Liverpool Property News

-

Shining a light on energy-efficient homes

Read More

Buyers are increasingly looking for more energy-efficient homes, with 39% of survey respondents noticing greater interest from buyers, an increase from 34% when the same question was asked last year.

43% stated that sellers were looking to attach a premium to homes that are more ...

-

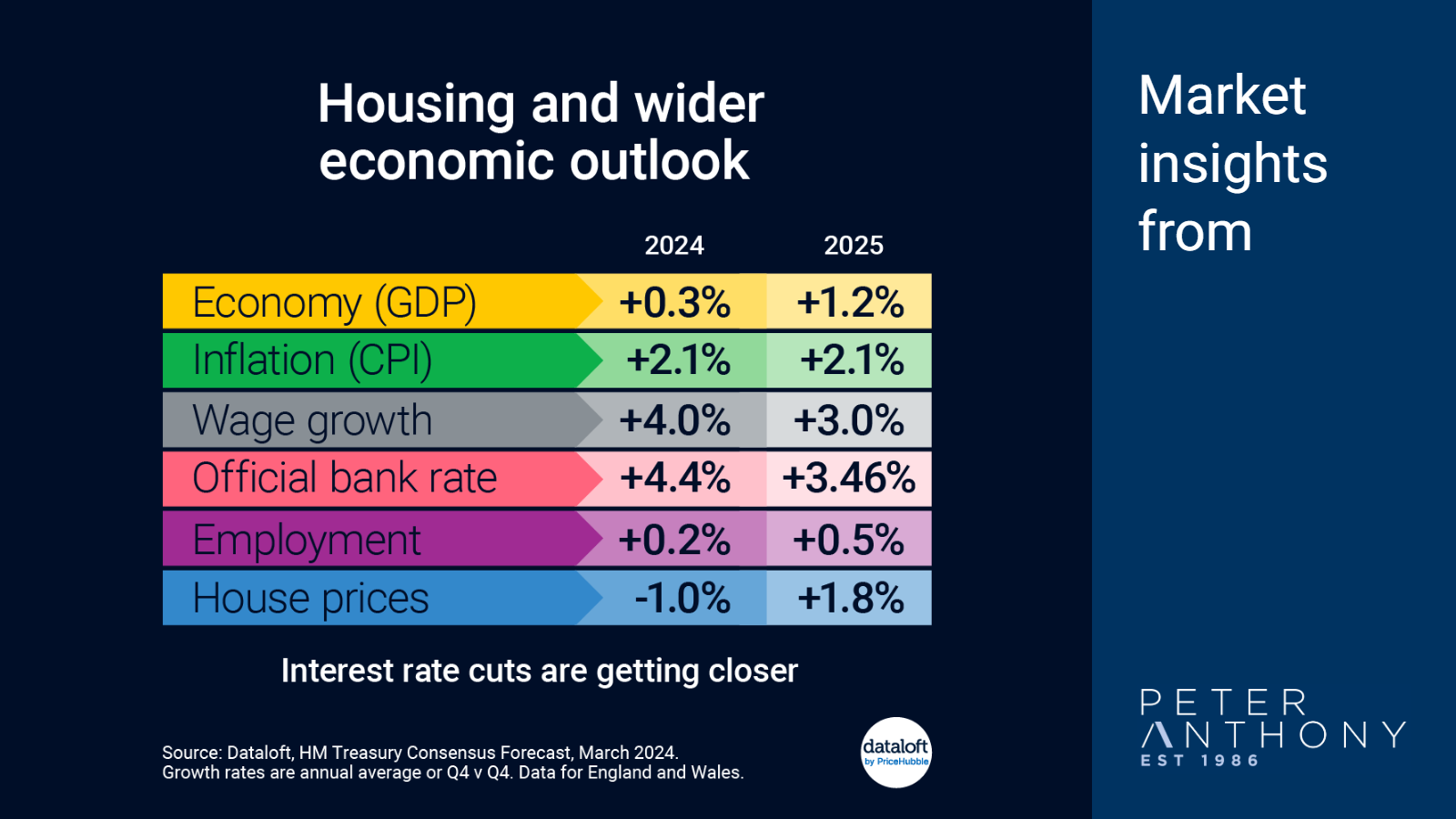

Housing and wider economic outlook

Read More

Monitoring the outlook for various economic indicators gives us a good view on both the current and future direction of the housing market.

At the Bank of England March meeting the bank rate was held at 5.25% but the governor announced "We are on the ...

-

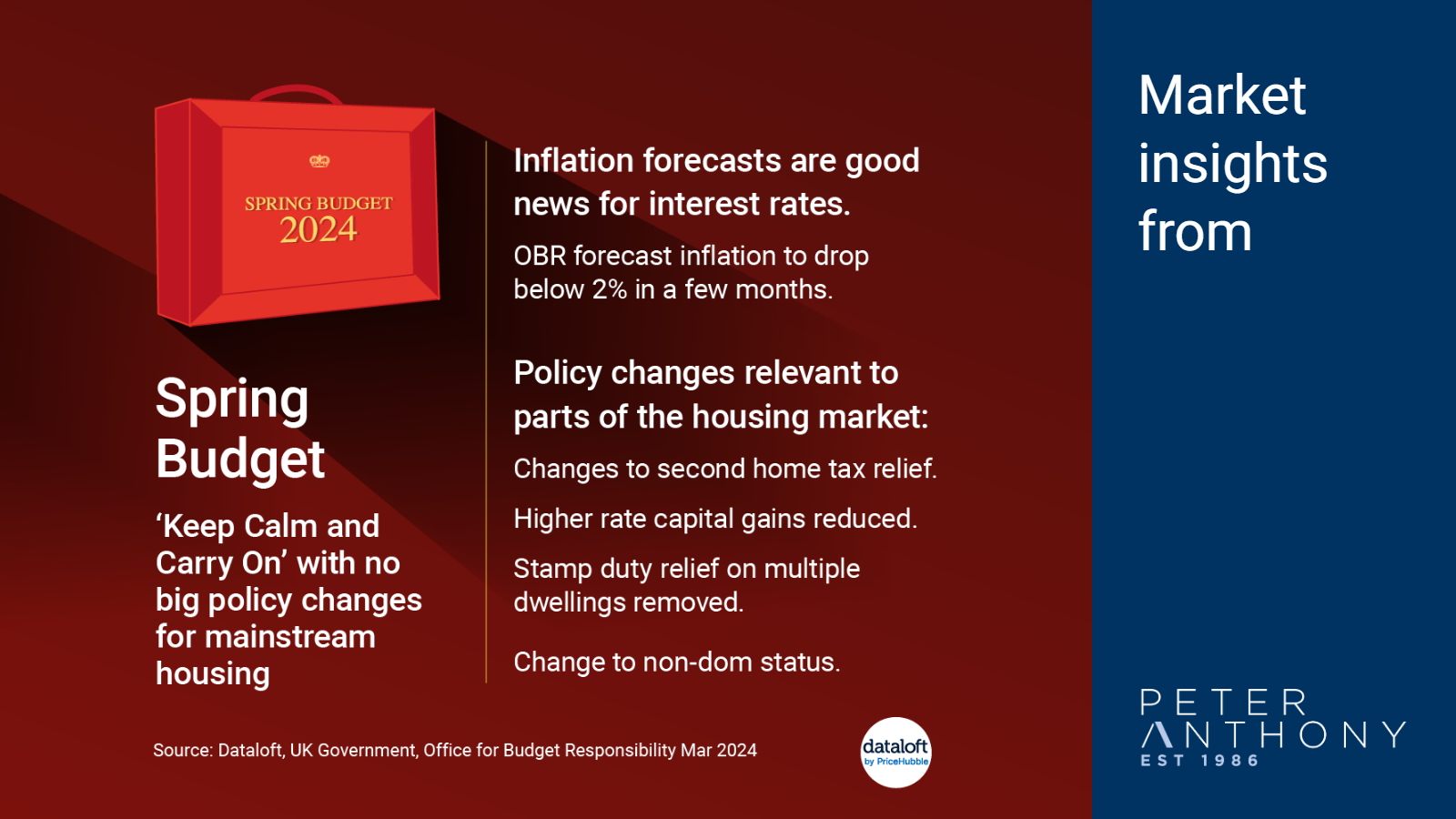

Spring Budget 2024

Read More

The Spring Budget this year felt very much like a keep calm and carry on budget for the housing market. There were no dramatic policy announcements to interrupt usual housing market activity.

Better inflation forecasts from the Office of Budgetary Responsibility are good news for ...

-

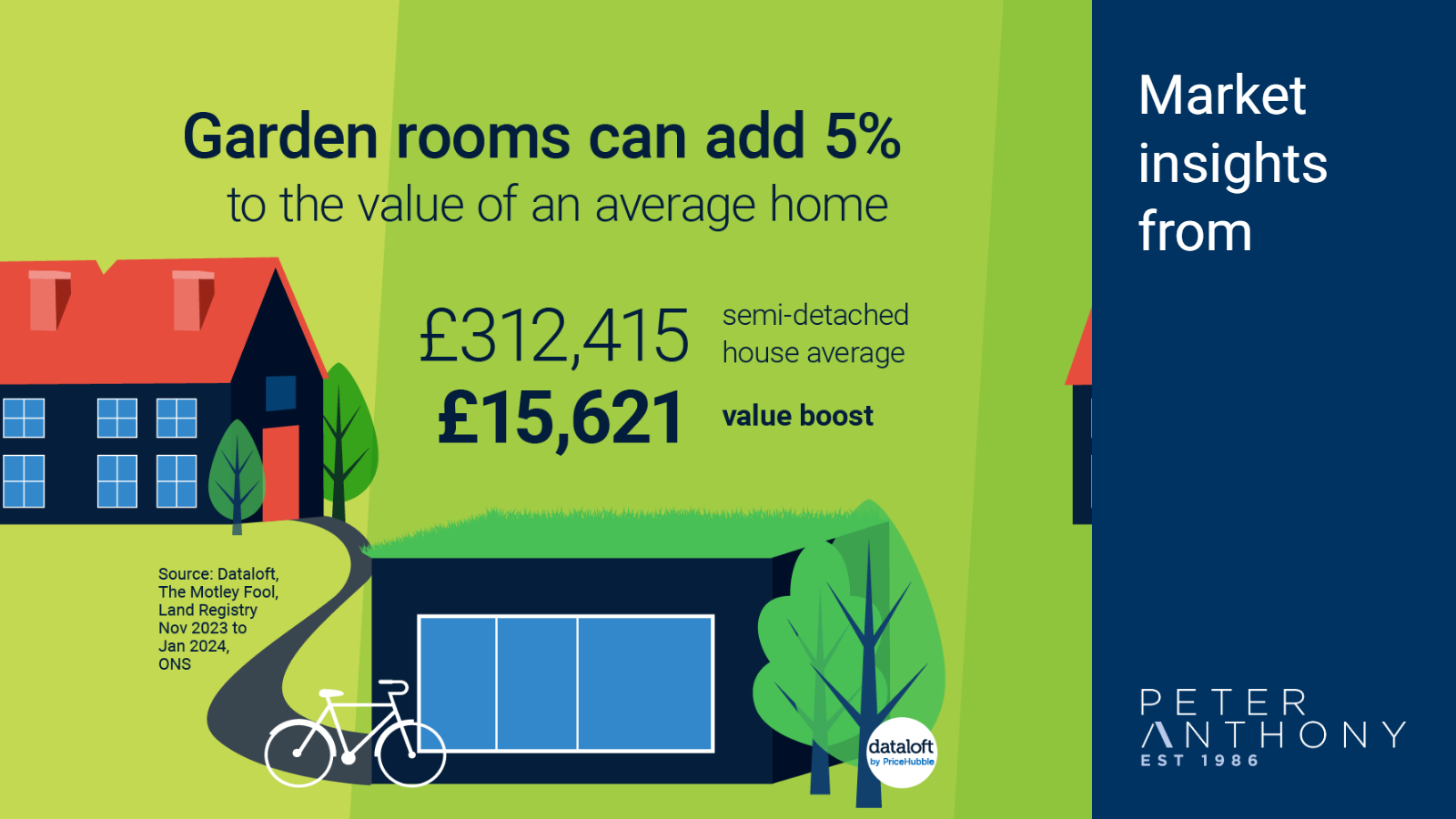

Garden rooms can add 5%

Read More

Spring is around the corner with seven-spot ladybirds, daffodils and snowdrops emerging across the country. Naturally our attention is turning to gardening and planning what to do with our outdoor space.

Research by The Motley Fool found that adding a quality garden room is the ...

-

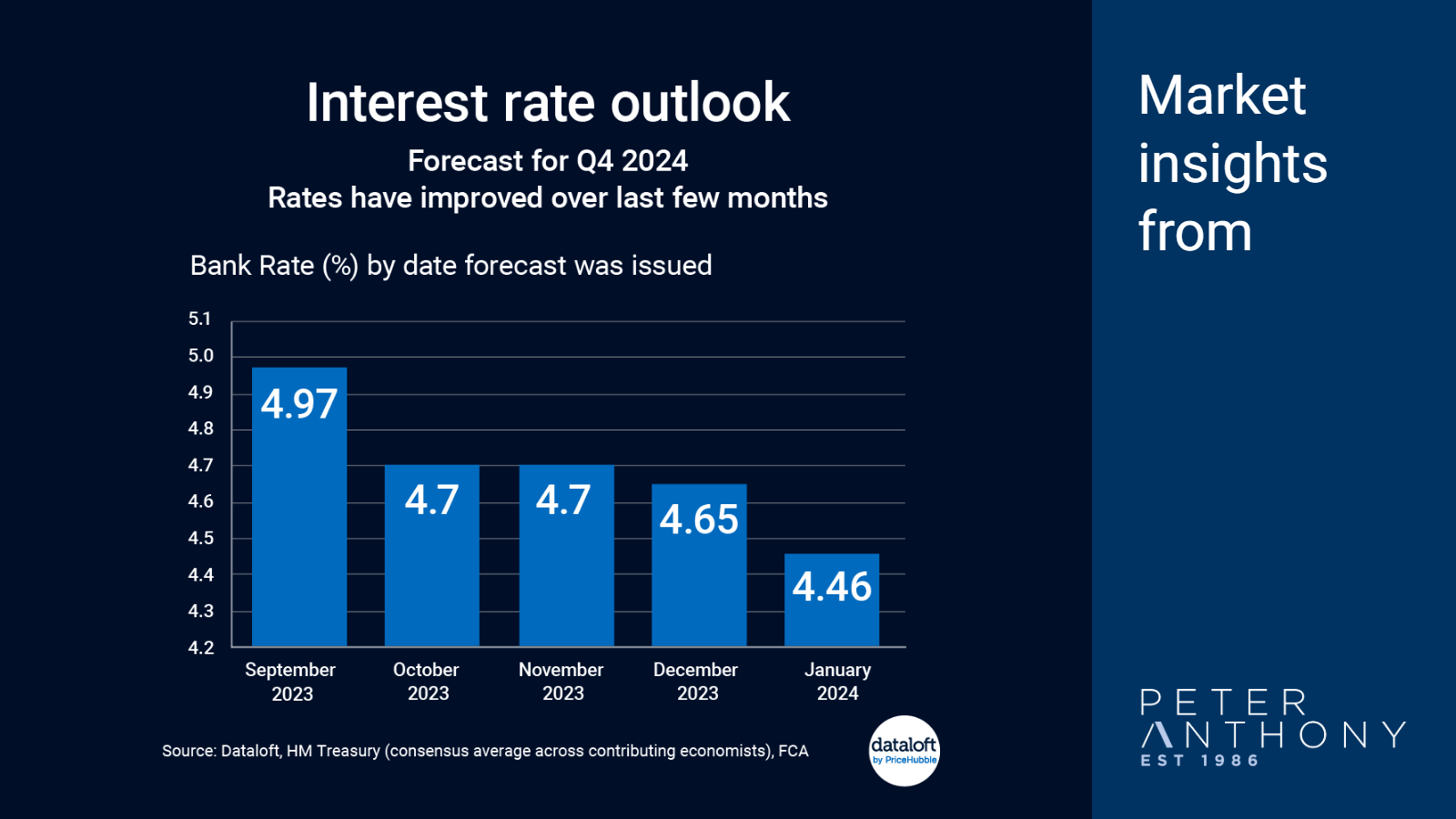

Interest rate outlook

Read More

The Bank of England held the Bank Rate at 5.25% in its February 2024 meeting. The Bank Rate has been at this level since August 2023. Given current economic data, it is more likely that interest rates will be cut in the second half of ...

-

January jump in asking prices

Read More

The average new seller asking price rose by 1.3%, the biggest price rise for January since 2020. This is over double the 20-year average of +0.6%.

As mortgage rates fall and the economic outlook brightens, buyer demand is improving, with 42% of agents reporting that ...

-

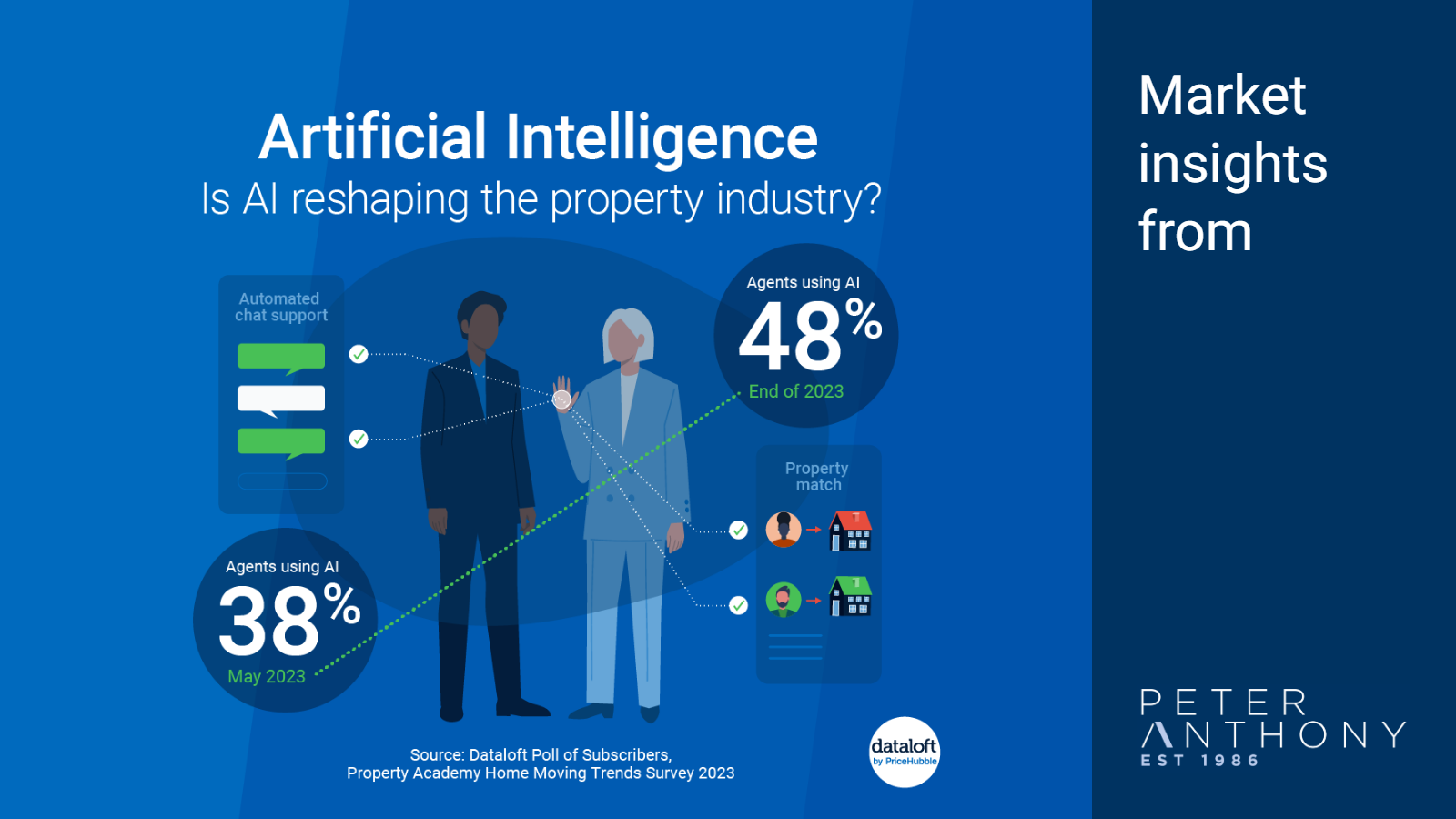

Is AI reshaping the property industry?

Read More

Artificial Intelligence left its imprint on the property market landscape in 2023, starting to reshape the way things operate.

48% of estate agents reported using ChatGPT or equivalent in their business (compared to 38% in May), and a further 19% were exploring it in use ...

-

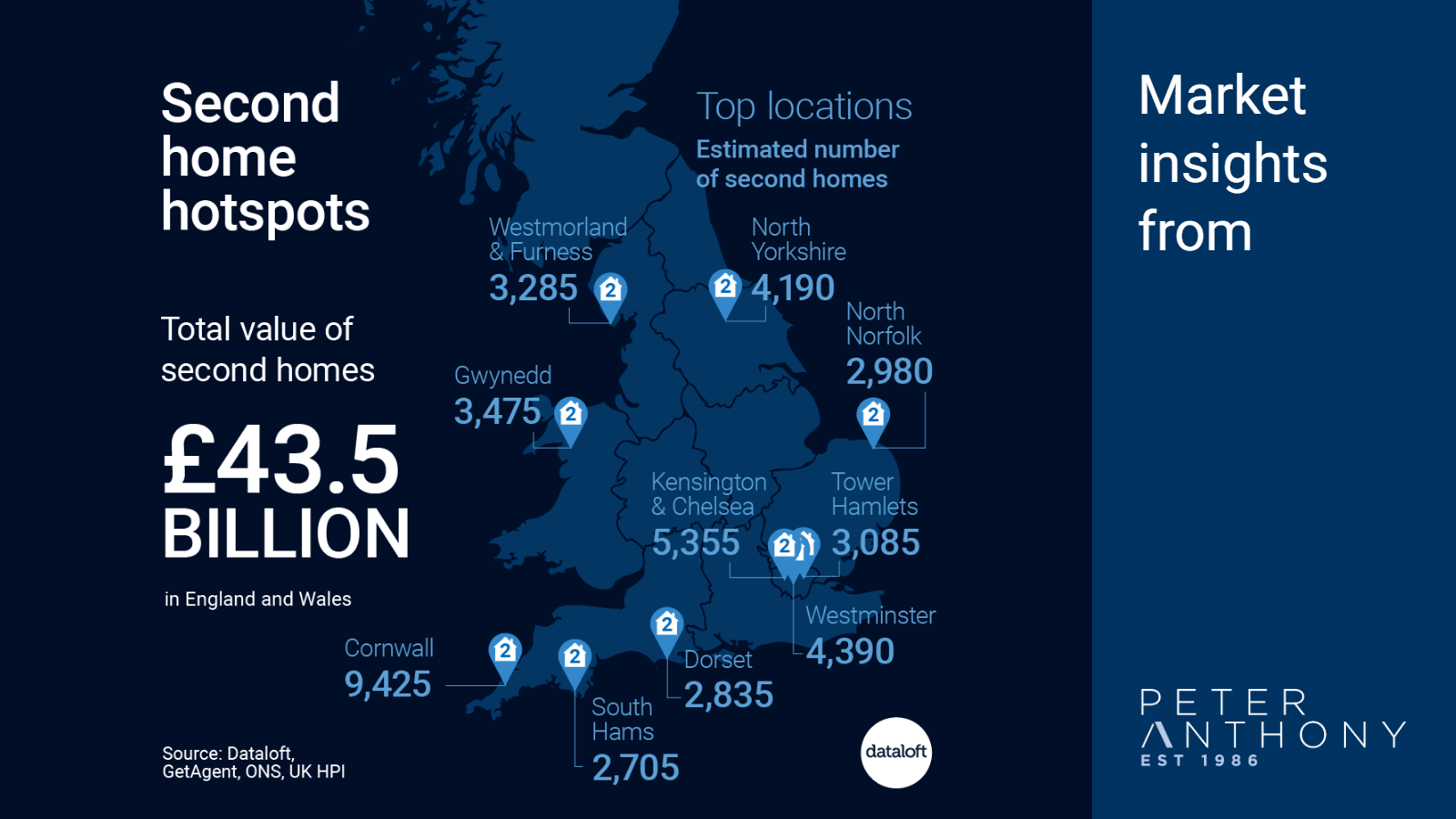

Second home hotspots

Read More

Cornwall has been ranked as the top hotspot in the UK for second homes, with 9,425 currently located there. Kensington and Chelsea came second with 5,355, and Westminster third with 4,390.

Kensington and Chelsea tops the charts for the highest total value of second homes ...

-

Days of Christmas | Oh! Christmas tree

Read More

Resplendent with twinkling lights and cherished ornaments, the Christmas tree is a symbol of warmth, tradition, and the spirit of giving.

The average Christmas tree will grow for 15 years before it's ready for sale. In the same time frame, rents have lit up by ...

-

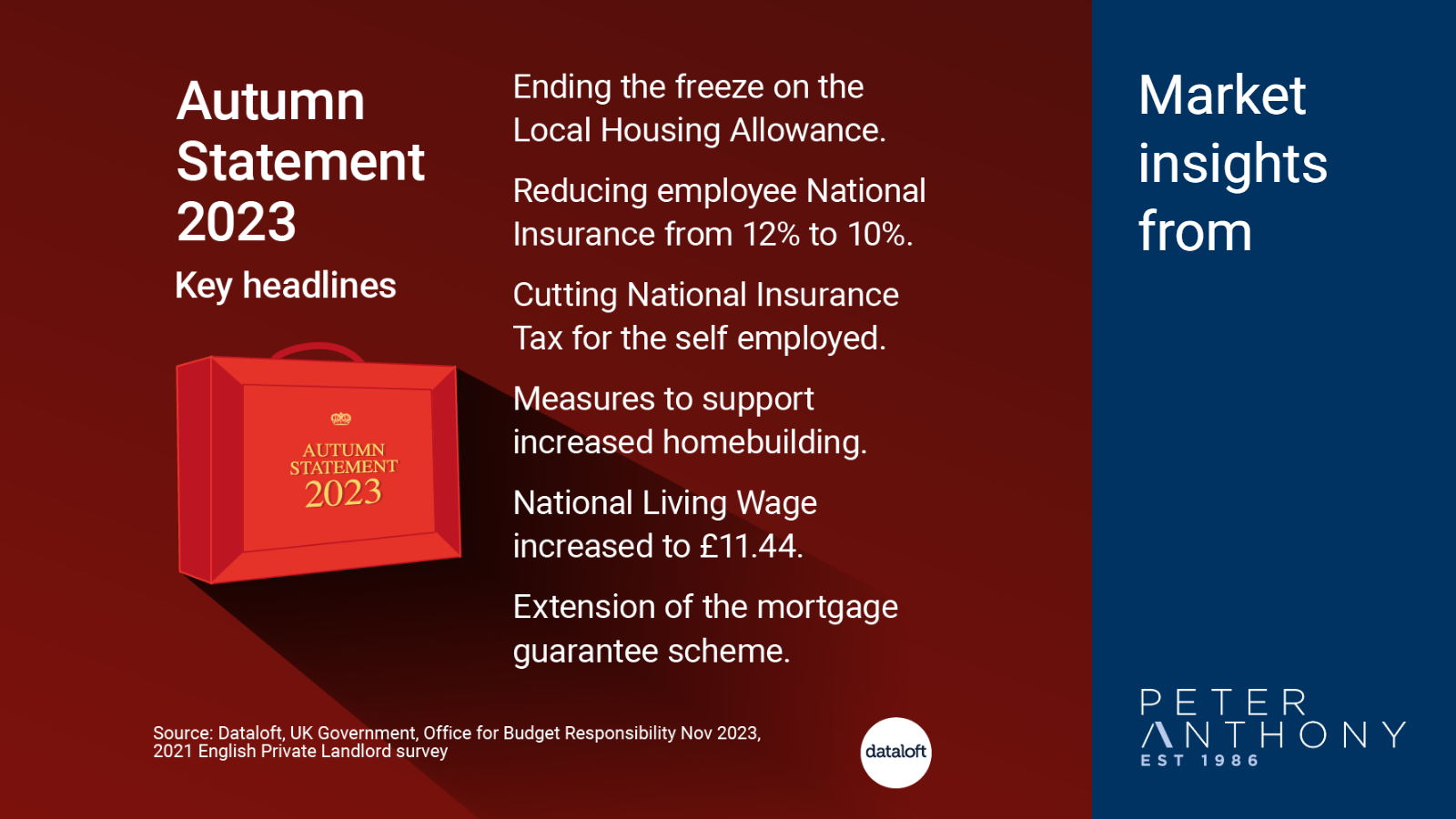

Autumn Statement 2023 Key headlines

Read More

In the Autumn Statement, the Chancellor announced support for low-income renters by raising the Local Housing Allowance to cover the lower 30% of rents. This will give 1.6 million households an average of £800 of support.

Cuts to employee National Insurance from 12% to 10% ...

-

First-time buyer funding

Read More

The average deposit paid by a first-time buyer was £43,693. Perhaps unsurprisingly, almost two-thirds (63%) were in the top 40% income bracket.

Just over two thirds (68%) of first-time buyers paid less than a 20% deposit, while a fortunate 5% were mortgage-free.

85% reported funding ...

-

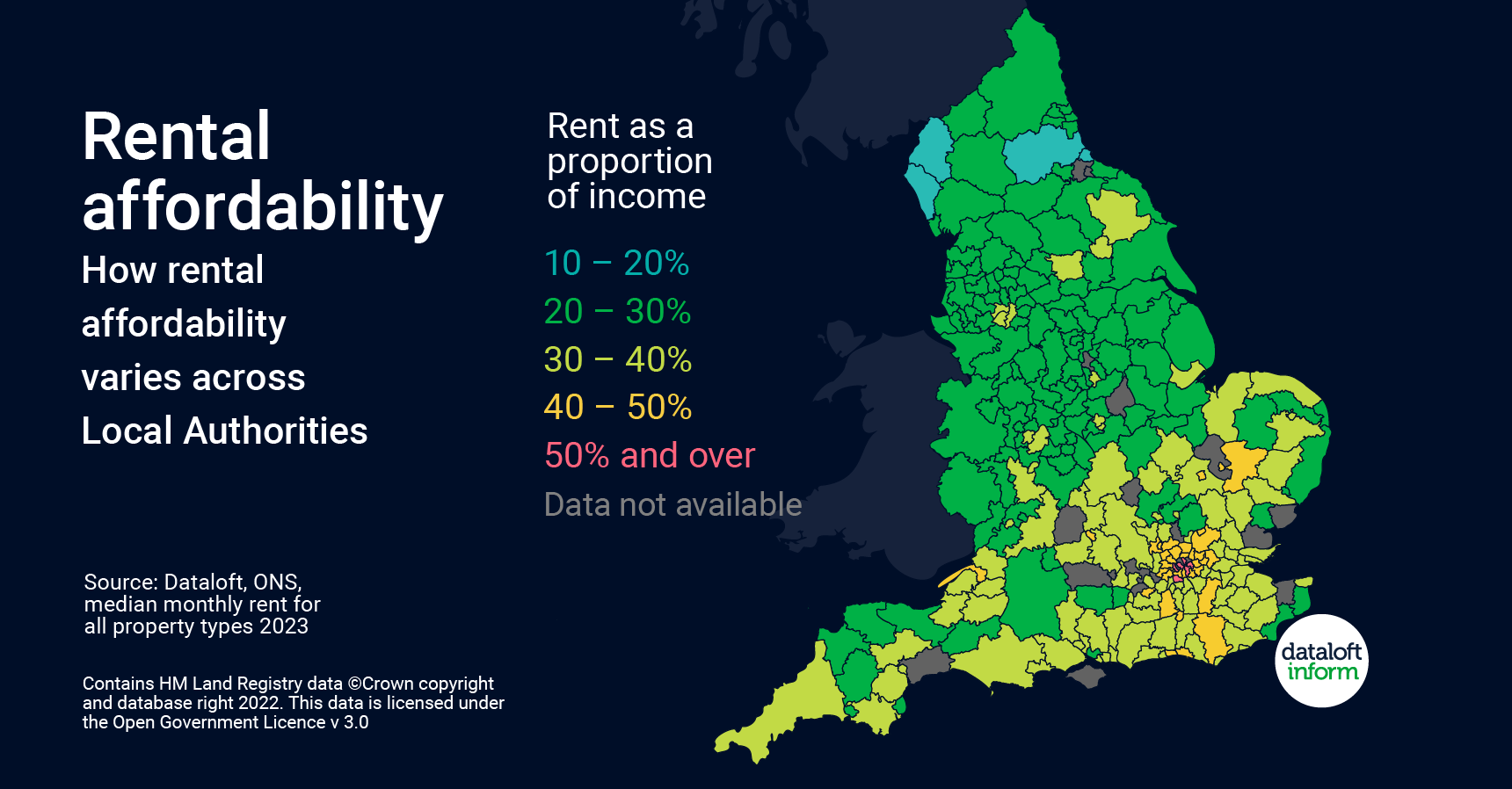

Rental affordability

Read More

Although earnings in the south of England are generally higher than in other parts of the country, anyone needing to rent a home, will have to give up a higher proportion of their income just to cover the rent.

‘Rental affordability’ is a good indicator ...

-

More renters are small business owners

Read More

Newly released data from the 2021 census shows that there were significant changes in the make-up of people living in the private rental sector in the last decade.

There was a 17% jump in the proportion of private sector renters working in higher managerial and ...

-

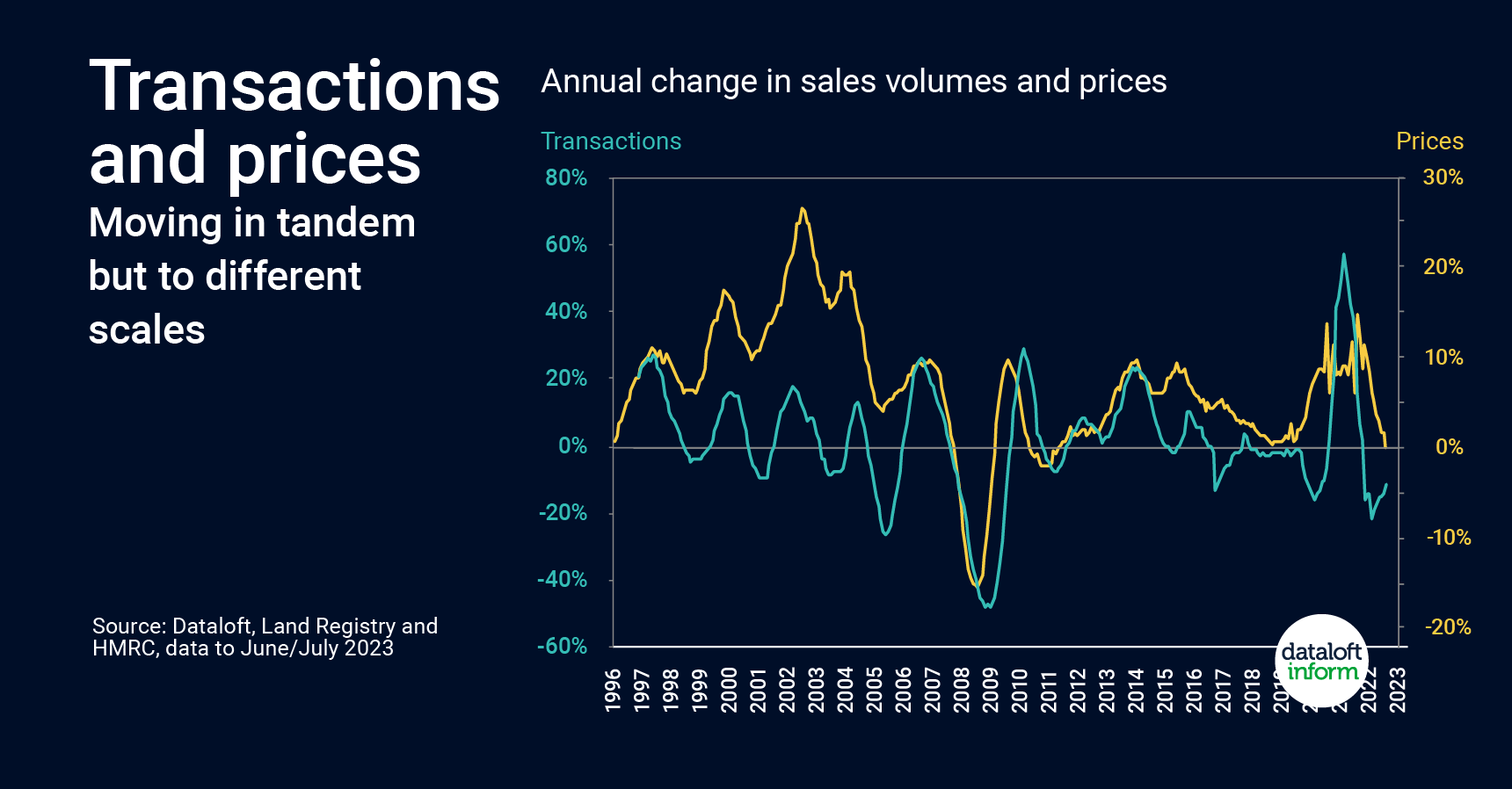

Transactions and prices – moving in tandem but to different scales

Read More

There were just over one million residential sales across England and Wales in the year to end July. This is -11.4% below the volume a year ago.

Whilst it is lower than the high transaction volumes experienced during the pandemic, it is only 7.8% below ...

-

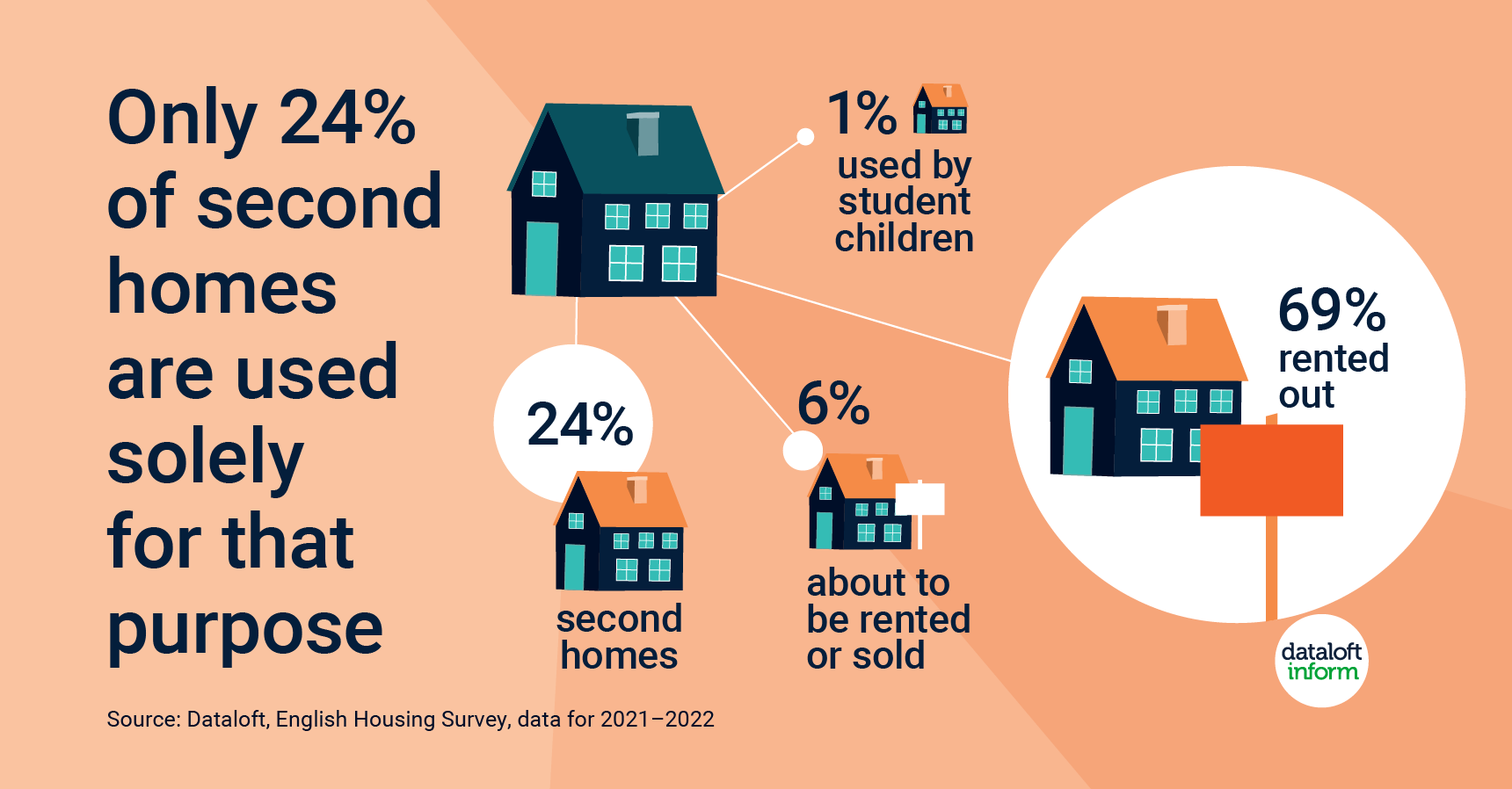

Only 24% of second homes are used solely for that purpose

Read More

Latest data from the English Housing Survey reveals that there are 3.3 million second homes. Of that, the vast majority are rented out (69%).

A small portion are second homes which are due to be rented out or sold shortly (6%) and a very small ...

-

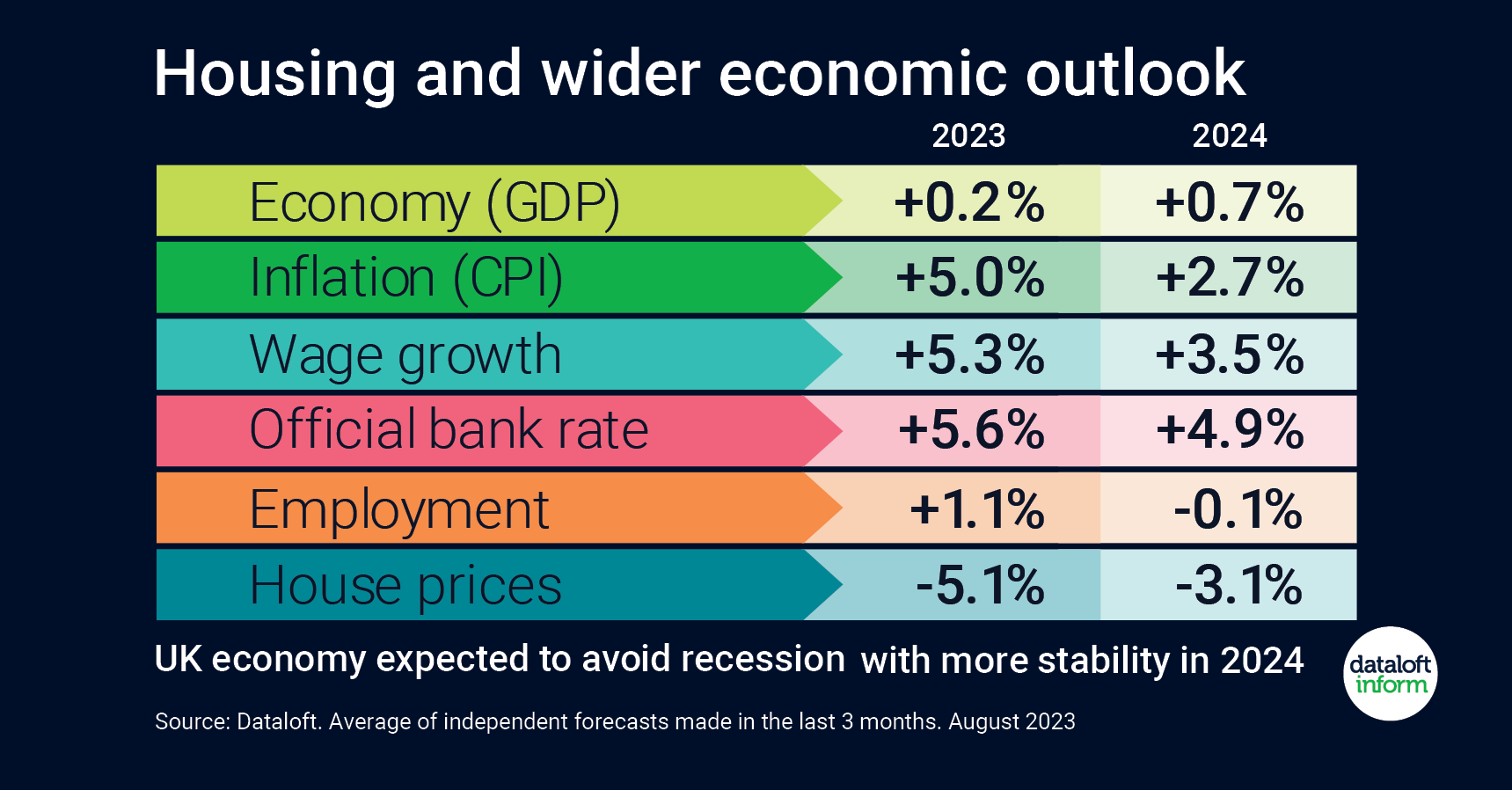

Outlook for the housing market and wider UK economy

Read More

Monitoring the outlook of various economic indicators gives us a good view on both the current and future direction of the UK’s housing market.

With 14 consecutive interest rate rises, the Bank Base rate reached 5.25% in August. Latest projections are that rates are likely ...

-

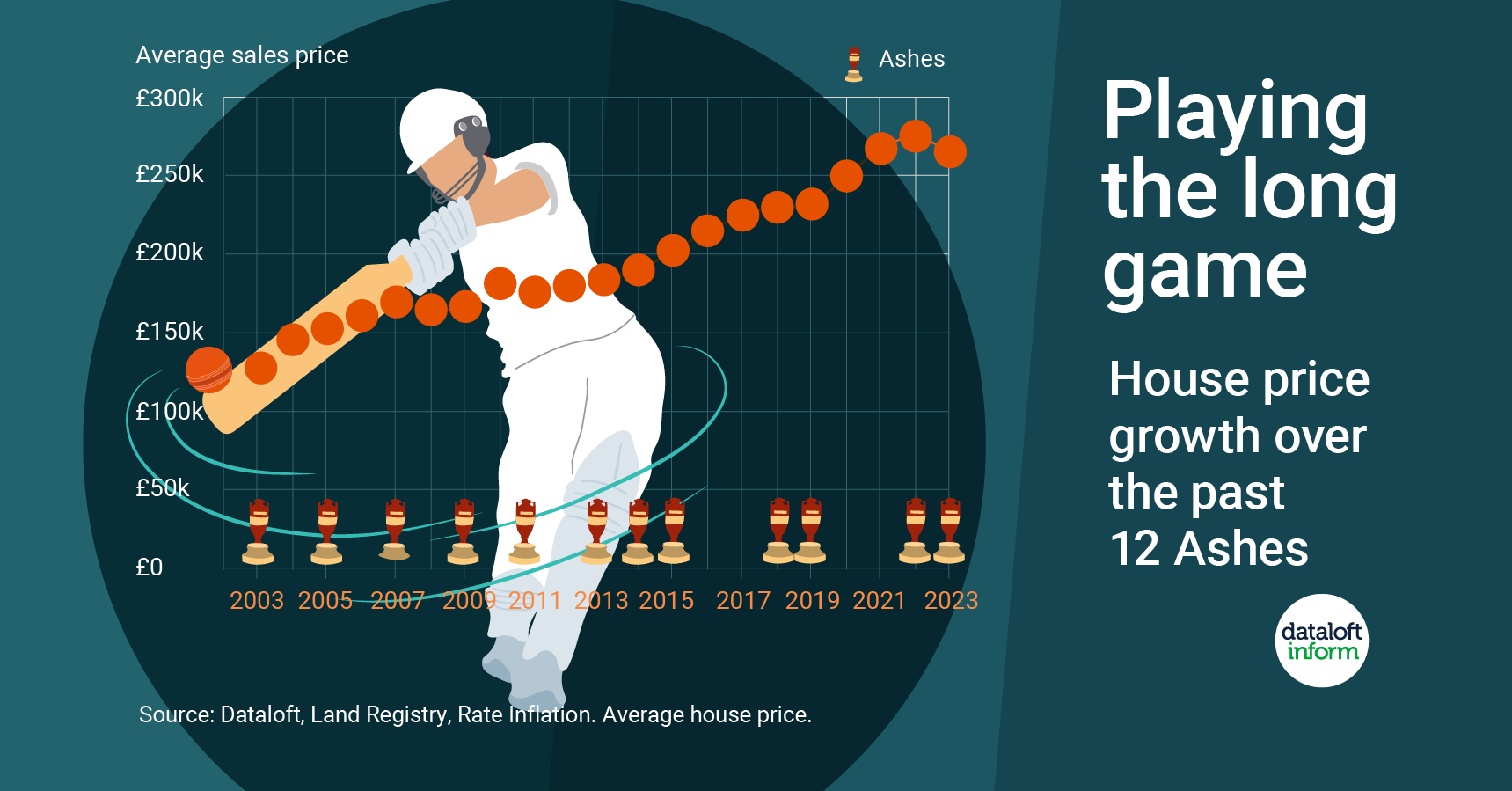

Playing the long game

Read More

The Ashes are over for another year but with the cricket season still very much in play, we take a nostalgic look at changes in the housing market over previous series.

The last time England won the Ashes was eight years ago in 2015 at ...

-

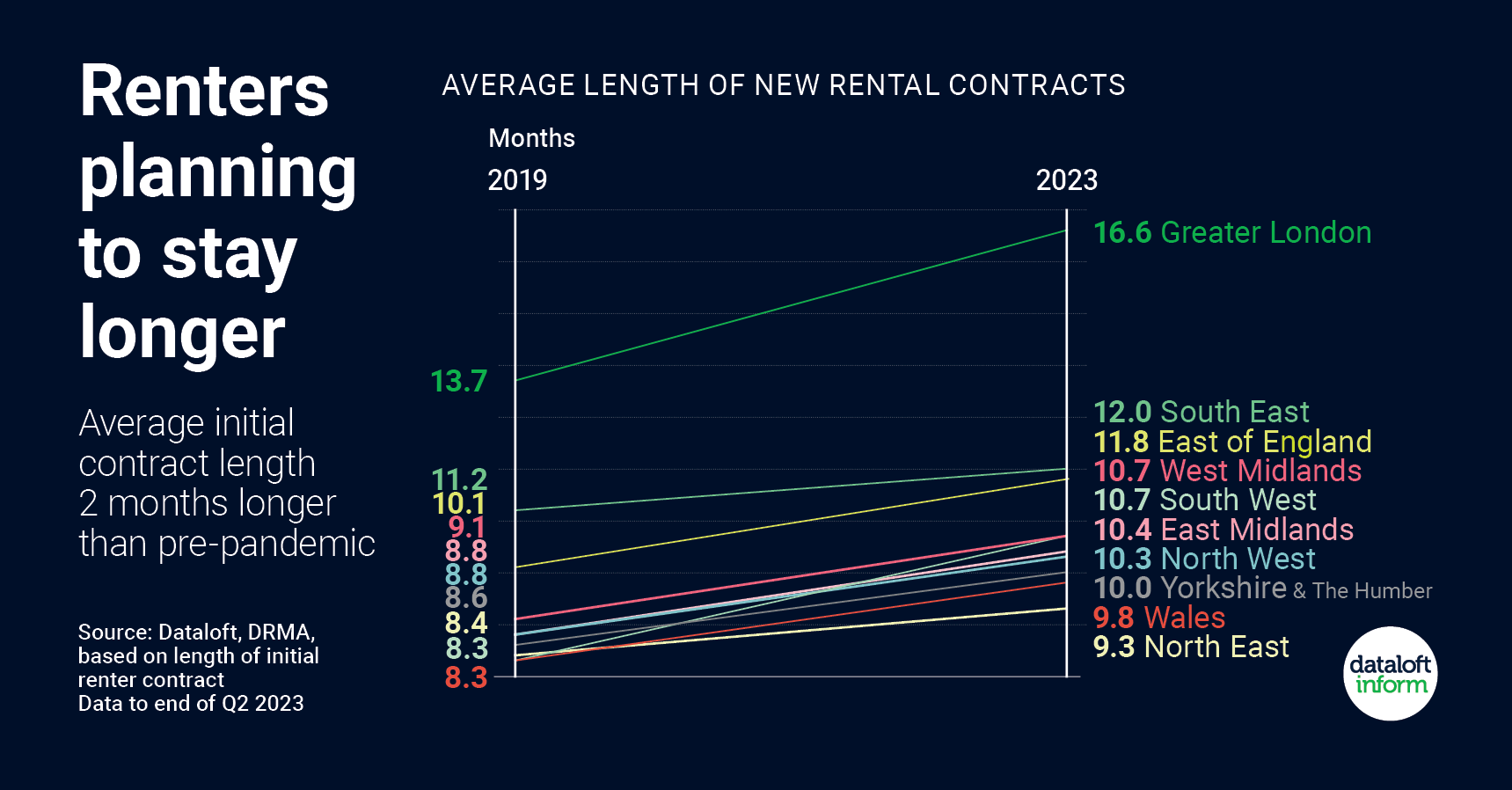

Renters planning to stay longer

Read More

The average length for an initial rental contract in Q2 2023 was 12.7 months, up from 10.5 during the same period in 2019. Renters are planning to stay for longer, in part due to low levels of stock and rising rents in the open market....

-

Perfect picnicking

Read More

The start of British Summer Time, coincides with National Picnic week, a picnic being a great way to spend time outdoors with family and friends.

More than 27.6 million homes, the equivalent to 95% are within a 10-minute walk of an accessible public park, garden, ...

-

Community matters

Read More

The 1st–7th June is National Volunteers' Week across the UK. It is estimated that over half of all those aged 16+ in England and Wales have volunteered at least once in the past 12 months, around one in three volunteering at least once per month....

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell Apr 9, 2024, 10:30 AM

Gillian Bell Apr 9, 2024, 10:30 AM