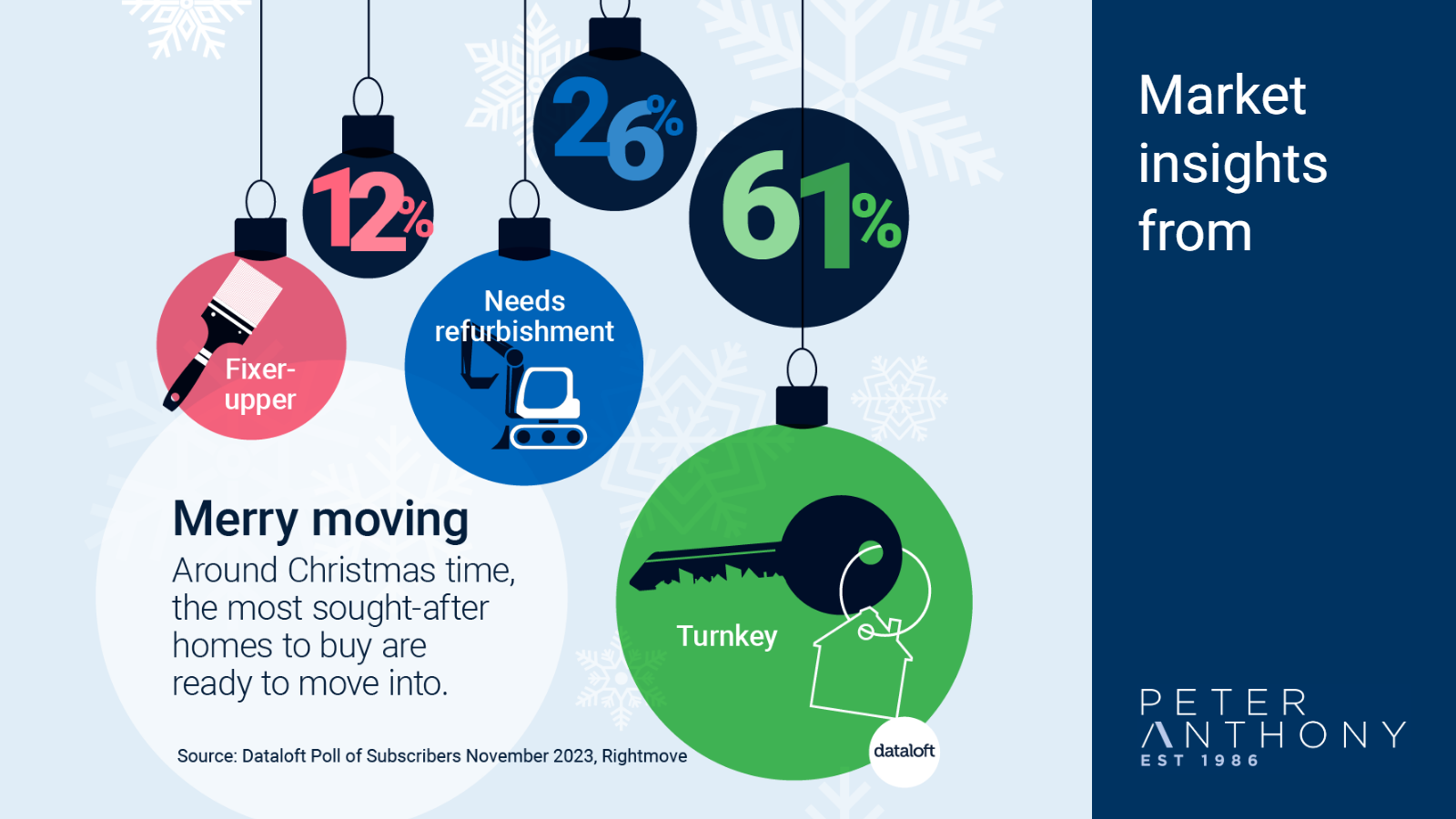

Days of Christmas | Merry moving

Read More

As we approach Christmas, 61% of respondents say "Ho-Ho-No!" to any refurbishments or fixer-uppers, wanting to move in hassle free in the countdown to Christmas.

Over a quarter said homes in need of refurbishment are most sought after, on average a merry 8% cheaper than ...

-

Reasons for renting

Read More.png?sfvrsn=f142ba30_1)

According to The Property Academy Renter Survey 2023, over a third of renters rent because they don’t have the deposit to buy a home.

However not everyone wants to buy. A substantial 27% of renters were renting out of choice over necessity, with 37% of ...

-

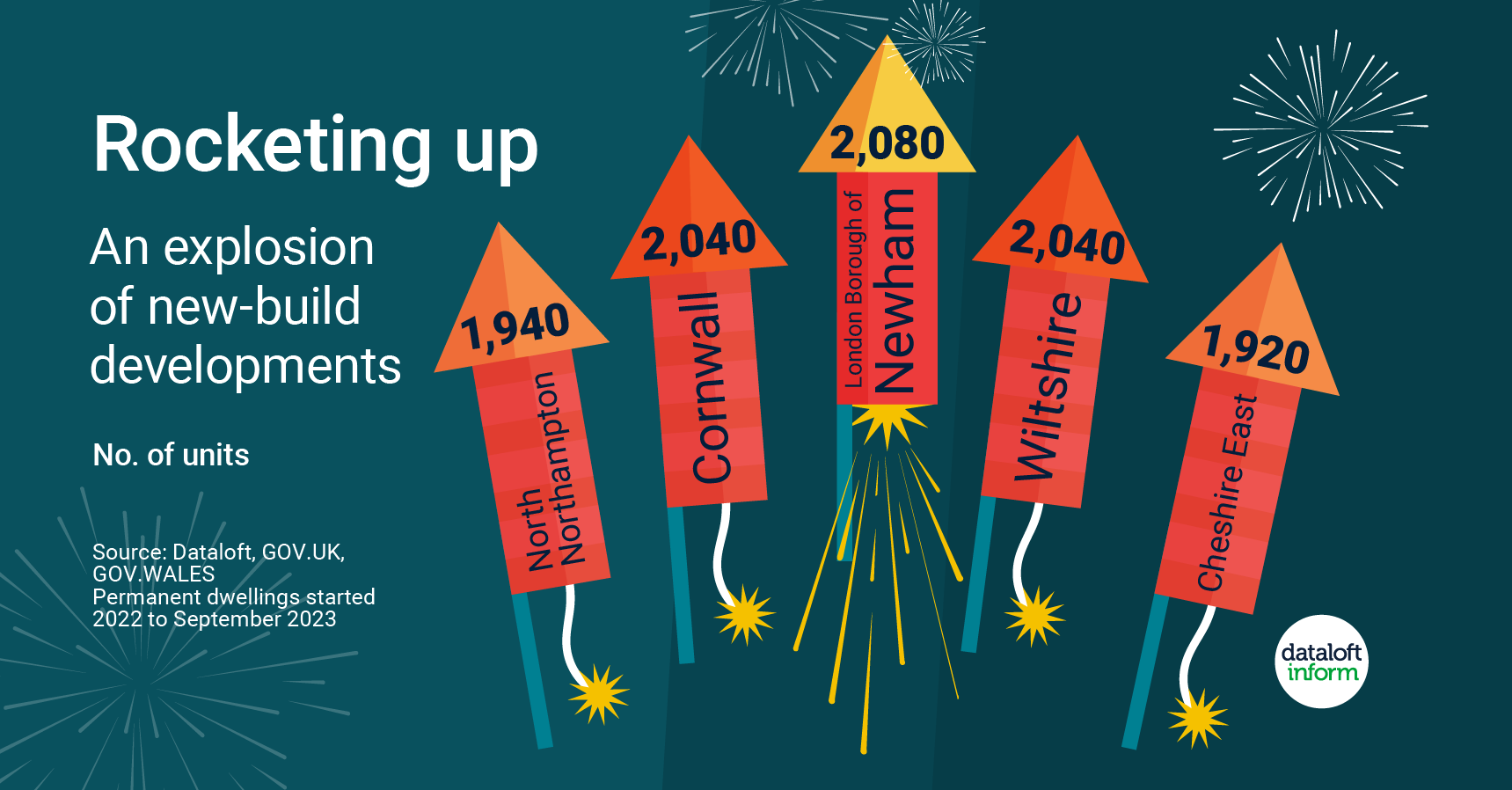

Rocketing up: new-build developments

Read More

Against a backdrop of housing undersupply, some areas are rocketing up in their new building development.

Newham, undergoing regeneration, leads the rankings with 2,080 dwellings started in 2022–2023 and 1,490 completed in the same time frame.

Cornwall and Wiltshire were next, with a dazzling 2,040 ...

-

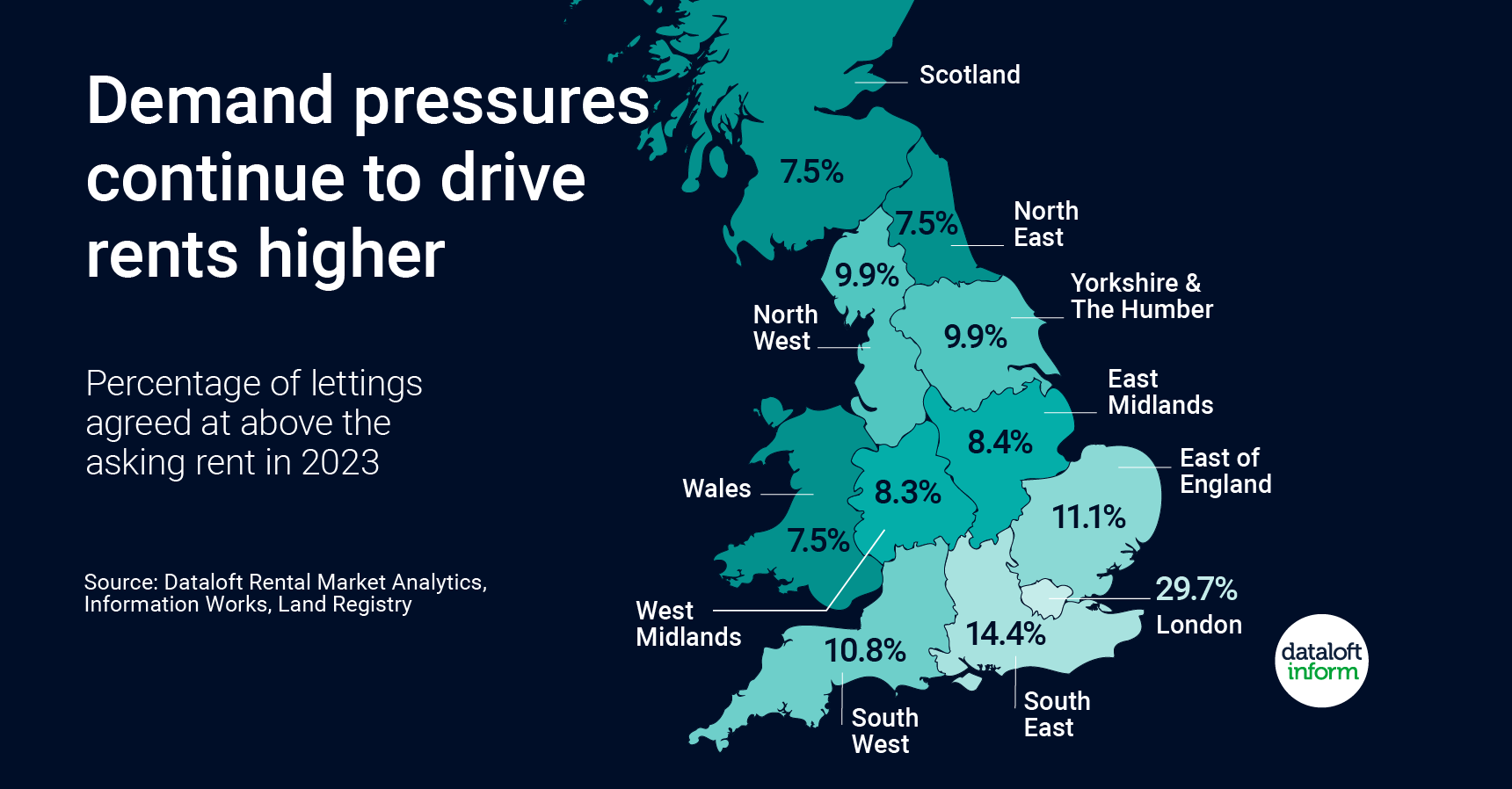

Demand pressures continue to drive rents higher

Read More

Almost one in six rental transactions in 2023 have been agreed at above the asking rent, compared to less than one in 15 in 2019, according to new analysis from Dataloft.

The situation is most marked in London, where 30% of rentals agreed this year ...

-

Yields on homes of multiple occupancy

Read More

The cast of Friends were role models for a generation, living the dream in a shared apartment. There are over half a million 'Homes in Multiple Occupation' (HMOs) in England and Wales and they play a key role in keeping costs down for many renters....

-

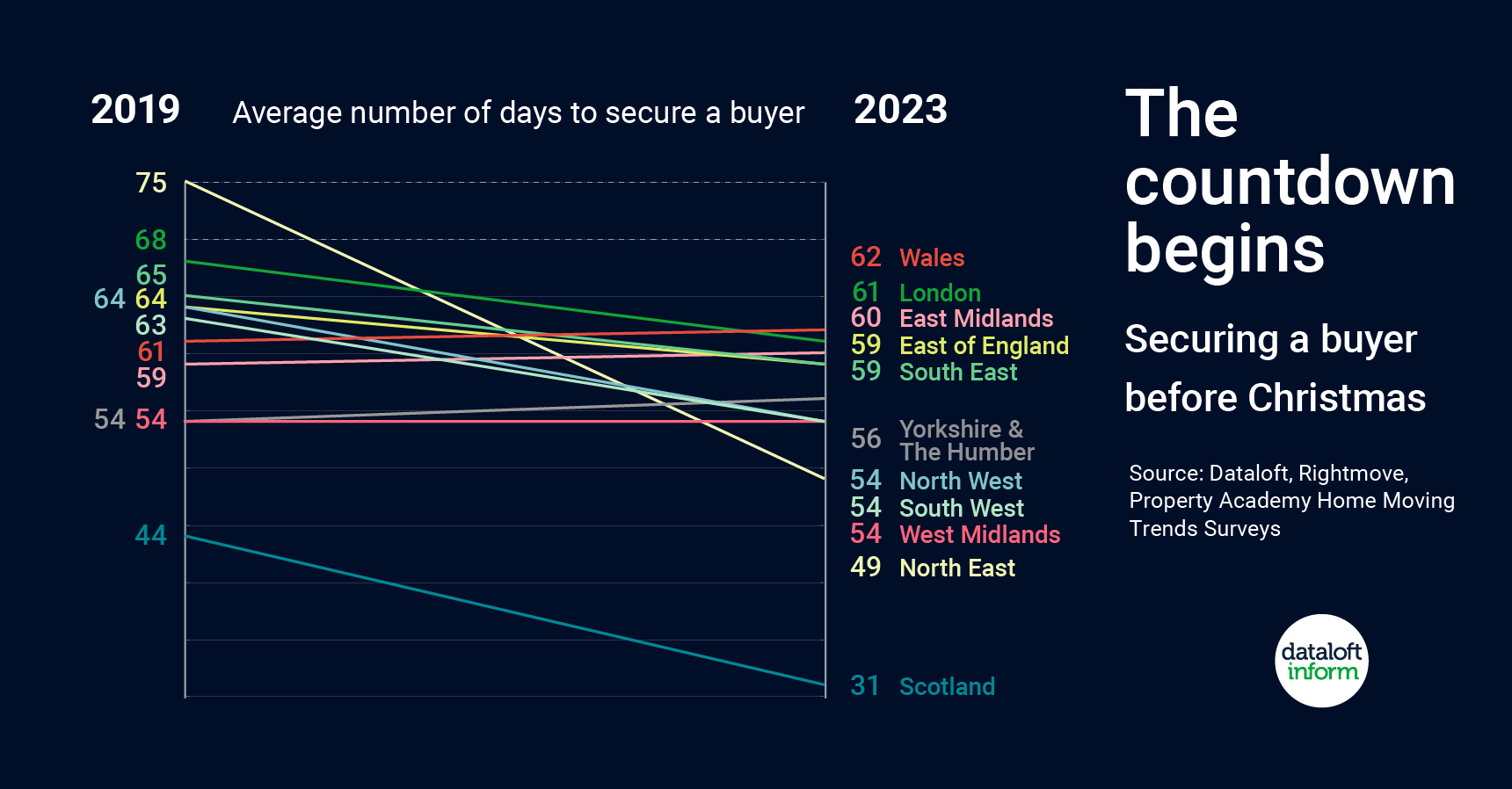

Securing a buyer before Christmas

Read More

For buyers in the market now, the 'move in for Christmas' date is fast approaching.

Properties are selling quicker than pre-pandemic, with an average of 55 days to secure a buyer, down from 62 in July 2019.

However, the time taken to complete a sale ...

-

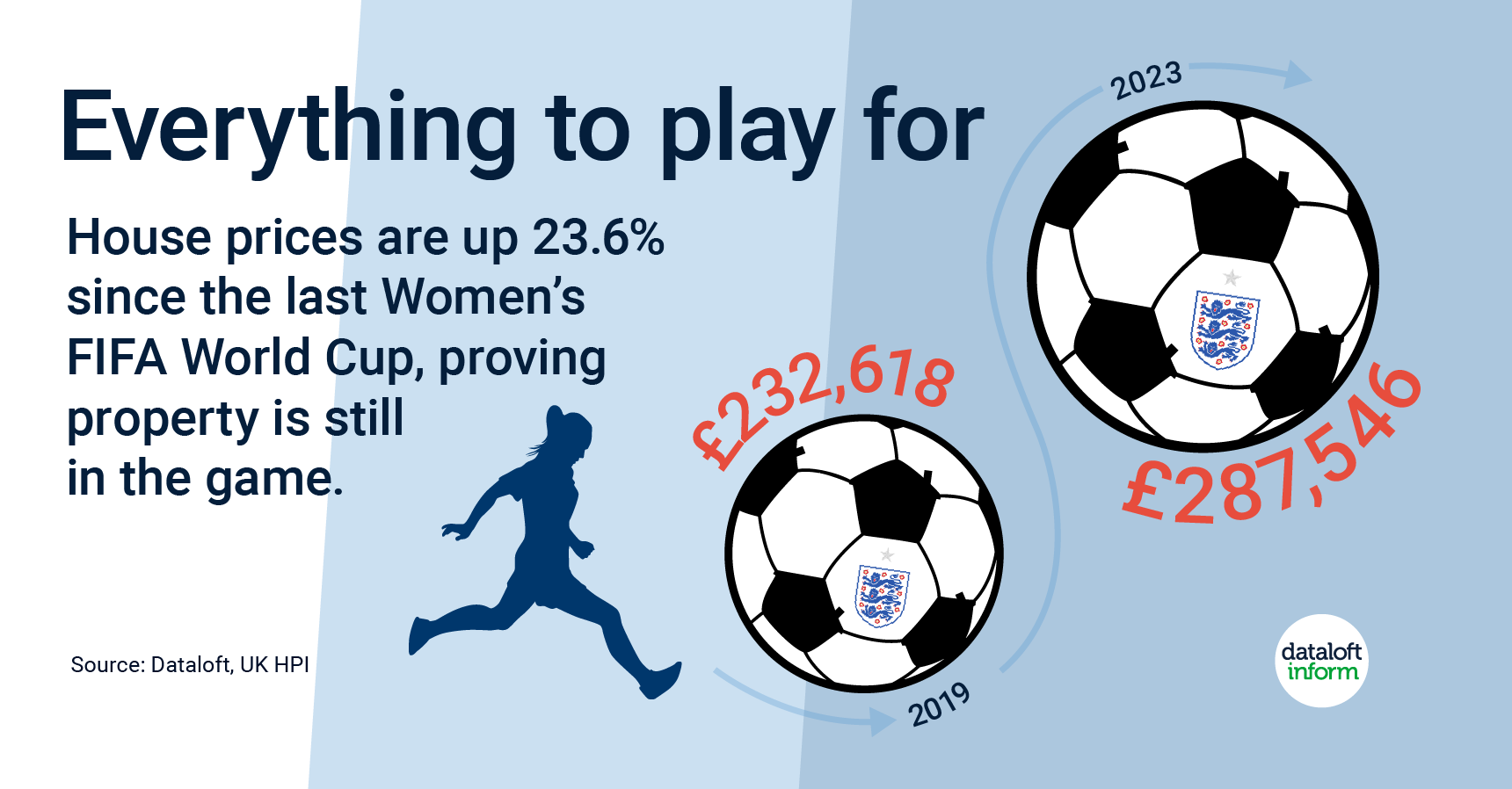

Everything to play for: Women’s FIFA World Cup

Read More

Despite heartbreak in the World Cup final, the Lionesses are inspiring a new generation of sportswomen. In England alone, the EURO 2022 legacy created over 416,000 new opportunities to engage women and girls in grassroots football activities across schools, clubs and the community.

Since the ...

-

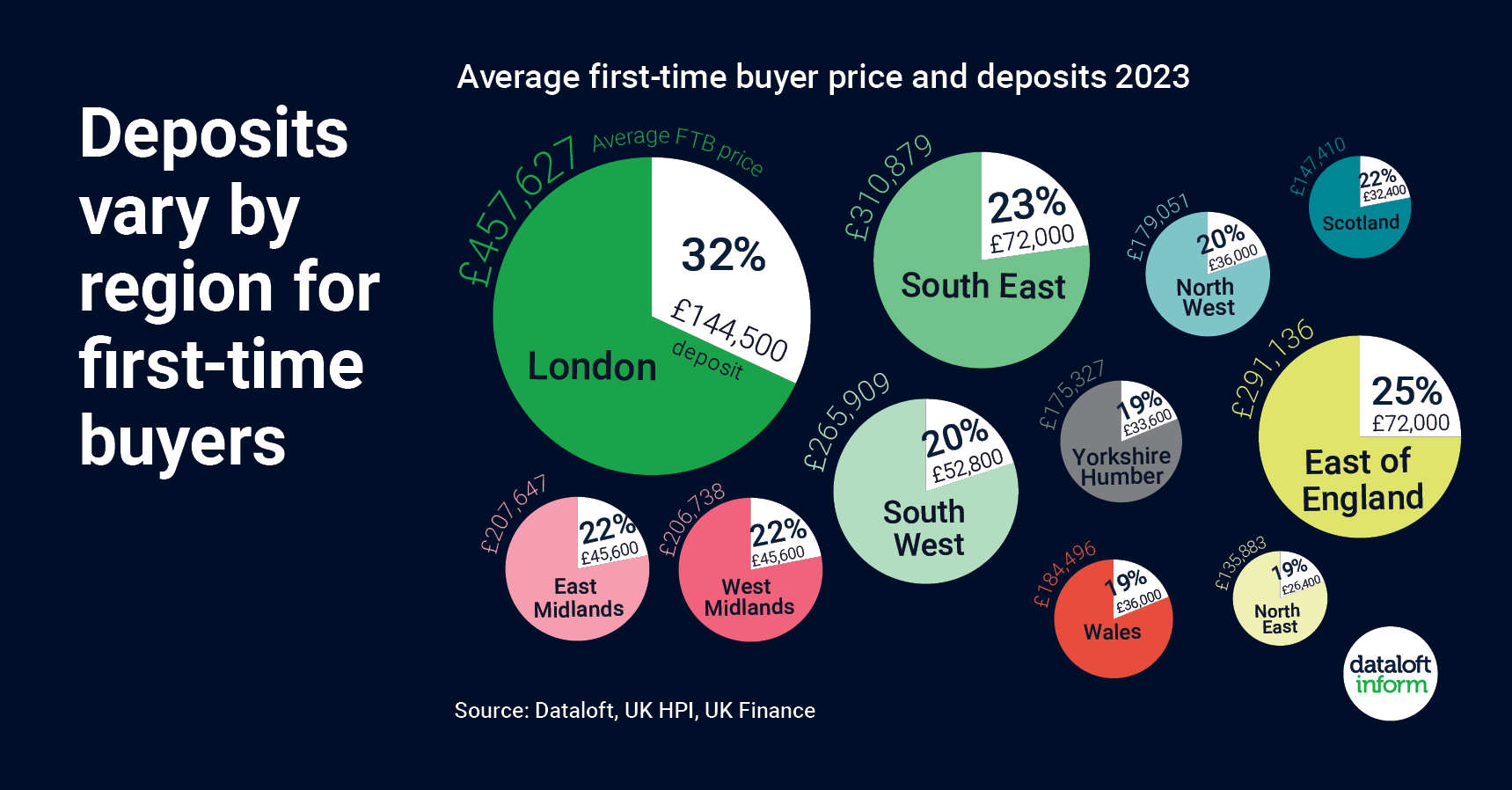

Deposits vary by region for first-time buyers

Read More

To buy a home in the UK, first-time buyers have an average deposit of between £26,400 and £144,500.

The average deposit paid by a first-time buyer in the UK is 24% of the purchase price (UK Finance), with many putting down a larger deposit down ...

-

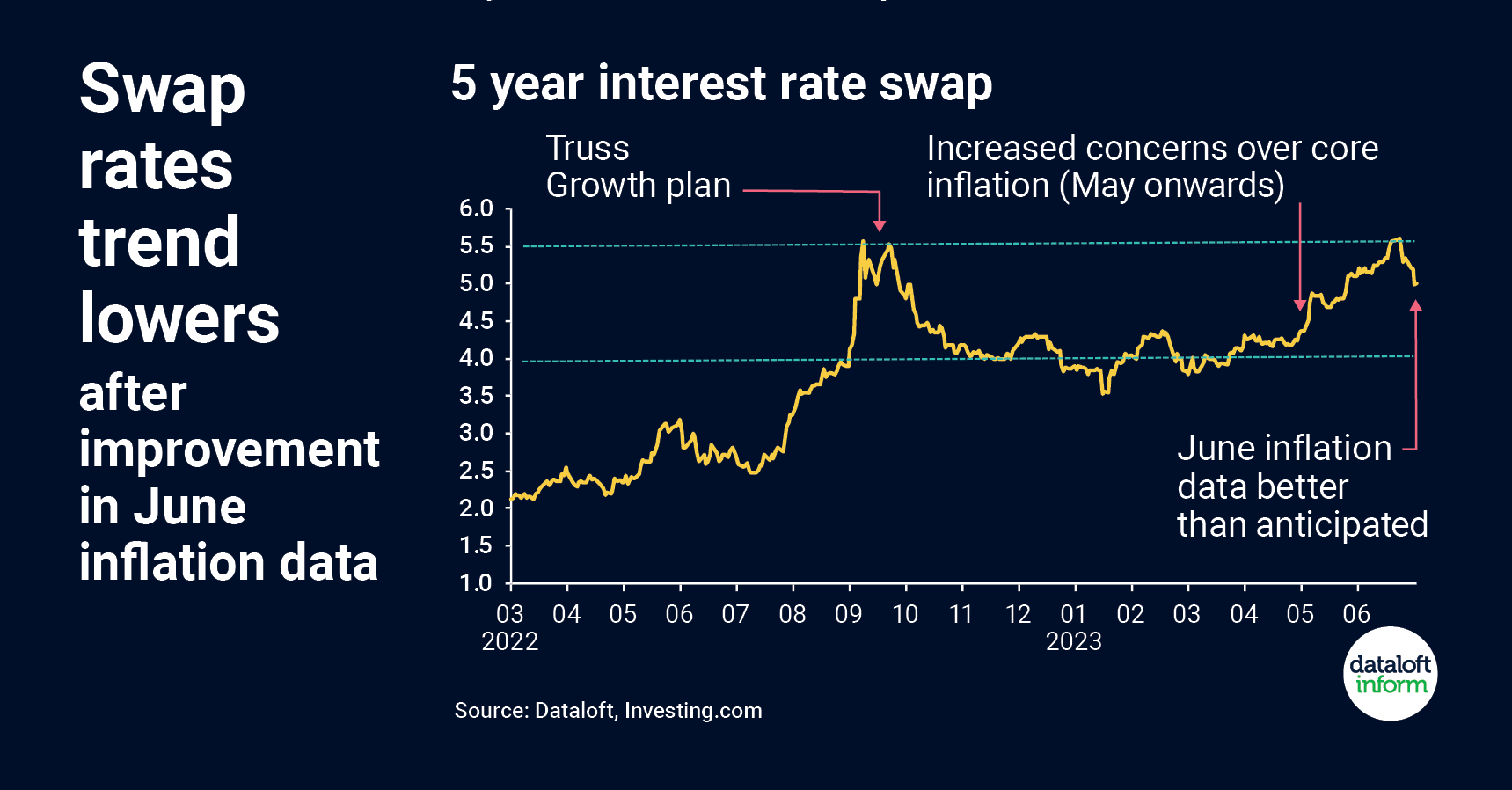

Swap rates trend lowers after improvement in June inflation data

Read More

Swap rates give us a good indication of changes to come in mortgage costs – reflecting the cost of borrowing for lenders.

The 5-year swap rates had settled to around 4% for much of the first half of the year but from May it trended ...

-

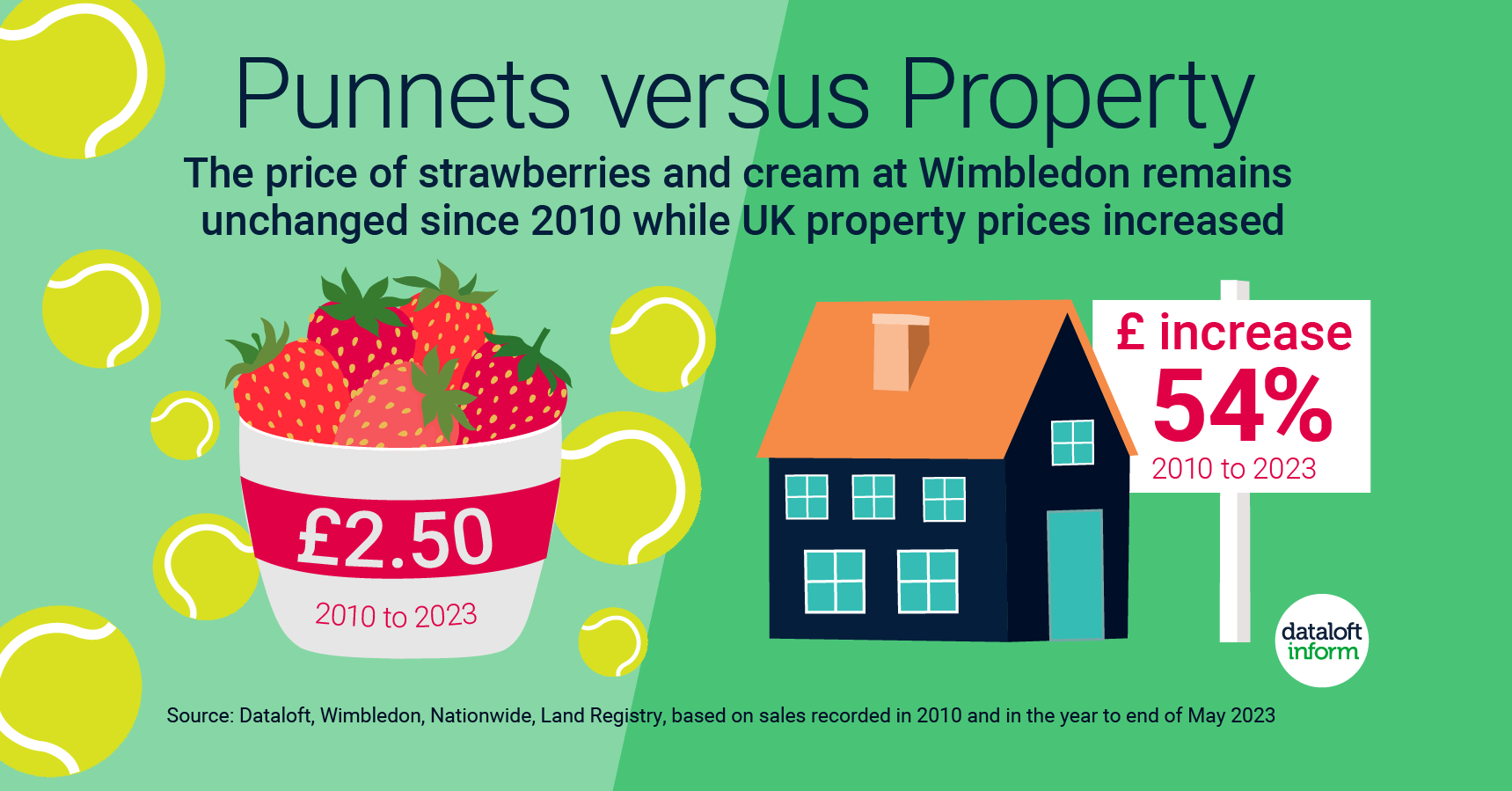

Punnets versus Property

Read More

The 136th Wimbledon Championship is underway. The All England Club is set to host around 800 players, 679 matches and over half a million spectators before its conclusion on Sunday 16th July.

Each year at the Championships around £500,000 is spent by spectators tucking into ...

-

Realistic pricing for market conditions is essential

Read More

More than 75% of agents state that properties are selling at a reduction on the initial asking price according to the latest poll of Dataloft Inform subscribers.

With property price growth softening, realistic pricing is paramount to sales success, with many vendors seemingly overly optimistic ...

-

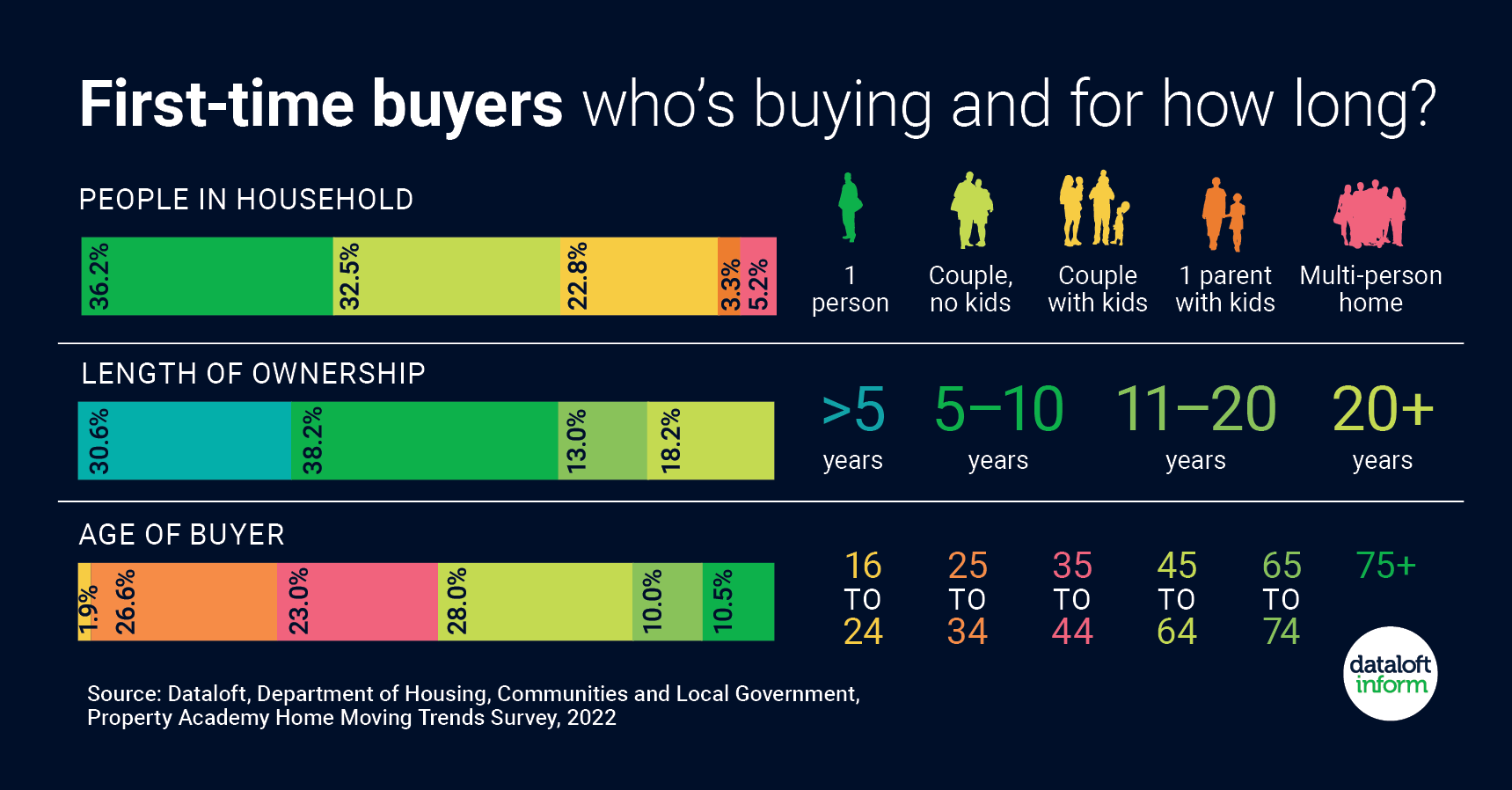

First-time buyers, who’s buying and for how long?

Read More

5.5 million households are currently living in their first-time buyer home, the equivalent of over 35% of all owner occupiers.

36% of first-time buyer households are single person households. Over 60% are couples with or without dependent children. One in five of those who live ...

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Tom Simper Apr 2, 2024, 12:30 PM

Tom Simper Apr 2, 2024, 12:30 PM