Liverpool Property News

-

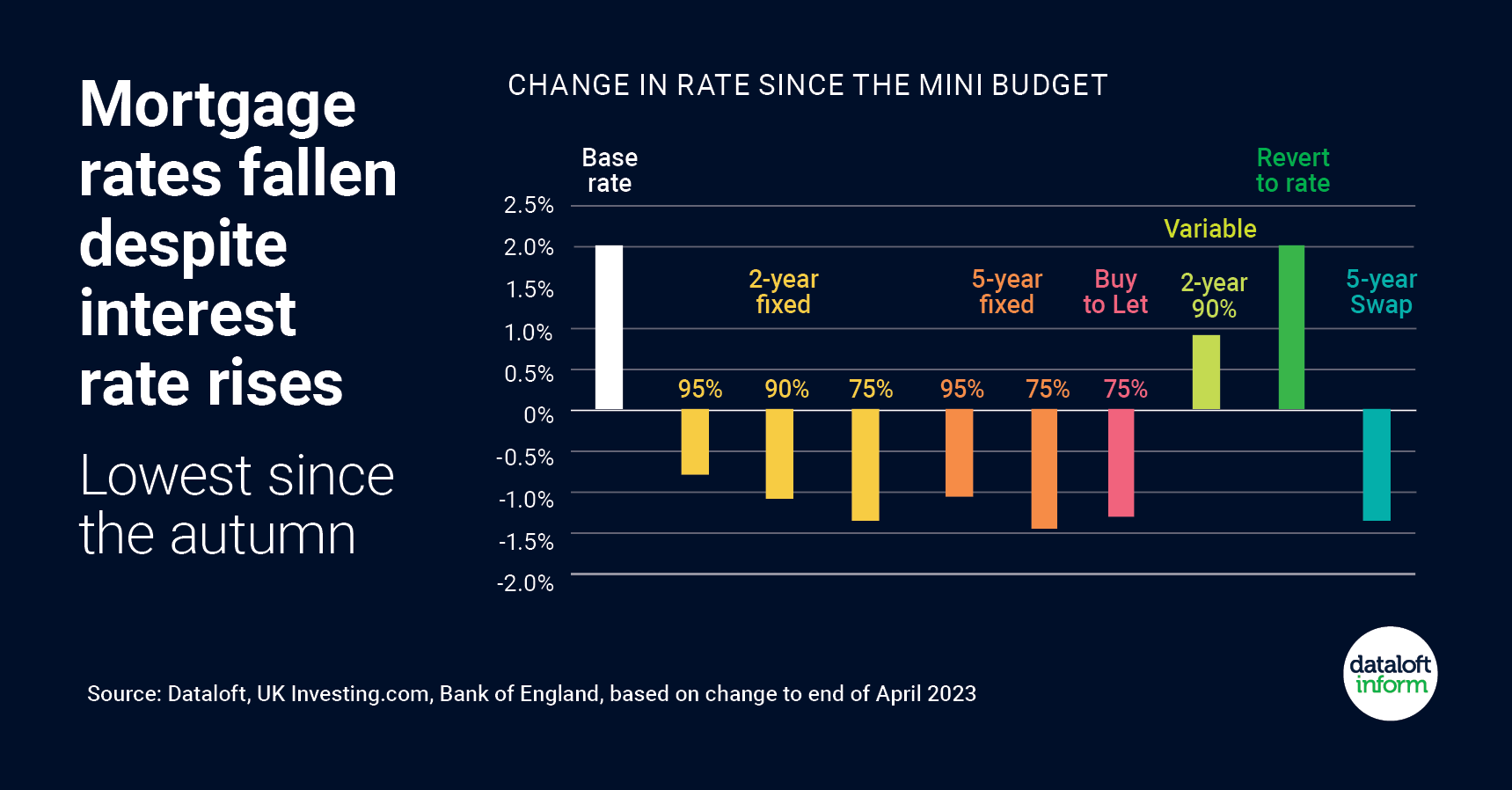

Mortgage rates fallen despite interest rate rises

Read More

Analysis of mortgage interest rates in recent times shows that while the base rate of interest has risen, mortgage rates for those seeking to purchase have fallen back from their autumn peak.

Average fixed rate mortgage rates had fallen back to their lowest since the ...

-

Snakes alive – 55 days to sell

Read More

At 55 days, the average time taken to sell a property (from listing to sold subject to contract) is nearly two weeks faster than the last so-called 'normal' market of 2019 (67 days).

Rightmove report the number of sales agreed in March 2023 is just ...

-

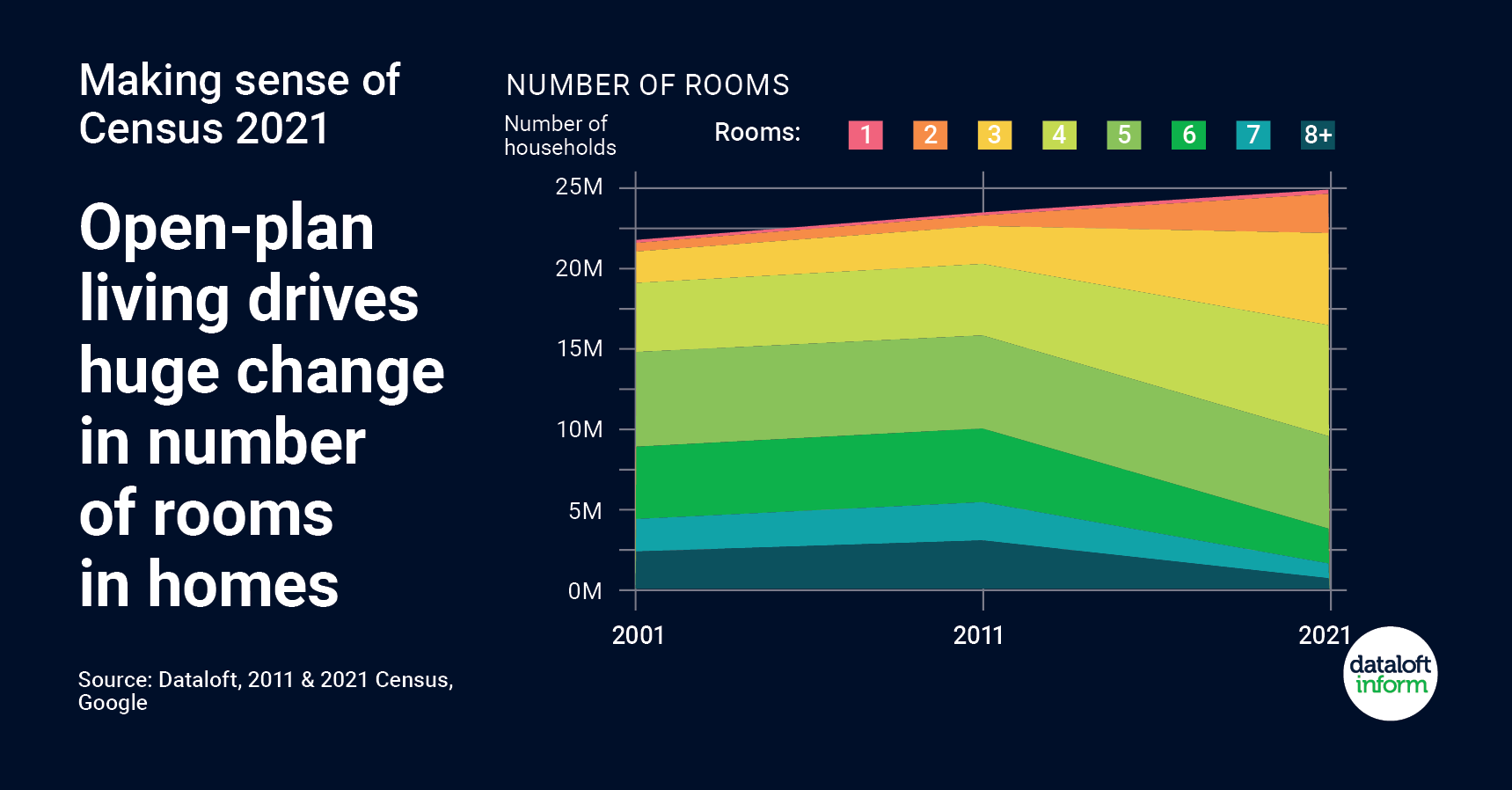

Census 2021 and the change in number of rooms

Read More

Open-plan living has become a huge trend over recent times for both renovations and new build housing. Fewer walls create additional light and space and more sociable living.

The recent 2021 census data has hinted at the massive impact this trend has had. The number ...

-

Spring forward for home sales

Read More

Mid-March marks the start of spring, long acknowledged as the best time to sell your home.

Rightmove report demand levels are currently 6% higher than in 2019, and with the Easter holidays just a few weeks away, now is a great time to get your ...

-

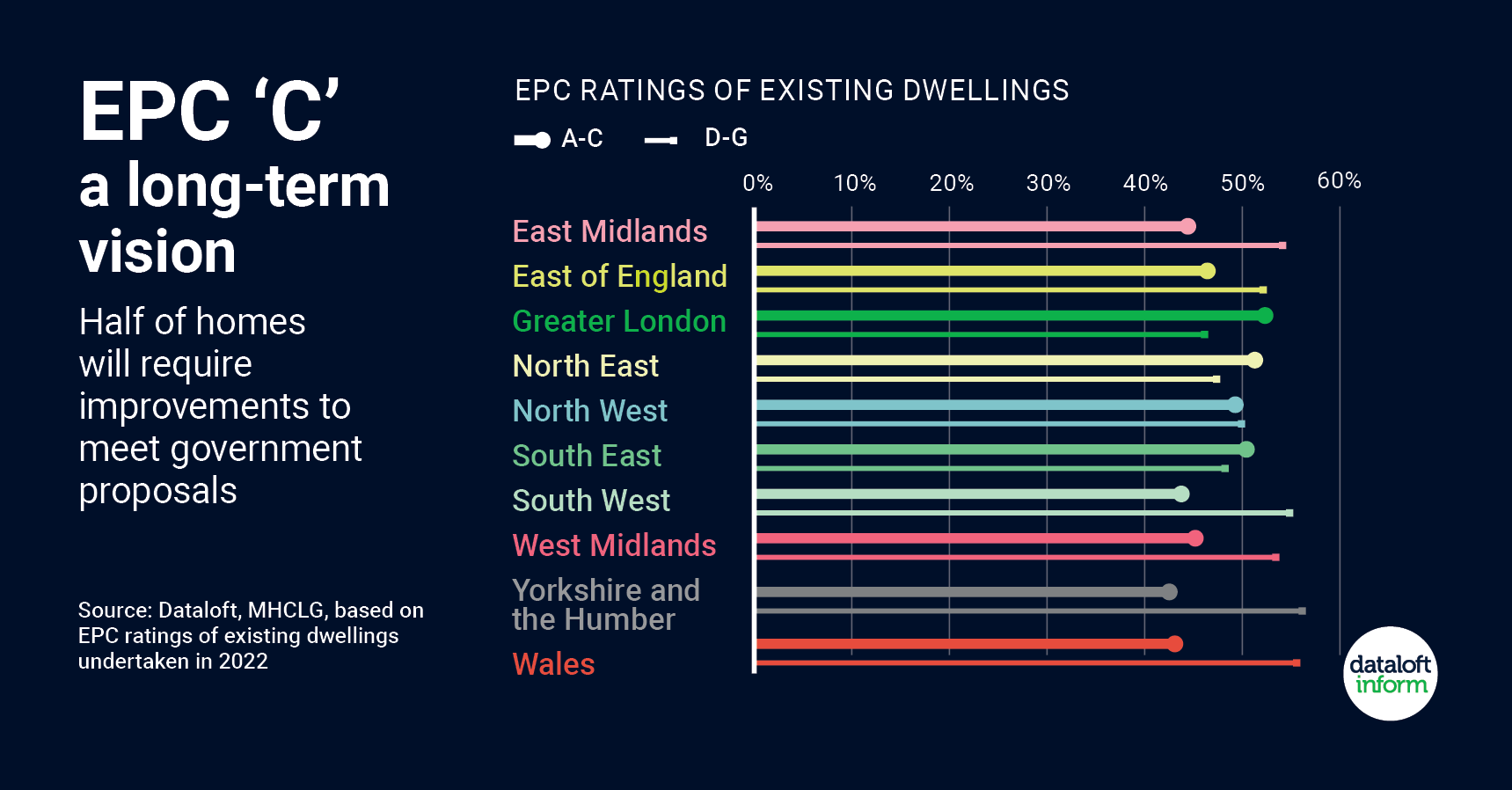

EPC 'C' – a long-term vision

Read More

As part of their Net Zero Review, the government is proposing that all homes sold will need to have an Energy Performance Certificate rating of 'C' by 2033.

Virtually all (96%) of new build dwellings in 2022 achieved an EPC rating of 'A' or 'B'. ...

-

Lucky Number Seven

Read More

Seven. Considered by many a lucky number, and as a homeowner if you stay in a property for 7 years it is likely to have risen in value.

Analysis of historic monthly house price data from Nationwide indicates that at no point since records began ...

-

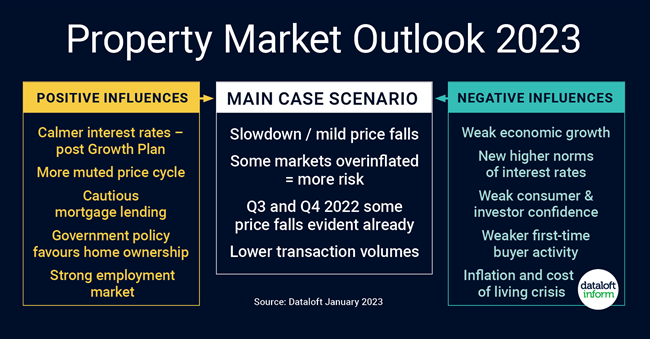

Property Market Outlook 2023

Read More

Dataloft's central (main case) outlook scenario for house prices is of a market slowdown and mild price falls. Lower transaction volumes but better than suggested by recent low mortgage approvals data.

There are reasons to be positive about the housing market and the outlook has ...

-

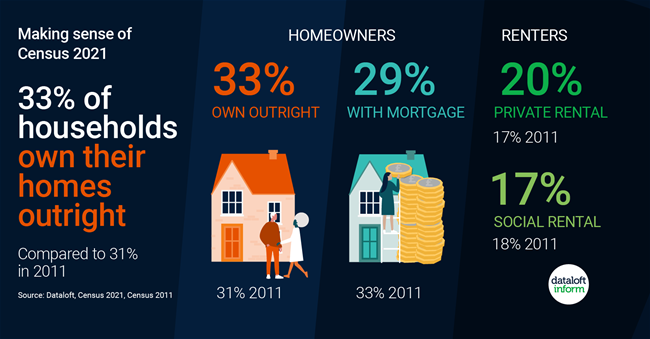

Making sense of Census 2021

Read More

The census began recording mortgage status in 1991. The 2021 census marks the first time the data has shown that amongst homeowners, those that are mortgage free are now in the majority.

In the 10 years since 2011, the % of households who have become ...

-

Dataloft Days of Christmas Part 9

Read More

Christmas dinner is an essential part of the festive celebrations, but could you 'Grow-your-own?'. We had a look at the increasing number of households growing their own produce .

Almost two-thirds of UK homes have turkey or chicken for their Christmas dinner. Since 2019/20 the ...

-

We've won Best Lettings Branch of the Year in L3!

Read More

Our Liverpool team has won Gold in the allAgents awards!

Well done to our team for winning best lettings branch of the year in L3.

Call on 0151 214 3480 to discuss your property now! -

Dataloft Days of Christmas Part 4

Read More

As the story goes, one of the wise men gave the gift of gold but gifting a home might have been more financially prudent.

The average price of a house in the UK is currently £294,559, this is a 73% increase in value compared to ...

-

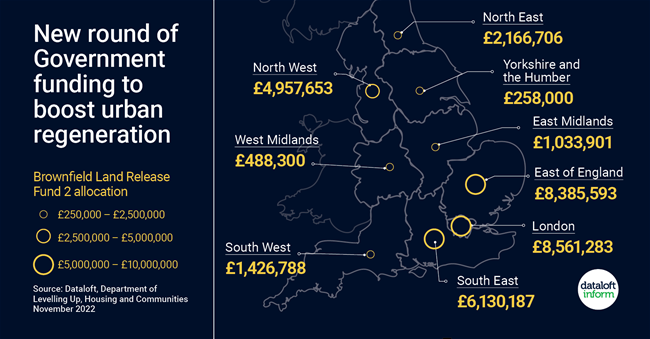

New round of Government funding to boost urban regeneration

Read More

41 councils across the country have been allocated funds to kickstart regeneration projects which could deliver over 2,200 homes for local communities.

So far, only £35 million of the £180 million Brownfield Land Release Fund 2, announced earlier this month by the DLUHC, has been ...

-

Need to move

Read More

Home moves can be triggered by dreams and desires as much as necessity – as proven by the post-Covid trend for lifestyle change.However, almost a third of moves were ‘needs-based’ according to a survey of 10,400 home movers by the Property Academy in summer ...

-

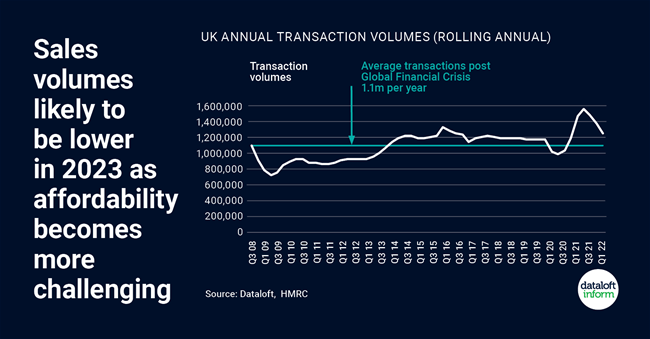

Sales volumes likely to be lower in 2023 as affordability becomes more challenging

Read More

With rising interest rates and more challenging affordability (especially for first-time buyers), sales volumes will likely slow in 2023.

Uncertainty has an impact on housing market activity; with a new Prime Minister and Chancellor there is hope that this extra layer of uncertainty clears.

Current ...

-

Buyers attracted to energy efficient new homes

Read More

The attention focused on energy bills and the cost of living crisis might be influencing more people to consider buying a new home.

Over half (51%) of home buyers would consider buying a new build and 17% of them are looking only at brand new ...

-

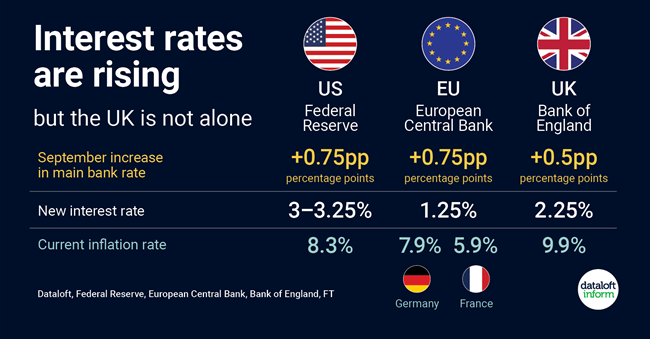

Interest rates are rising

Read More

In the September meeting, the Bank of England increased its bank rate to 2.25%. Its seventh consecutive rise and again increasing the rate by a significant amount (+0.5 percentage points).

Many UK borrowers are protected from any immediate increase by fixed rates (representing 94% of ...

-

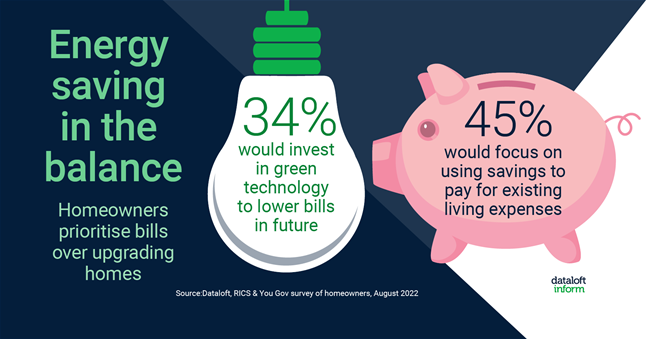

Energy saving in the balance

Read More

The cost of living crisis threatens progress towards the UK's Net-Zero ambition, as 45% of homeowners prioritise everyday bills over upgrading their homes (34%), according to recent findings from the RICS and You Gov.

Over half (51%) of homeowners who hadn't already installed new energy ...

-

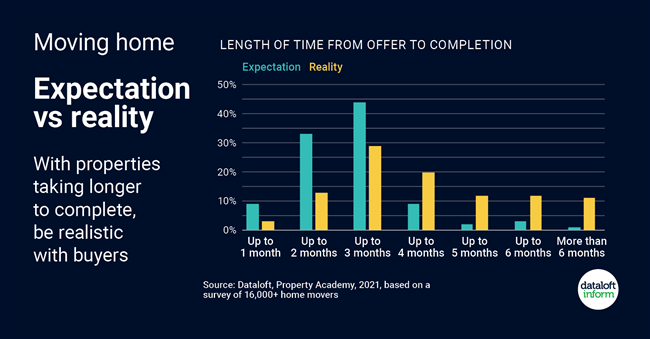

Moving home: expectation vs reality

Read More

Properties continue to go under offer more quickly than pre-pandemic, but the time taken to complete a sale has risen. Conveyancing delays remain a significant issue.

In 2019 a survey of home movers found 55% of sales completed within 3 months. This fell to 45% ...

-

Help to Buy deadline approaches

Read More

There are less than three months left for First Time Buyers to benefit from the Help-to-Buy Equity Loan scheme. The deadline for new applications is 6pm on 31st October 2022.

The Equity Loan scheme has helped over 300,000 First Time Buyers take a step onto ...

-

Homeowner stays shorten while renters rent for longer

Read More

While we wait for the 2021 census housing data we look to the newly published 2020/21 English Housing Survey data to help us understand the changing relationship we have with our homes since the last census.

Since 2011/12, owner occupiers have seen a drop in ...

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell May 13, 2023, 13:00 PM

Gillian Bell May 13, 2023, 13:00 PM