Levenshulme and Burnage Property News

-

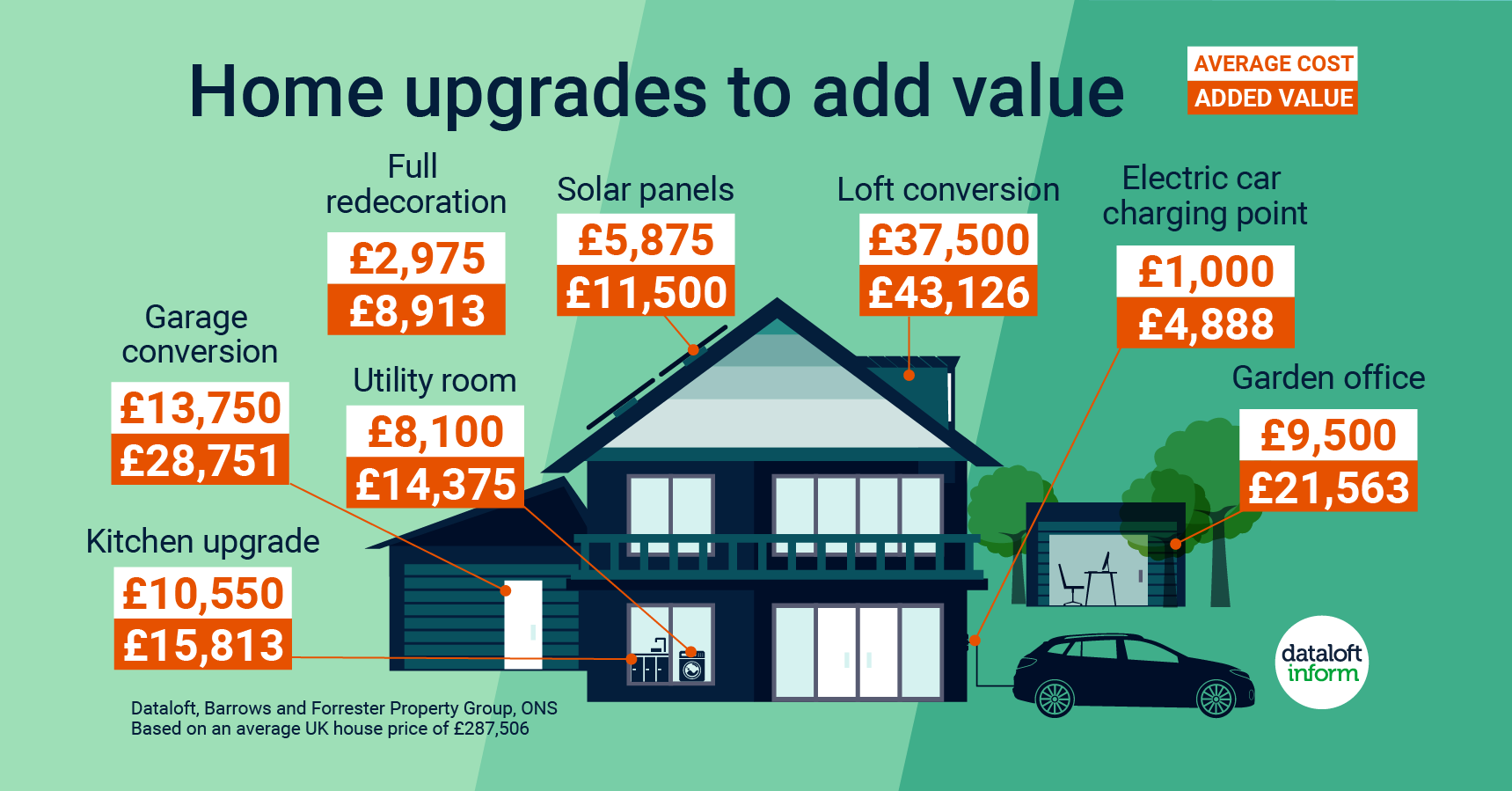

Home upgrades to add value

Read More

-

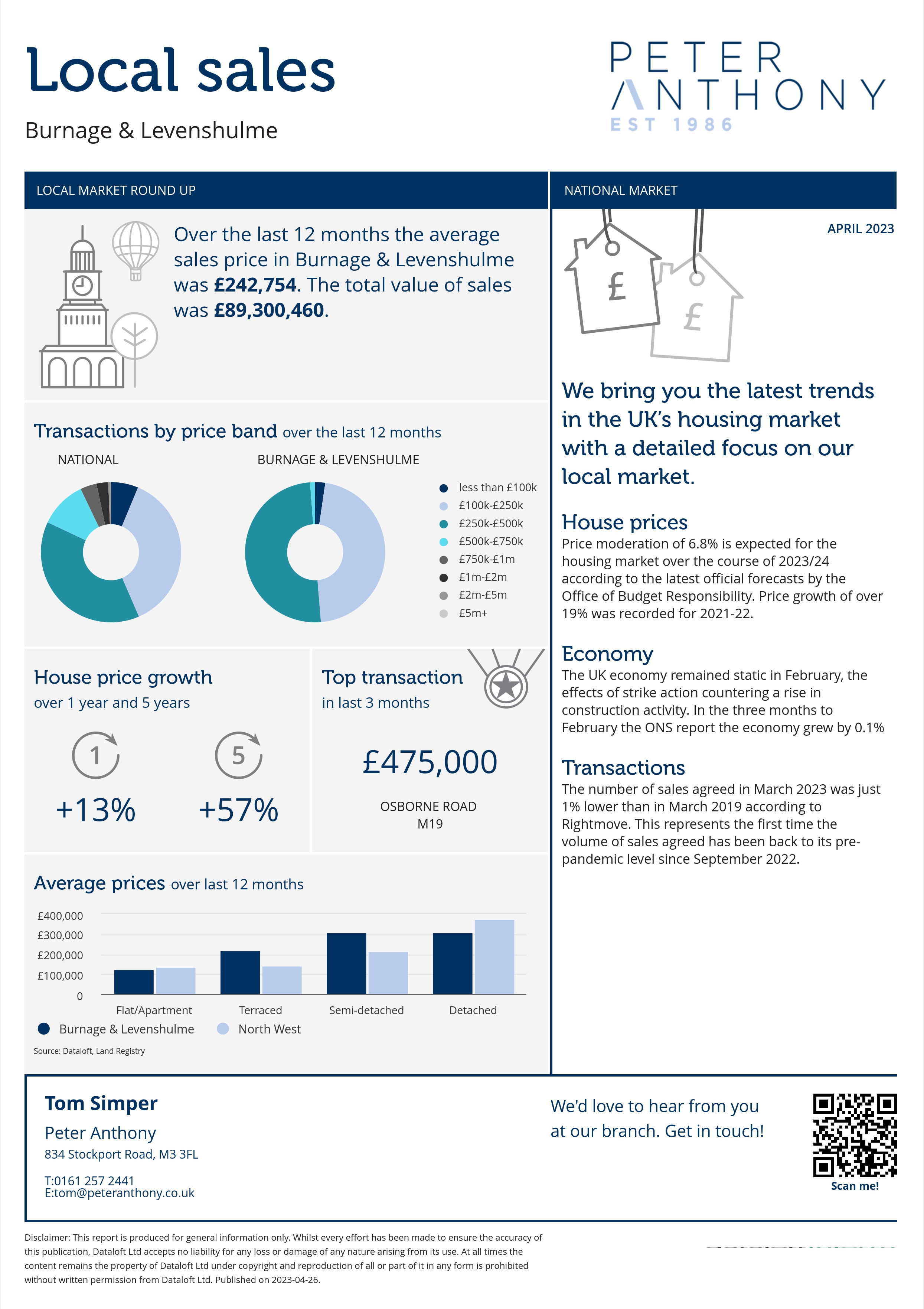

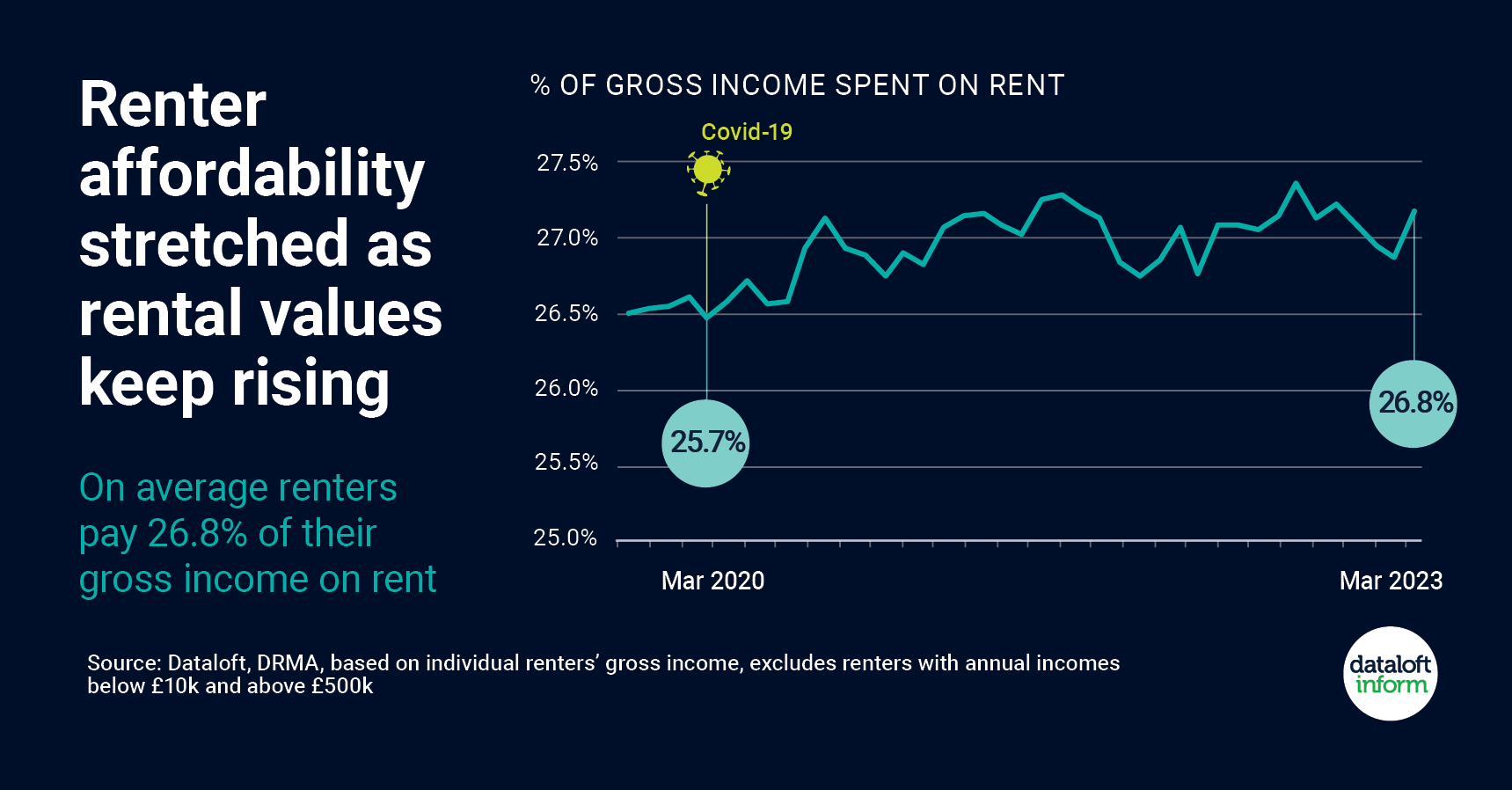

Levenshulme & Burnage Sales & Lettings Update

Read MorePlease see latest updates of both the residential sales and lettings markets.

If you have any questions relating to how both the sale and lettings markets then please don't hesitate to contact me on 0161 257 2441.

-

Stunning 4-bed Family Home in Burnage

Read MoreTake a look at this fabulous new sales instruction!

This beautiful four bedroom home is immaculately presented throughout and offers excellent modern living accommodation over three floors with approximately 1100sqft of living space. This property has to be viewed to be fully appreciated!In ... -

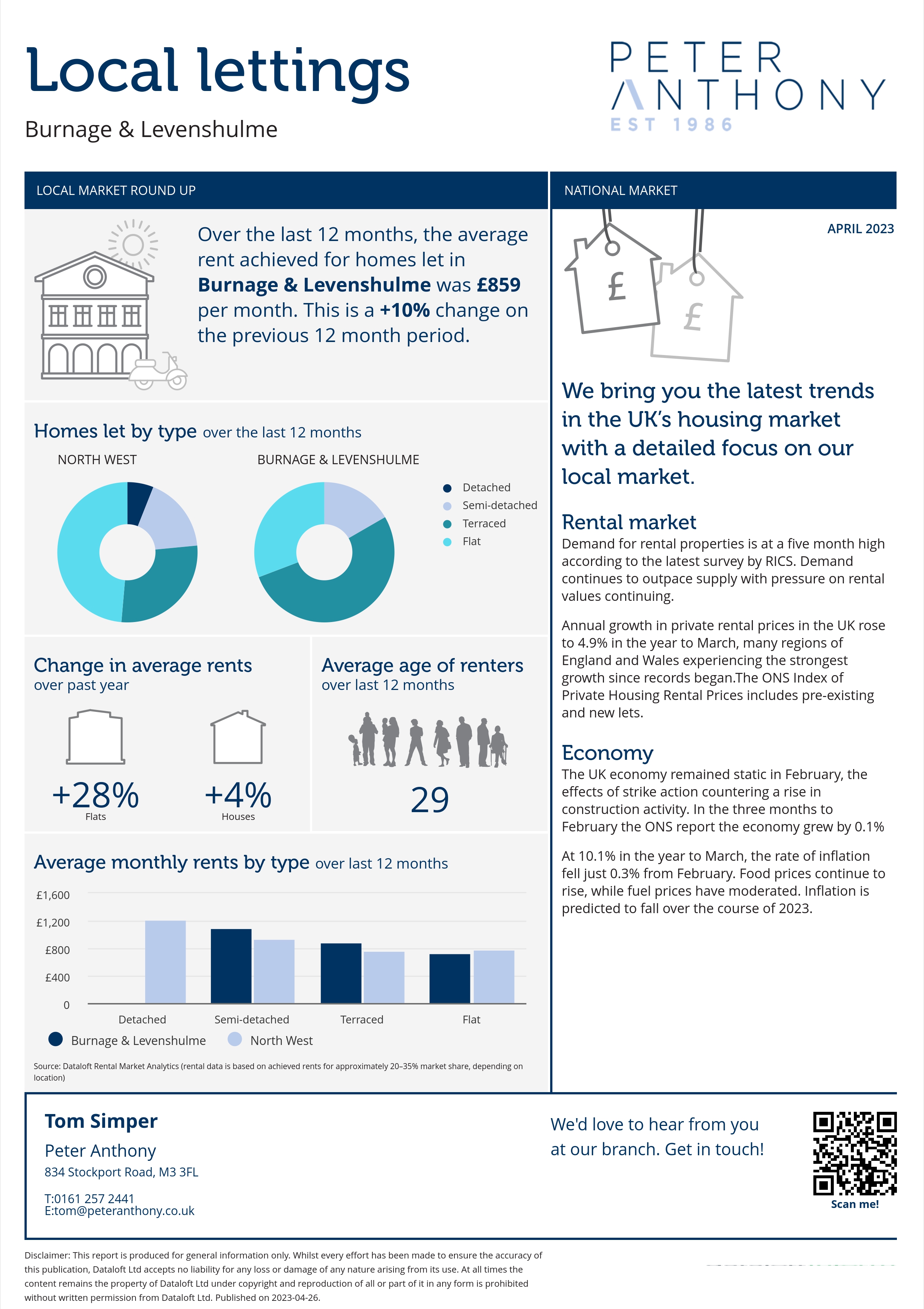

Renter affordability stretched as rental values keep rising

Read More

Renter affordability is becoming increasingly stretched as growth in private rental prices continues. On average renters now pay 26.8% of their gross income on rent, compared to 25.7% three years ago.

Annual rental growth in the UK was 9.8% in the year to March, based ...

-

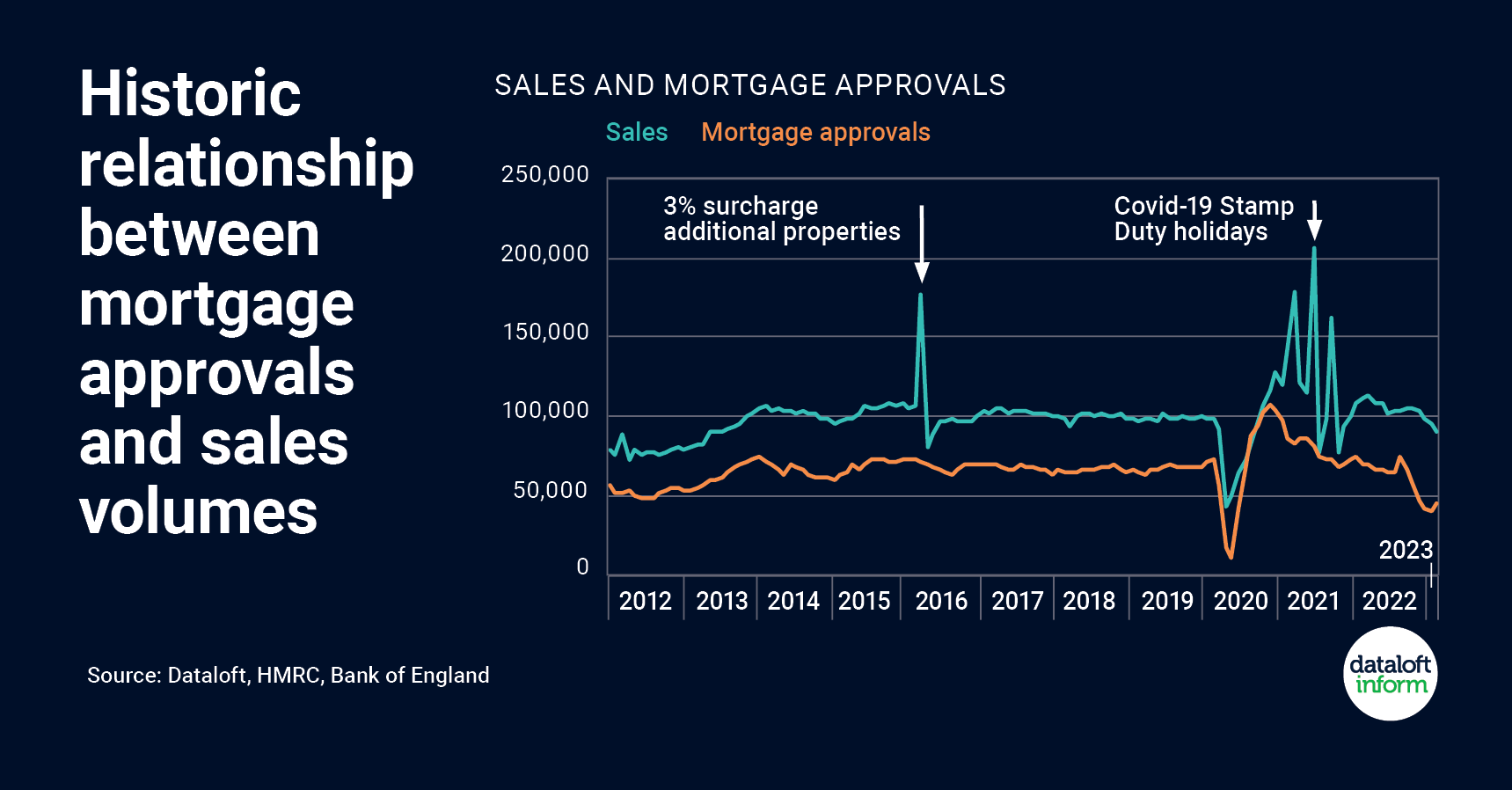

Clear relationship between mortgage approvals and sales volumes

Read More

Official data indicates sales volumes in February were 4% lower than January, while mortgage approvals for the month were 10% higher, the most significant uptick at this time of year since 2011.

In the 5 years prior to the pandemic, mortgage approvals in February were ...

-

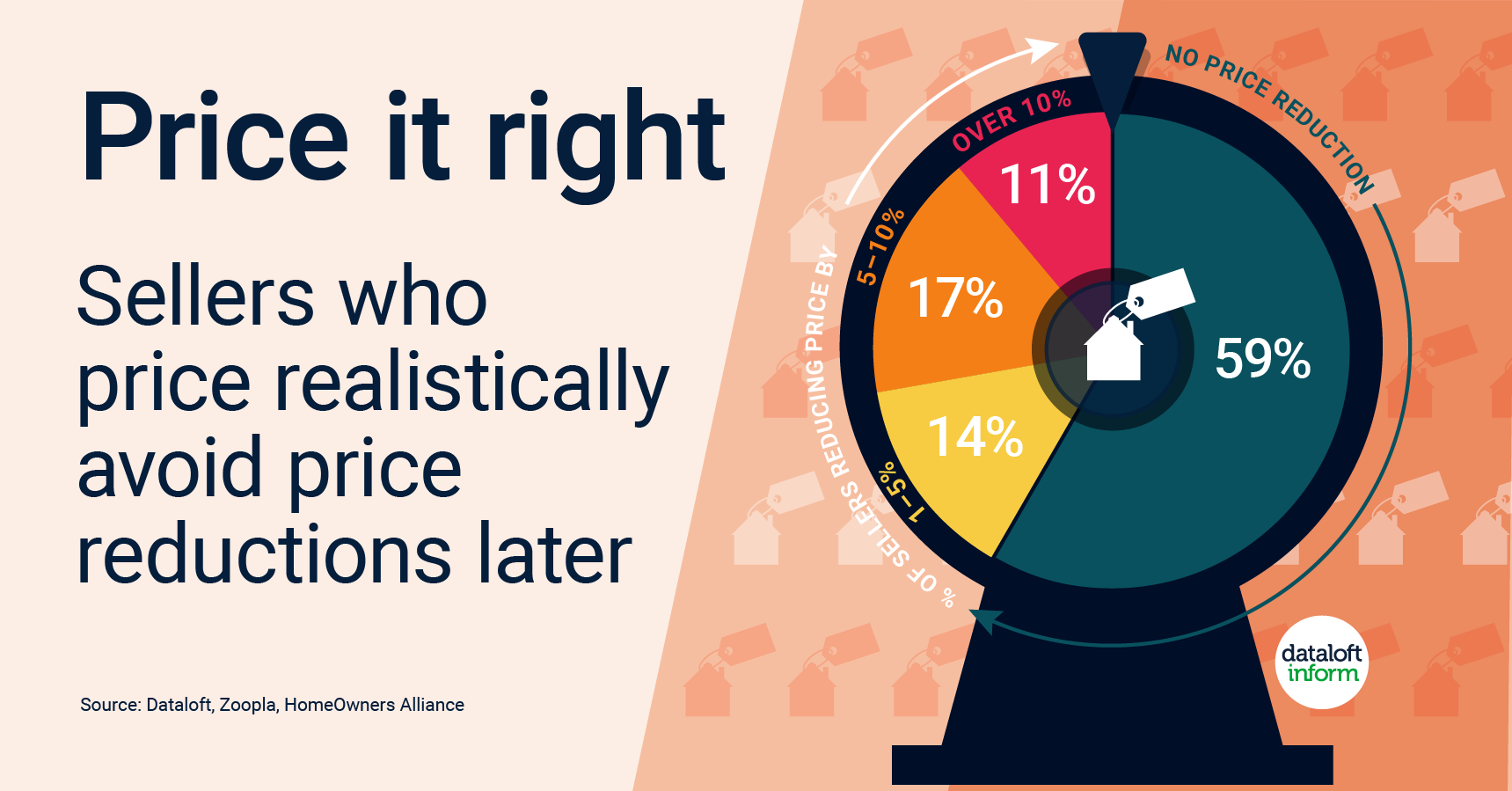

Price it right

Read More

With price sensitivity increasingly evident in the property market, understanding local market conditions and pricing realistically are essential to achieve a sale. Zoopla report that while 59% of listings in February had no price reduction, four in ten did.

8–14 days is the optimum listing ...

-

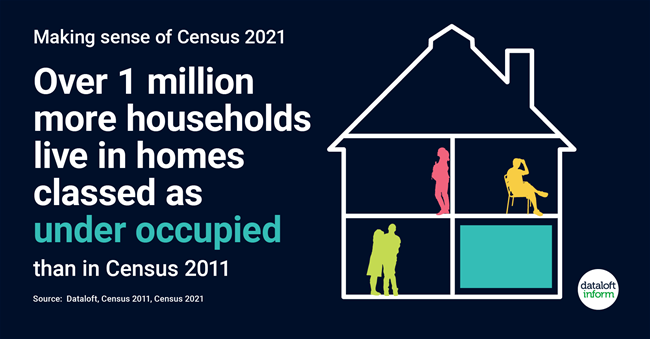

Over 1 Million More Households Than in the Census 2011

Read More

The 2021 census reports that just over 1 million more households live in accommodation classed as being under occupied than in 2011. This is 69% of households.

An under-occupied household is classed as a household with more bedrooms than required. Conversely, the number of over-occupied ...

-

Head over heels in love with your home?

Read More

Buying a home is like falling in love. You can expect to go through the same ups and downs, emotional tugs and pulls, and even similar stages.

The one that got away? Don't panic, there are plenty more fish in the sea! 2023 is predicted ...

-

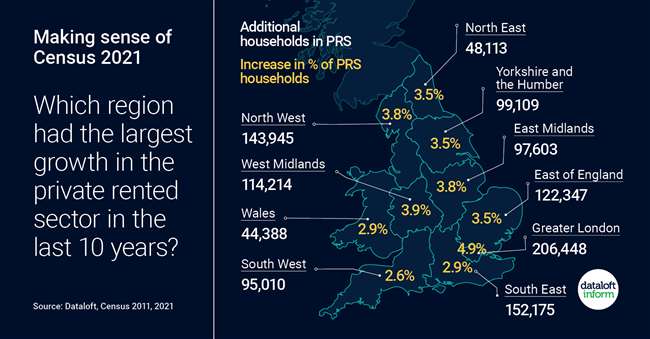

Census 2021 – Private rented sector growth

Read More

The number of households living in the private rented sector (PRS) has grown by 1.1m in ten years across England and Wales. At 20% of households, this is up from 17% in 2011.

All regions have recorded growth in the PRS since the last census ...

-

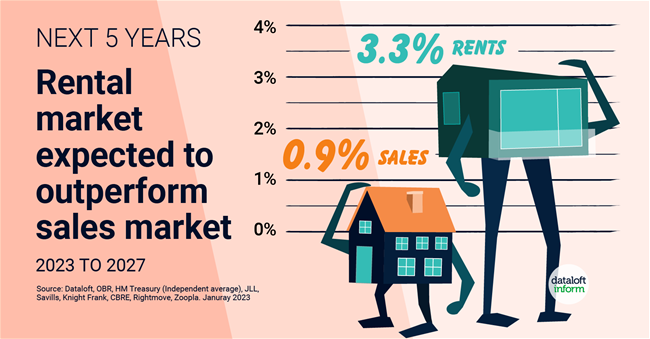

Rental market expected outperform sales market over next 5 years

Read More

An average of economists and housing market commentator forecasts over the next 5 years expect the rental market out perform the sales market, at 3.3% compared to 0.9% per year.

The sales market could see falls in average prices of homes by -7% by the ...

-

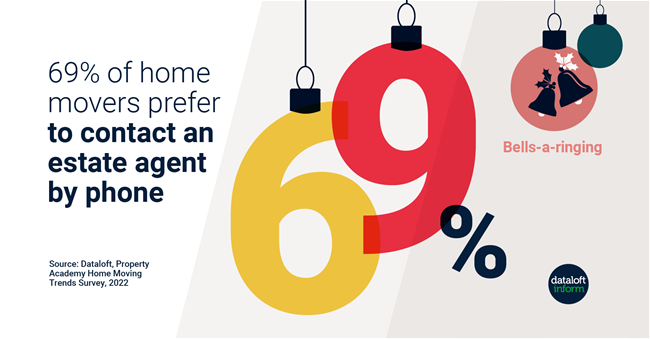

Dataloft Days of Christmas Part 8

Read More

The Central Council of Church Bell Ringers estimates it takes two and a half years to learn the basics of ringing bells. Fortunately ringing estate agents is a little easier.

From booking viewings to agreeing offers, when contacting an estate agent, over two thirds (69%) ...

-

We've Won Gold in the 2022 allAgents Awards!

Read More

Congratulations to our Levenshulme Team for winning Best Lettings Branch and Best Sales Branch in the allAgents 2022 awards!

Call on 0161 257 2441 to discuss your property now! -

Dataloft Days of Christmas Part 3

Read More

There may not be a train line to the North Pole yet, but with the country returning to pre-Coronavirus normality, people commuting via public transport is on the rise again.

A shorter commute is important in a property for close to two-thirds of renters and ...

-

What has happened with prices in Levenshulme and Burnage since the last World Cup?

Read MoreAs any football mad person, I have been enjoying watching the world cup so far even if I don’t agree with where it is held. I was thinking the other day about the changes of prices for both sales and rental properties with the local ...

-

Top ten mortgage lenders

Read More

The UK's top ten mortgage lenders lent an eye-watering £260 billion in 2021, increasing their market share to 84.4%, up from 82.4% in 2019 (data released in August 2022, UK Finance).

The top 4 lenders retain their rankings with Lloyds Bank in first place followed ...

-

The importance of community

Read More

Humans are social animals, forming societies and seeking contact with others for well-being purposes. It is not therefore surprising that buyers and renters look for a sense of community in their new home search.

Three quarters of home movers rated the local community as 'Important' ...

-

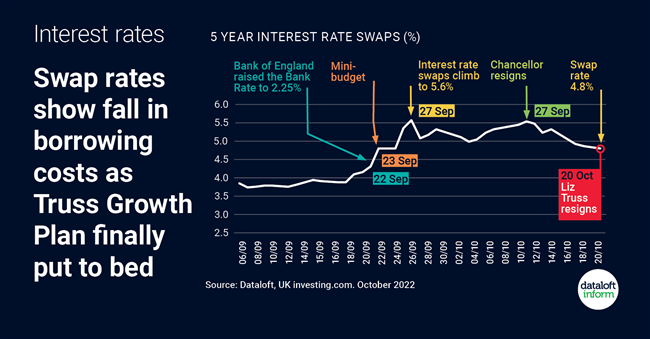

Swap rates show fall in borrowing costs

Read More

Recent political instability added to volatility in the financial markets and pushed up the cost of borrowing.

Swap rates are a good indicator of what to expect in borrowing costs because they reflect what borrowing costs for the lenders. 5-year swap rates rose to 5.6% ...

-

Home buyers want financial advice

Read More.png?sfvrsn=eaebcd30_1)

84% of home movers seek financial advice at some point during the buying process. The majority (64%) do this prior to purchasing.

Of movers who seek advice and require a mortgage, 39% use an agent’s recommendation for their choice of mortgage provider, rising to over ...

-

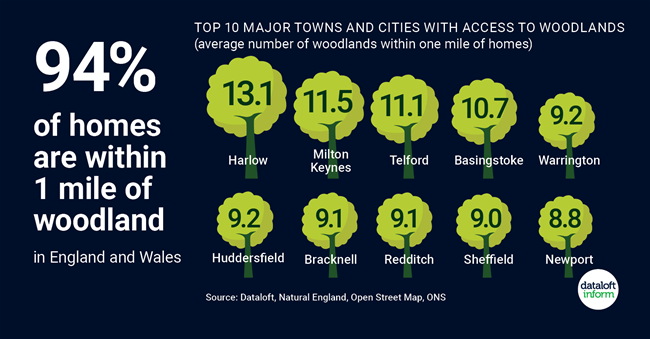

Homes Near Woodlands

Read More

94% of households within England and Wales are within one mile of an accessible woodland, despite the loss of almost half our ancient woodlands in the last 80 years.

Access to woodlands isn't just limited to the countryside. Across built-up areas there are, on average, ...

-

Outstanding Ofsted report adds value

Read More

House prices are significantly higher in the catchments of Ofsted 'outstanding' primary schools, even compared to those ranked 'Good' in their Ofsted report.

Average sale prices are 10% higher around a primary school with outstanding status, (based on £ per sq ft and compared with ...

About The Blog

This Blog looks at what is happening in Manchester, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Tom Simper - Editor

Manchester is one of the fastest growing markets in the country. If you need any assistance buying, selling or letting properties in the area we have over 30 years of experience and local knowledge to help.

T: 0161 441 0563

E: [email protected]

Tom Simper May 10, 2023, 14:00 PM

Tom Simper May 10, 2023, 14:00 PM