Liverpool Property News

-

Average commute rises for private renters

Read More.png?sfvrsn=288bc430_1)

Traditionally, those living in private rented homes have tended to live close to their place of work. This is often a lifestyle choice to minimise commute times/cost and to enjoy city living.

Across England and Wales, the distance renters live from their place of work ...

-

On the move

Read More

More than 1 in 3 are in the process of, or are considering moving home, according to a survey of 3,000 respondents conducted by Nationwide in April.

Housing market activity remains buoyant, despite increasing pressure on household budgets which is impacting consumer confidence.

A desire ...

-

Easter addresses

Read More

Nearly 1,700 property sales have taken place on Easter- related addresses over the past 12 months. At £731 million, their sales value is significantly more than the £415 million set to be spent on Easter Eggs.

88% of Easter-related sales included 'Cross' in the address, ...

-

Spring Statement: Key Takeaways

Read More

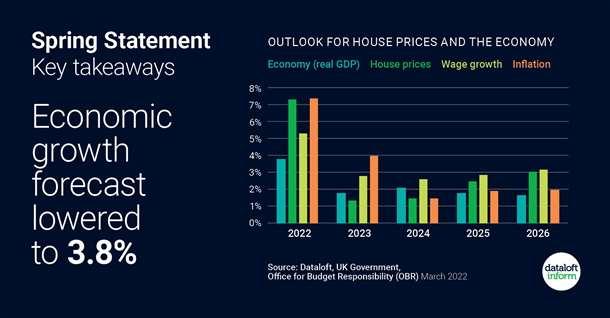

The Chancellor warned that the global economic outlook is 'challenging' in his Spring Statement. The OBR has lowered its economic growth forecast to 3.8% this year, down from the 6% forecast in October.

Property price growth is expected to outperform economic growth this year, averaging ...

-

Does your rental property hit the energy performance mark?

Read More

Government targets state that by the end of 2025 new lets will require an Energy Performance Certificate (EPC) rating of band C or above.

Just over half (51%) of all rental properties let out over the last 12 months had an EPC of band C ...

-

Strongest annual house price growth in December since 2002

Read More

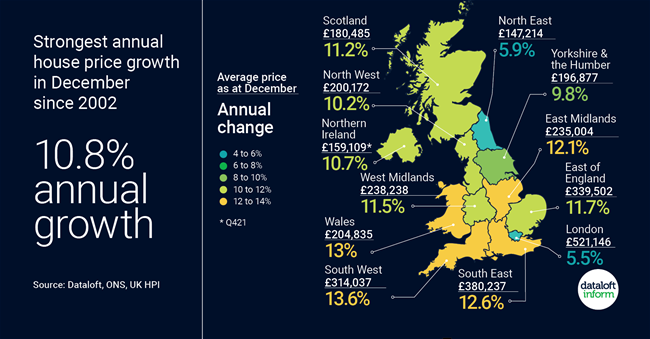

The UK recorded average house price growth of 10.8% in 2021. This is the strongest annual growth at the year end since 2002.

The average price of a UK home now stands at £274,712, marking another record high. House prices increased by nearly £27,000 over ...

-

Change of scene?

Read More

Change of scenery/lifestyle remains a key driver behind home moves, as the persistent shortage of supply has held back potential home moves.

Change in lifestyle/scenery becomes a more significant reason as the value of the home rises, peaking at 21% in the £750k – £1m ...

-

Record year in investment in the UK tech sector boosts local economies around the UK

Read More

Last year a record £29.4 billion was invested in the UK's tech sector, more than double the previous year. This is positive news for regional economies and housing demand.

A quarter of the UK's 115 unicorns (start-ups worth $1bn+) were created in 2021. Nine of ...

-

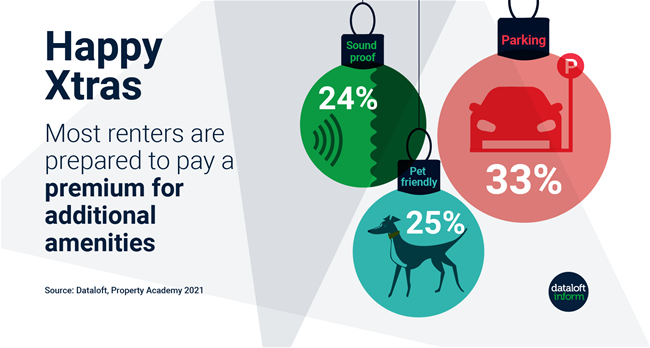

Dataloft Days of Christmas: Happy Xtras

Read More

Affordability/rental costs top the renter wish list when it comes to choosing a home, followed by pleasant neighbours and broadband speed.

However, in terms of the added extras, most renters would pay a monthly premium (£50 in London, £40 outside) for certain features, just 28% ...

-

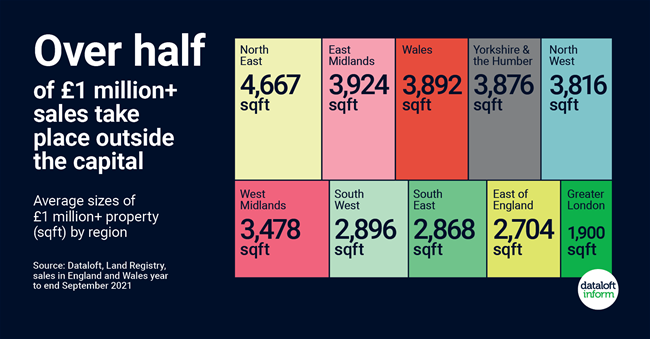

£1 million+ sales

Read More

Nearly 20,000 sales have taken place over the past year priced £1 million or more. Over half of these have been outside of the capital, compared to just 41% back in 2018/19.

High value areas in desirable locations have seen high levels of activity, the ...

-

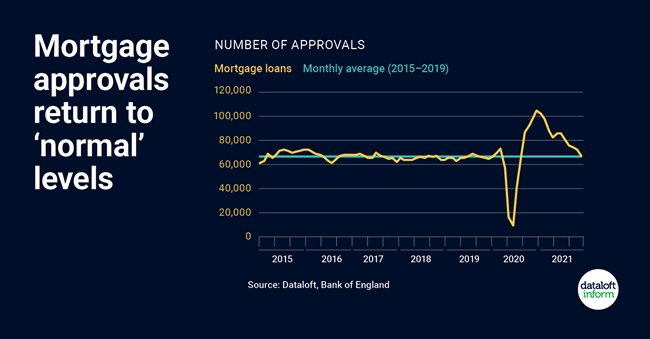

Mortgage approvals return to ‘normal’ levels

Read More

October saw mortgage approvals return to more 'normal' levels.

The Bank of England report 67,199 mortgages were approved in October, just above the long-term monthly average of 66,462 (based on 2015–2019).

The property market is predicted to return to calmer market conditions during the first ...

-

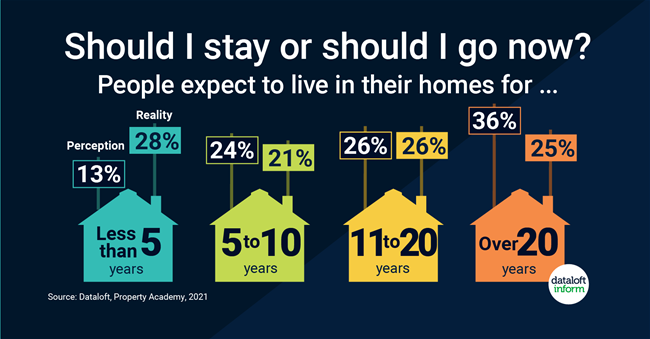

Stay or go – how long do people stay in their homes?

Read More

Many people move more often than they expect to. This is a key finding of the 2021 Home Moving Trends Survey, conducted by the Property Academy and analysed by Dataloft.

While just 13% of home movers expect to move within the next 5 years, the ...

-

Best Lettings Agent in L3 2021

Read More

Congratulations to our branch manger Gill and all the team from our Liverpool office for receiving the gold 'Best Lettings Branch of the Year' award from allAgents!

Call us on 0151 214 3480 to discuss your property today! -

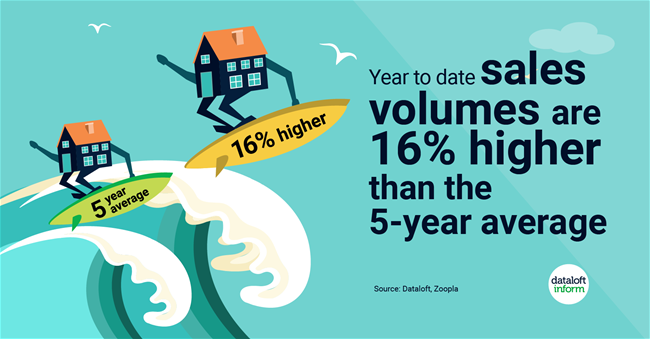

Sales volumes higher

Read More

The property market continues to ride the wave as we head to the end of 2021. Although softening, demand remains stronger than a year ago. Sales volumes to date in 2021 are 16% above the 5-year average (Zoopla).

Despite rising inflation and likely interest rate ...

-

Demand stabilising but prices set to remain firm

Read More

Buyer demand is stabilising according to the latest edition of the RICS Residential Survey.

At a national level the new buyer enquiries indicator posted a net balance of zero in September, a sign of stable demand.

For the third consecutive month the volume of newly ...

-

Price growth predictions

Read More

Property continues to rise in value. An average of independent forecasts predicts prices will end the year 5.8% higher than at the start.

Annual price growth has moderated since the double-digit figures evident in May and June, however the search for space continues to drive ...

-

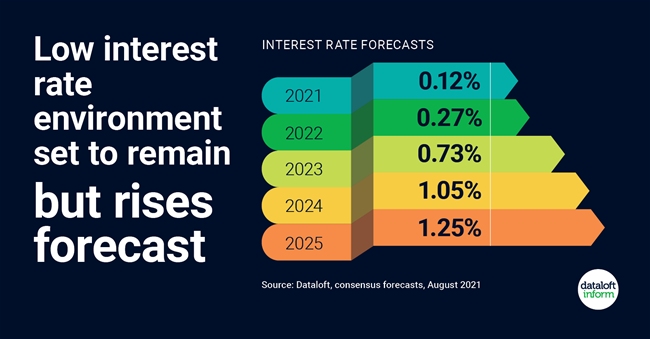

Interest rate forecast

Read More

The low interest rate environment the UK has experienced for over the past decade is set to remain, although rates are anticipated to rise.

The consensus forecast, based on the expectations of 18 different city and non-city analysts, expects interest rates will nudge slightly higher ...

-

First-time buyer surge

Read More

A record 45,965 Help-to-Buy equity loans were issued to first-time buyers in the year to the end of March 2021, as appetite from first-time buyers (FTBs) continues.

Over one third of property purchased by FTBs has been priced £200,000 or less, with over half of ...

-

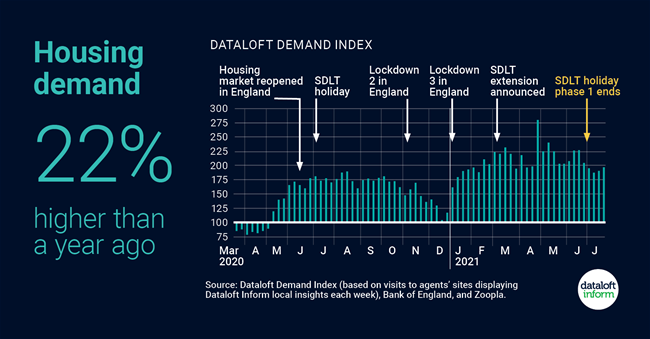

Housing demand

Read More

The Dataloft Demand Index shows housing demand is currently 22% higher than a year ago, as housing market momentum continues to be bouyant.

Demand fell 7% following the SDLT and Land Transaction Tax deadline on 30th June, but remains higher than a year ago. Buyers ...

-

1 in 8 plan to move within 5 years

Read More.png?sfvrsn=76c4e130_1)

One in every eight home movers across the UK expects to be in their new home for less than 5 years, over one third for a decade or less.

Over half of home buyers aged up to 34 expect to move again within a decade, ...

About The Blog

This Blog looks at what is happening in Liverpool, the property market, events and community news along with investment ideas and tips for those loosing to invest in the area.

Gill Bell - Editor

T: 0161 707 4745

E: [email protected]

Gillian Bell May 16, 2022, 10:30 AM

Gillian Bell May 16, 2022, 10:30 AM

David Boyd Nov 17, 2021, 11:30 AM

David Boyd Nov 17, 2021, 11:30 AM